The Government increased the non-taxable minimum of the Income Tax that has been in force since this month, in addition to the changes in the scales retroactively to January of this year to alleviate the pocket of workers.

He Government increased the non-taxable minimum Income Tax that is in force from this month, in addition to the changes in the scales with retroactivity to January of this year to alleviate the pocket of the workers. But what impact does it have on wages? A report from IARAF (Argentine Institute of Fiscal Analysis) tried to explain it.

The content you want to access is exclusive to subscribers.

According to the IARAF, “in a context of normality and relative stability, this annual adjustment would be sufficient”. However, with the inflation that Argentina is facing, if the calculation parameters are not adjusted, it causes more and more workers to be affected by the tax.

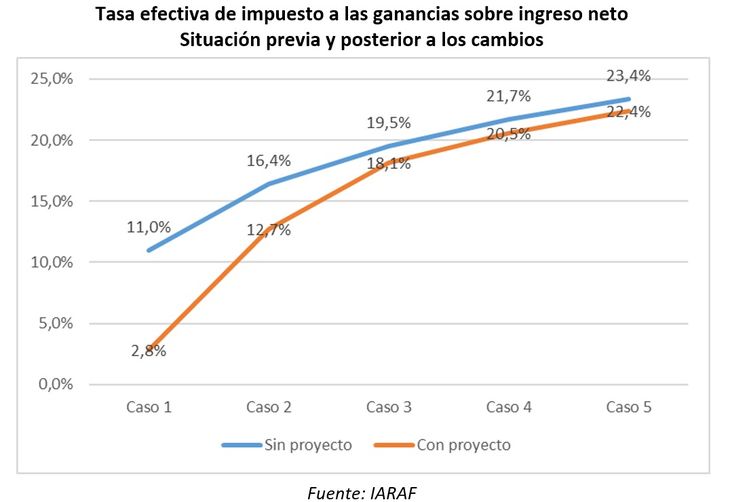

According to the IARAFif that adjustment had not been arranged, a worker that in January it was just over $405,000, it would end up 2023 paying income tax equivalent to 11% of your net income, while with the current change you will only end taxing 2.8% (It is not absolutely excluded since in a few months prior to the updates arranged it will have been reached).

Earnings: how are salaries with the changes

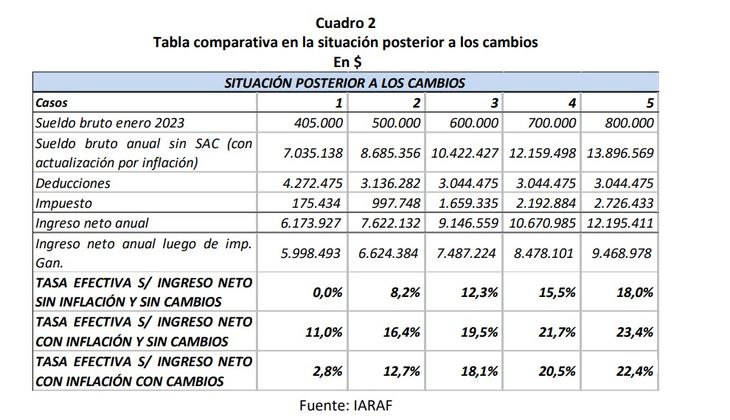

The adjustments were the 100% increase in gross income levels that have the full additional deduction (which was set at $700,875case 1) or partial and decreasing ($808,341case 2), and a 35% adjustment in the caps of the scale sections, without modifying at all the minimums and general deductions that ordinary workers can compute.

Screenshot 2023-08-20 152104.jpg

However, as well as the updating of the value of gross salary that allows the application of the total additional deduction (case 1), it is shown to be effective in maintaining the majority of employees. workers outside of the tax, the other measures reduce little andl growth of effective aliquots that the workers affected by nominal effects will suffer and not by a growth in their real income.

Thus, in the exemplified case 2, which allows the additional deduction to be partially computed, the distortion due to the increase in the effective rate is cut in half. In the other cases (which do not experience any adjustment in their deductions), the effect of the adjustment in the scale sections very marginally reduces the growth of Tax pressure that they will experience

Graph 1 shows the structure of effective rates both for the situation prior to the changes and for the subsequent one. In other words, the effective tax rate thats workers they would have had without the modifications you make versus those they will have based on the changes implemented. It can be seen that the greatest differences are concentrated in cases 1 and 2, that is, in those workers who in January 2023 had a gross monthly salary of $405,000 and $500,000, respectively.

WhatsApp Image 2023-08-20 at 2.59.41 PM.jpeg

“The inflation it deteriorates the real parameters of the tax and thus increases the effective rates. The recent changes reduce the latter, with the drop being greater in the cases of salaries lower,” concludes the IARAF.

Source: Ambito