The acceleration of the monetary issue occurred in the framework of the electoral defeat of the Government in the PASO and the questions to the Minister of Economy within the ruling party itself for an alleged “adjustment.”

From there, the urgency to improve the purchasing power of citizens began to gain strength in the Frente de Todos, despite the numerous restrictions of the Argentine economy to grow and distribute resources.

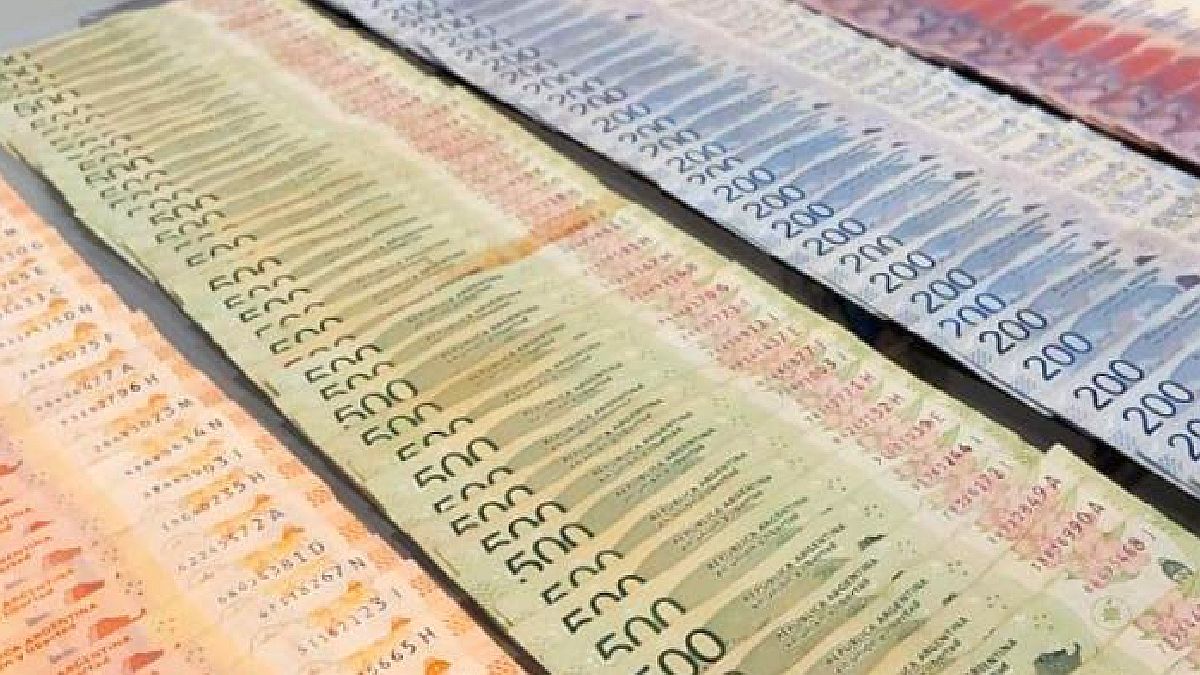

However, the BCRA was in charge of absorbing $ 245,800 million in October through the placement of Leliqs and Passive Passives, the two remunerated liabilities that the entity uses to offset the effect of the monetary issue on the demand for dollars and inflation.

As a result, the stock of these remunerated liabilities jumped 6% (almost 3% real) in the month to reach $ 4.44 trillion.

That is why the Monetary Base (BM), made up of the money in the hands of the public and the reserve requirements of the commercial banks in the BCRA, rose just 2.3% nominal during the past month.

This implied a new slowdown compared to the rise in September (2.6%) and a contraction in real terms, taking into account that the consulting firms and financial entities that participated in the last REM estimated a monthly inflation of 3.2% for October.

In particular, working capital increased only 1.8% per month. Compared to October 2020, far from a strong expansion, the BM fell by around 14% in real terms.

Source From: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.