peso dollarizing.jpg

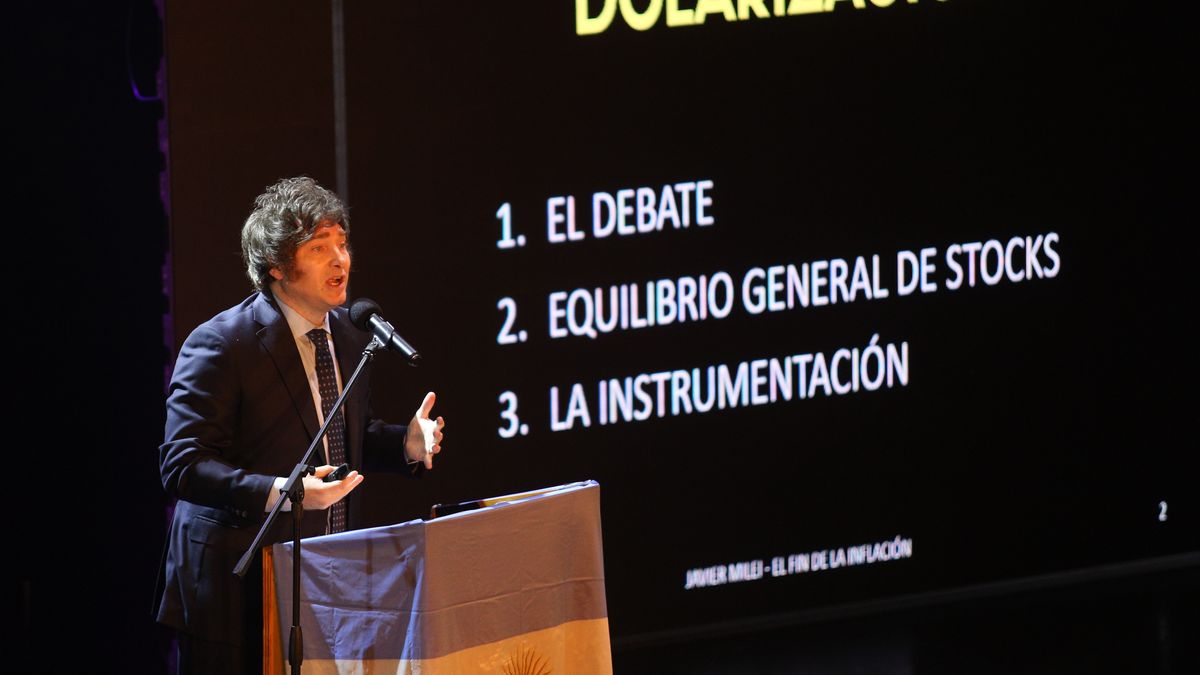

Milei’s proposal is to replace the peso with the dollar.

And, in light of this initiative, many voices are beginning to warn about the risks involved in adopting dollarization in the Argentinawhich would have consequences politically and socially significant as a whole, both in the short and long term.

In the train of analyzing these consequences, it is well worth the analysis of how it went to Ecuador with his dollarizing experience. And, in this sense, the defenders of this model maintain that the strong escalation of the inflationthe main justification that analysts allege for paying the peso, was solved in Ecuador when the dollar it became legal tender.

However, other voices warn that this dollarization process It has not served to solve the underlying problems of the country and they emphasize that it is not possible to talk lightly about the subject, but that there are some aspects to be analyzed. How has Ecuador fared in this regard?

Dollarized Ecuador: 23 years later

The dollarization of the Ecuadorian economy was a measure implemented in the year 2000 by the government of Jamil Mahuad. This measure consisted of replacing the sucre for him dollar US as legal tender. The dollarization aimed stabilize the economy and reduce the inflationafter a severe crisis.

Gabriel PuricelliResearcher at the Public Policy Laboratory (LPP) explains to Ámbito that one of the immediate effects of dollarization was that it did resolve the 1999 financial crisis and “put an end to inflation” immediately.

However, guido zackdirector of the economics area of Foundhe points out, in statements to Ambitone year after dollarization was implemented, the Ecuadorian economy still had a price increase level of 100% year-on-year.

With these data on the table, Zack points out that “dollarization not an immediate solution for inflation”, as a first conclusion.

Inflation and other problems

On the other hand, Zack explains that this Latin American country continued to have very serious economic problems, such as, a fiscal deficit very high, “which clearly had to finance with high foreign debt“, which became unpayable and, therefore, had to renegotiate it in 2020.

And, furthermore, the analyst provides a key piece of information by arguing that, after Argentina, Ecuador is the “country that has the level of risk country highest in Latin America”, followed by The Savior“another dollarized nation”, followed by boliviana country that, although it is not dollarized, does have an exchange rate Fixed over 10 years ago.

“This means that the dollarization nor is it the solution to all ills,” Zack warns about it.

Likewise, Zack maintains that “this process affected the Ecuadorian economy in a very strong way and did not solve its main problems”, but it turned it into an economy dependent on the oil pricewhich, when it goes down, makes it fall.

As Puricelli puts it, between 2000 and 2014, the commodity price boom, especially oil, led to a growth of GDP per capita in Ecuador. However, he maintains that this growth has now been “nine years stagnant, so it could be said that”dollarization exhausted its beneficial effects almost a decade ago“.

The problem of oil dependency

It also warns that this situation of stagnation makes it difficult to export diversification and the development of economic activity of the country in general.

Why is this? Puricelli indicates that, like the Argentine convertibility, “the dollarization acts as a corset for the development of Ecuador and prevents a industrial sector pay good wages”, which in turn facilitates the “flourishing of organized crimewhich receives higher incomes than what a weak and low-productivity business sector can afford”, which would explain the wave of violence and drug trafficking that Ecuador is going through these days, where several political figures have been recently assassinated.

Thus, for the international analyst, “the irruption of violence in daily life and in the current electoral campaign they are a by-product of that economy corseted by the adoption of another country’s currency“.

What happens, according to Zack, is that “the dollarization leave it to Ecuador without the necessary political tools to be able to offset the effects of the prices of the raw Materials that it exports, of which it has no control”.

Everything would indicate that the adoption of the dollar as legal tender in Ecuador served at first to reduce the inflation significantly and the economy grew at a faster pace initially. However, that vanished in the short and medium term as a result of leaving the country no monetary sovereignty and made it difficult to implement countercyclical economic policies.

According to a document dated 2020 from the Latin American Strategic Center for Geopolitics (CELAG), this process was detrimental to that country and explains that this is because dollarization:

- It was a decision made by the elites behind the town.

- benefited the elites, but no, to the popular classes.

- The deficit in the balance of trade It has been financed with foreign debt.

Dollarization: problem or solution for Argentina?

With the foregoing, the analysts consulted by Ambit argue that Argentina would present many of these problems that the country is experiencing today. Dollarized Ecuador.

“I wouldn’t immediately solve the inflationary problem, it would not solve the fiscal problems, nor those of indebtedness. Definitely, It is not a solution for the Argentine economyZack concludes.

For his part, international analyst Luis Rosalespoints out that implementing dollarization requires addressing fundamental problems, such as the reduction of “state spending excessive and the improvement of labor laws to increase competitiveness and open the economy to international trade”.

Rosales admits that, in the current context of Argentina, “the dollarization would be complicated to implement”, and it is more viable and “logical” for Argentines to recognize the need to put their finances in order, adjust spending, improve tax collection and work towards a solid national currencysince, “Argentina succeeded as a large country, without the need to resort to dollarization“.

By achieving the necessary conditions for dollarizei.e. have a balanced fiscal resultstop financing with issuance to the Treasury, align relative prices and accumulate international reserves. Those conditions, “are those necessary to stabilize the local currencyZack concludes.

So, the question is, if the necessary conditions are reached to stabilize, either with its own currency or implementing dollarizationwhich are practically the same, why would you choose the dollar instead of weight? When one takes away tools from the public sector to encourage economic growth and the other gives it monetary sovereignty and capacity to respond to eventual crises. It would be necessary to see why some politician in favor of the option of dollarization.

Source: Ambito