Behind the devaluation last Monday after knowing the result of the STEP, the consultants began to sharpen the pencil and already foresee a difficult outlook for the remainder of the year. At least six of them forecast very pessimistic numbers for the CPI around two digits until December marked by a context of General Elections.

The inflation for the month of july accelerated to a rate of 6.3%, 0.39pp more than the previous month, explained by the increase in seasonal goods and services, as announced this week by the INDEC. However, for most analysts it will be the last month that we would see inflation of 6% – which is already high.

Ecoviews

With accrued price acceleration of 60.2% in the first half, and with the whirlwind after PASSEDthe consultant Ecoviews projects a inflation with a closure of 180% and attributes it specifically to dollar jump. “The 21.8% jump in the official exchange rate and the promise to keep it fixed until the general elections were not enough to reassure the market.”

“From Econviews we project that the inflation It will generally be around 12% in August and September. The Central Bank’s strategy of anticipating the devaluation of the next 60 days makes the inflation be one step higher. In a context of political uncertainty and little credibility in the current leadership, the price freeze and the use of the official exchange rate as nominal anchor, they are not enough.

“The “plan to arrive” of Massa has a very high cost in terms of inflation for the next administration. We believe that the only month with a real chance that the inflation to be in one digit is October, assuming that the government is successful in leaving the dollar stuck at 350 for two months,” said the consulting firm of Miguel A. Kigüel.

Screenshot 2023-08-20 121328.jpg

roman group

In the report “The Economy post-STEP towards October”, the consultant detailed three base scenarios taking into account the variables inflationexchange rate and economic activity.

- BASE scenario (65% probability): Sustained deterioration, but not out of control, of the main macroeconomic variables, but with support from the IMF in transition.

In relation to the dollar, it is not enough with the post-devaluation PASSED and in the last part of the campaign the Central Bank is forced to devalue again at the inflationary rate so as not to lose competitiveness due to the transfer to the price of the devaluation already made. estimate one inflation of 12% monthly for August-September, to maintain the fixed exchange rate.

- Pessimistic scenario (15% probability): The main driver of this scenario is non-cooperation between presidential candidates, with its impact on the lack of control of economic variables. Refering to inflationthere would be a spiralization to a scenario of hyperinflation at levels above 20% per month, where the nominal race between wages and prices would increase, without finding an anchor.

- Optimistic scenario (20% probability): The market absorbs as positive that 60% of the voters opted for a pro-market proposal, and there is the expectation of possible agreements between said forces to continue with the reforms that the economy needs.

Inflation: They consider that in August and September there will be an acceleration in the price movement, but without spiraling, with an average below 10% per month.

GCL

in the report “Post STEP 2023 Scenario”, the consultant assumed that the inflation “will be higher” in these months. “We estimate that half of the economy already worked at the free exchange rate, but a large part and mainly a large part of the basic basket is still at the official exchange rate. With the inertia that the economy was experiencing and assuming a ticket at 50% pricesthe inflation will go to a range of 20-25% accumulated between August and September, with a floor of 13% in August. In other words, in two months the real exchange rate will possibly be at the same level as a few weeks ago.”

“The difficulty of making this exchange ‘correction’ without solving substantive issues could install the inflation inertial in two digits for the rest of the semester. Something that could spread more anger to the electorate. Just assuming that in the fourth quarter prices converge at a monthly rate of 8%, as of December the inflation it would reach 155% per year; if it ‘stabilizes’ at 10%, the year would close at 170%”.

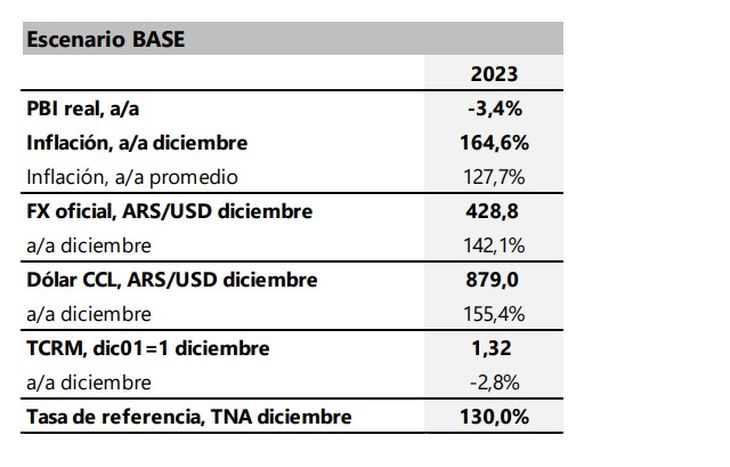

The following table summarizes the main variables of our baseline scenario as of December 10 2023. “We do not rule out new corrections as the days go by and the evolution of this volatile situation,” they explained.

Screenshot 2023-08-20 123137.jpg

Anker Latin America

This week’s macro financial monitor was very pessimistic for the consultancy. “We believe that in recent days the probability of a deepening of the crisis has increased,” she began bluntly.

As they maintain, they expect a “acceleration in inflation greater than that of other episodes of exchange rate tension, such as October 2020 or June 2022. On this occasion, not only durable goods suffered the impact (via price increases or temporary withdrawal from sale), but there was a high immediate transfer at prices on many products of massive consume. The latter and the rise in financial dollars is explained by the combination of political uncertainty and the strong restriction of access to foreign currency since the end of July, which prevents the new official FX from becoming a reference for the economy.”

As he maintains, the inflationary dynamics may still take time to be reflected in the statistics, but it will result in the “quick improvement in the real exchange rate”. “In the current context, we estimate an inflation floor in the zone of 25% accumulated in August and September“.

Cohen

“The acceleration of the inflation It leads to a nominality at a higher level and carries with it a considerable risk of spiraling if expectations are not anchored and the north of inflation between 180% and 200% per year cannot be ruled out by 2023″.

The interesting thing about the report Cohen is that it points out that the proposals by Javier Milei in relation to dollarization “they reinforce the risk of spiralization.” As they maintain, because the execution of a dollarization “It’s very different from the ad.”

To close, they maintain that the floor of inflation of the next few months will comfortably start in double digits “and we will probably reach the general elections with a annual inflation around 140%”.

fmya

The consultancy led by Fernando Marull projects a 200% inflation by 2023, an even more pessimistic vision than the previous ones – although not ruled out. At the same time, he compared the inflation projection of August between 12% and 13% with March 1989, same context of spiraling of the inflation after a devaluation.

It is worth remembering that between 1975 and 1991 inclusive, the country had a annual inflation of more than 80%. In nine of those sixteen years, consumer prices reached 3 digits, while in another two years the rates reached 4 digits – 1989 and 1990. In other words, the Marull consultancy reaffirms the high risk of spiraling and the catapult for hyperinflation.

Source: Ambito