The proposal of javier milei that Argentina is on the way to a dollarization generated multiple reactions not only in Argentina but also in the US among the main economists who advise international organizations. One of them was the 2007 Nobel Prize, Paul Kurgmann and Mark Sobel former US representative to the IMF. But now one more has been added: Robin Brookschief economist at Institute of International Finance (IFF) that brings together the large global financial institutions.

Through your account Twitter, the analyst compared the Argentine case with that of countries such as Brazil, Egypt, Pakistan, Turkey and Sri Lanka. “The dollarization in Ecuador is being romanticized in Argentina,” Brooks explained, sharing a note in the Financial Times titled “dollarization will not help Argentina.”

Screenshot 2023-08-20 143447.jpg

“Argentina is flirting with dollarization, which is a link to the American dollar with another name. That’s strange timing given how many pegs have erupted since 2019, including Nigeria (-52%), Egypt (-48%), Pakistan (-47%), Sri Lanka (-44%, pictured) and Ukraine (-36%) This is not the time for pegs,” the analyst explained.

The diagnosis: why Argentina should not dollarize

For Brooks, Argentina was repeatedly peso-USD pegged, “a policy that time and time again ends in massive devaluation and hardship. Dollarization is just a more extreme form of that peg.”

What is the problem with dollarizing?

According to the economist, inflation in emerging markets is above inflation in the US. If you peg your currency to USD, your real exchange rate inevitably rises and becomes overvalued. That makes the “explosive devaluation is inevitable”.

“There are many emerging markets, not just Argentina, that fall for the siren song of dollar parity. In fact, the last few years are a warning about all of this, as the Fed hikes made many of these guys of change were unsustainable. Egypt had to devalue, Pakistan had to devalue, Sri Lanka had to devalue.”

“Proponents of dollarization in Argentina say that it will solve economic imbalances. Many countries have such imbalances, but they let their currencies float, which avoids an explosive devaluation. Turkey does that and it is the example that Argentina should follow, while it fixes its policies,” he explained.

And the Ecuador case?

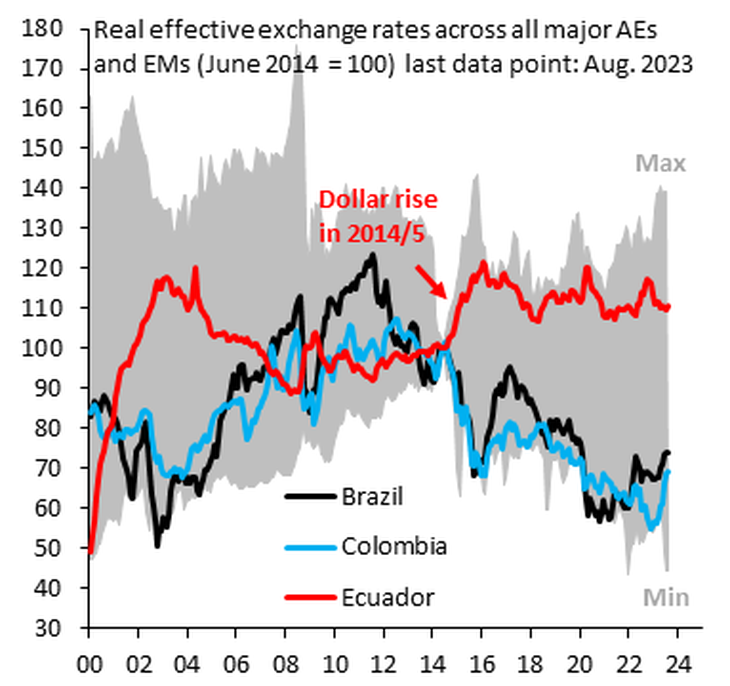

“Ecuador locked itself into a massively overvalued currency by pegging to the USD (which is all dollarization is). As a result, it is falling behind the rest of LATAM, where currencies have depreciated.

F35_T3BWgAEPqpZ.png

“Ecuador’s real GDP per capita (purple) has stalled below its Latin American peers. Argentina’s GDP per capita has also stalled, as Argentina is constantly trying to re-peg to the dollar. LATAM countries that allow their currencies float grow more consistently”.

Dollar: what is Brooks’ proposal

“The only reason Argentina has a parallel exchange rate is because the official exchange rate is almost pegged to the US dollar, that is, it is not set by the markets. Dollarization simply takes this status quo to the extreme and is exactly what WRONG. Let the peso float and fix your policies,” he concluded.

Source: Ambito