The data comes from the fourth installment of the monthly report “SME Commerce Perspective” of Mercado Pago / Invecq, carried out based on a survey of more than 1,200 SME businesses that operate with Mercado Pago in Argentina.

90% of SME businesses claim to be concerned about the inflation and the impact of the price increase on the profits of his business, indicated a private report prepared by Free market and the economic consultant Invecq. According to this document, two strategies are imposed among businesses throughout the country: offer additional services in their stores and generate returns with the balances of their sales.

The content you want to access is exclusive to subscribers.

The data comes from the fourth installment of the monthly report “SME Commerce Perspective” of Mercado Pago / Invecq, carried out based on a survey of more than 1,200 SME businesses that operate with Mercado Pago in Argentina.

The impact of technology on the industry

According to this report, 8 out of 10 businesses offer complementary services to moderate the impact of inflation. Today there are more than 28,000 businesses that offer phone recharges, money deposits and withdrawals, and service payments to their customers. On the other hand, 67% of the businesses surveyed declare invest your digital account balance to get returns.

“By adding services to their point of sale, businesses have the possibility of becoming ¨super shops¨, increase the traffic of your business and boost your sales. In turn, more and more merchants choose to invest the balance of their accounts, generating daily returns without losing the availability of money to use and transfer it at any time”, added Agustín Viola, Senior Director of SMEs and Entrepreneurs of Market Payment.

QR Market Payment.jpg

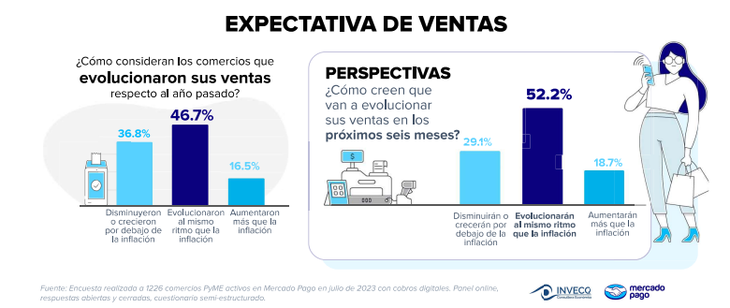

According to the merchants, the additional services attracted more visits to their business (53%), generated an increase in sales of their products (25%), had an impact on new genuine income (20%) and even allowed to save operating costs (17% ). Even so, with a view to next year, 52.2% of businesses trust that the evolution of their sales will be at the same rate as inflation.

“Traders maximize all available resources in its management of prices, costs and liquidity. This is a determining factor to sustain activity levels in a context of 115% annual inflation”, analyzed Santiago Bulat, Director of Invecq.

SME perspectives

According to the same report, 46.7% of businesses state that their sales andThey returned in line with inflation. But 36.8% affirm that they decreased or grew below the CPI. Refering to expectation For the next six months, 52.2% of the businesses assure that sales will evolve at the rate of inflation.

Capture.PNG

Source: Ambito