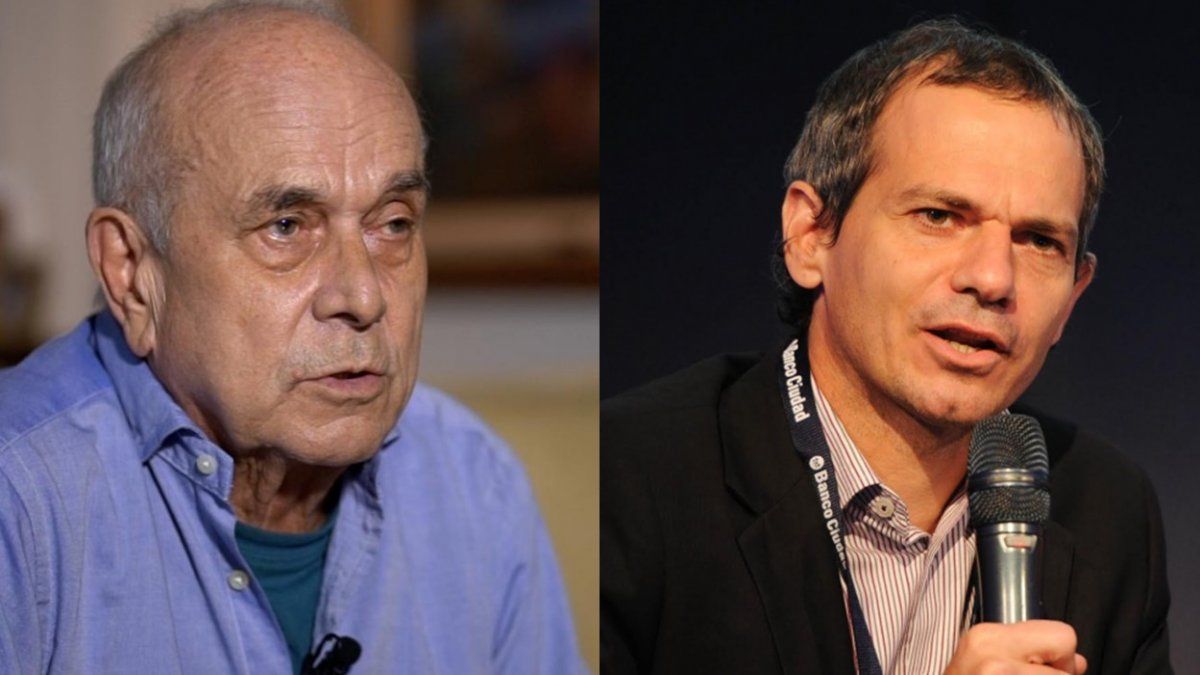

The former Secretary of Economic Policy during the government of Carlos Menem, the Economist Carlos Rodriguez, and the former vice president of Central Bank, Lucas Llach, They maintained a hard crossroads on social networks, around the dollarization project and the theoretical debate among economists on its viability is growing.

Dollarization: how is Carlos Rodríguez’s proposal

Rodriguez He stated that “it is easy to dollarize” but that the complicated thing would be to remove the pesos from circulation, something that, in his opinion, should be done gradually. Instead, Llach warned that such a move could lead to a hyperinflation and accused the former Menemista official of “throw dire and varied proposals slightly”.

Rodríguez indicated that “dollarization is very easy”, since in his opinion “the Dollars there are plenty of them because the private sector has them all, to a large extent hidden and another in the banks”.

“A pair of decrees and deregulations and those who are white can begin to circulate freely. And a Law of Popular Forgiveness of the Market and about 200 billion can circulate that are on the mattress, “he said.

In this sense, Rodríguez said that “The big problem is not to dollarize but to de-pesify.” “At today’s exchange rate there are some 40 billion dollars equivalent in pesos that nobody wants and are the cause of the chronic inflation we are experiencing. They are BCRA liabilities mostly backed by the famous Leliqs that are worthless,” he added.

Screenshot 2023-08-20 104958.jpg

The economist then said that “we must rescue those pesos and the government has nothing of value to give in exchange and that is the problem”. Therefore, he considers that “de-pessifying is possible”, but that “probably we have to do it little by little, starting with the Monetary Base, which would cost about 10 billion dollars.”

“Then the Leliqs (counterpart of the Fixed Term). An important fraction of the Fixed Term is in the hands of state entities. That part could receive a Bond. For the rest, it would be necessary to place debt or sell state assets. If an adjustment is made really fiscal, the Argentine debt would rise in price in the markets,” said Rodríguez.

Dollarization: Lucas Llach’s counterproposal

Instead, llach argued that the concept of “despesificar little by little” is “another colored mirror”. “There are two options to ‘de-pesify little by little’: (1) the pesos have a fixed exchange rate with the USD or (2) they do not have a fixed exchange rate with the USD. In case (1): `Come from to little, but for every 1,000 pesos I am going to give everyone 1 dollar. Would you wait to go? Of course not. Then there is a run against the scarce reserves and they end. It is launching a convertibility without reserves”. he explained her.

The former vice president of Central bank iHe indicated that in the second case “as I get dollars, I withdraw pesos, at market prices.”

“It’s much better. Peeeero: since prices would already be in dollars at some point (this is the key: the unit of account!) at that moment the demand for pesos would disappear,” he warned.

llach considered that “it is much more practical to use Dollars when prices are in dollars”, but warned that “at that moment the demand for pesos collapses and nobody is buying them: hyperinflation in pesos (the effect of which is less serious if all prices and wages are already dollarized, but that does not happen spontaneously )”.

“We need to have a serious discussion on this issue. You can’t throw away such dire proposals and so varied so slightly. We are talking, in a possible scenario, about the future of Argentines,” said the former official in the government of Mauricio Macri.

Source: Ambito