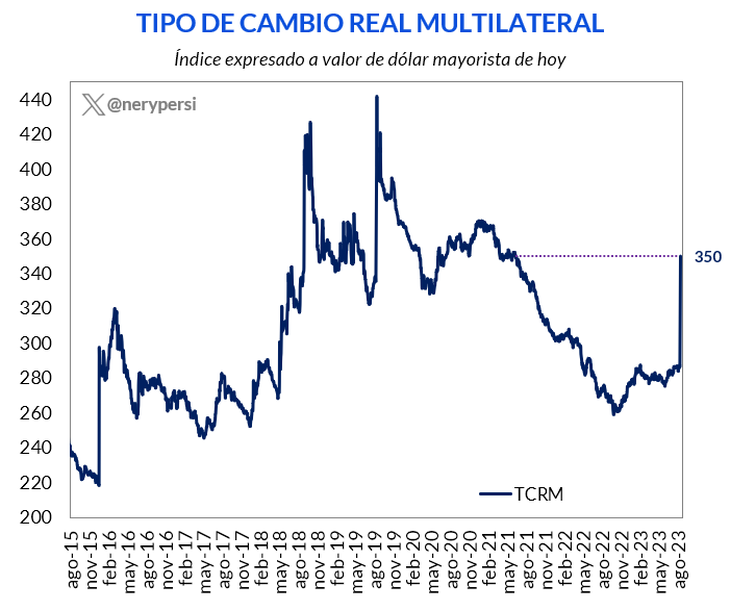

With the jump of the official, the highest level of the Multilateral Real Exchange Rate of the last two years was produced.

The multilateral real exchange rate (TCRM), an index that compares the Argentine peso with the currencies of the country’s main trading partners, He played his best level in the last 2 years after the devaluation decided this Monday by the Central Bank.

The content you want to access is exclusive to subscribers.

The monetary authority decided to raise the dollar wholesaler to the $349.95, until the elections on October 22, in a clear change of strategy. This increase implied a jump of $62.60 (+21.8%)on the day after open, concurrent and mandatory primary elections (PASO)where javier milei took the win.

image.png

“With the discreet jump of the official, we have the highest level of TCRM in more than 2 years (beginning of the “Plan Platita”). The inflation that is coming will probably erode it quickly”said the economist Nery Persichini.

In the program with the IMF, the Government had promised to maintain the TCRM at December 2021 values. However, the index that measures the competitiveness of the peso began a process of decline in April 2022 in a context of strong local inflationary acceleration, which greatly exceeded the monthly depreciation rate of the official dollar.

“Unfortunately this evaluation of the official exchange rate puts us in a new inflationary regime for the second semester of 10% of monthly inflation”said Alfredo Romano, director of the Economy and Finance area of the consultancy Romano Group.

“This implies that in two three months the official exchange ratedespite the fact that the Central Bank does not want to touch it, not in balance with which you will have to evaluate what to do. my feeling is that In three months, inflation determines by eating that small competitiveness that you were gaining from the evaluation of the currency”, closed

Source: Ambito