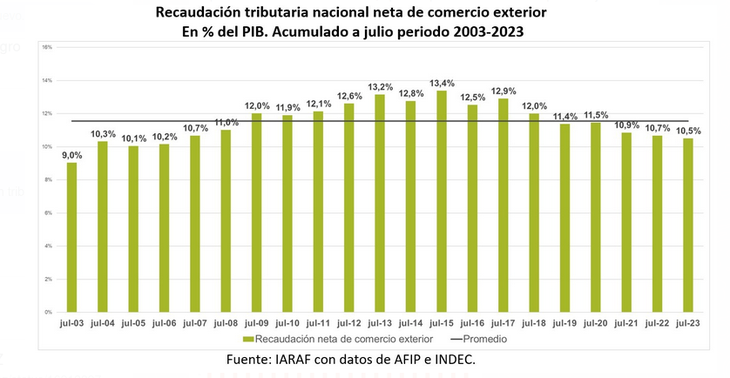

According to an IARAF report, it represents 11.2% of GDP. Also, if the effect of the drop in withholdings due to drought is eliminated, it is the lowest in 20 years.

Although the leader of La Libertad Avanza, Javier Milei, says that Argentines can no longer bear the fact that there are 170 taxes (in fact, there are 148), the truth is that Argentina currently has the lowest effective tax pressure in the last 17 years, taking only national taxes. In the first seven months it represents the 11.2% of GDP.

The content you want to access is exclusive to subscribers.

This can be verified even if the income generated by export duties is excluded from the calculations., which in 2023 are totally diminished due to the effect of the drought. Also netting out this variable and leaving only the collection of the rest of the taxes, the pressure is the lowest in two decades. In that case it is 10.5%

Of course that it has not been achieved due to the reduction of rates or the elimination of taxeswhich is what many opposition leaders refer to, but simply because the income recorded every month by the Federal Administration of Public Revenues (AFIP) has been declining since the beginning of this year. The real tax pressure is measured as a relationship between the Gross Domestic Product (GDP) and the income generated by taxes. It is different from legal pressure, and this one does have quite high levels in Argentina. It is estimated that in a hypothetical scenario of zero evasion, the pressure would reach 45% if provincial taxes and municipal taxes are included.

The Argentine Institute of Fiscal Analysis (IARAF) states in a report that “Even without considering the taxes on foreign trade, badly hit by the drought, in 2023 the lowest national effective tax pressure of the last 17 years has been registered and considering them, the tax pressure is the lowest of the last 20 years.”

Screenshot_2023-08-15_19-10-57.png

Taking into consideration In the first seven months of each year, the year with the highest national effective tax pressure was 2015, with 14.6% of GDP. In relation to that moment, the current tax burden is 3.4 percentage points of GDP below. The report indicates that without taking into account foreign trade, the accumulated until July reached 10.5% of the product, 0.2 percentage points of GDP below the previous year.

On the other hand, The IARAF report says that in relation to the average of 2003-2022, which was 11.5% of GDP, the collection of 2023 would end up 1 point lower.

It must be taken into account thatAlthough the data seems to be positive, strictly speaking, what it shows is the effect of lower tax revenuenot only due to the effect of the climatic event, but also includes other internal taxes that are also showing falls with the exception of VAT. In August it is possible that there will be a recovery in tax collections, hand in hand with the latest version of the agricultural dollarwhich promoted a greater liquidation of exports.

Source: Ambito