The Government of Brazil proposed to Argentina to pay for Brazilian exports in yuan to avoid being dependent on Reserves in dollars of the Central Bank and maintain the flow of bilateral trade, announced this Wednesday the Minister of Economy of the neighboring country, Fernando Hadad.

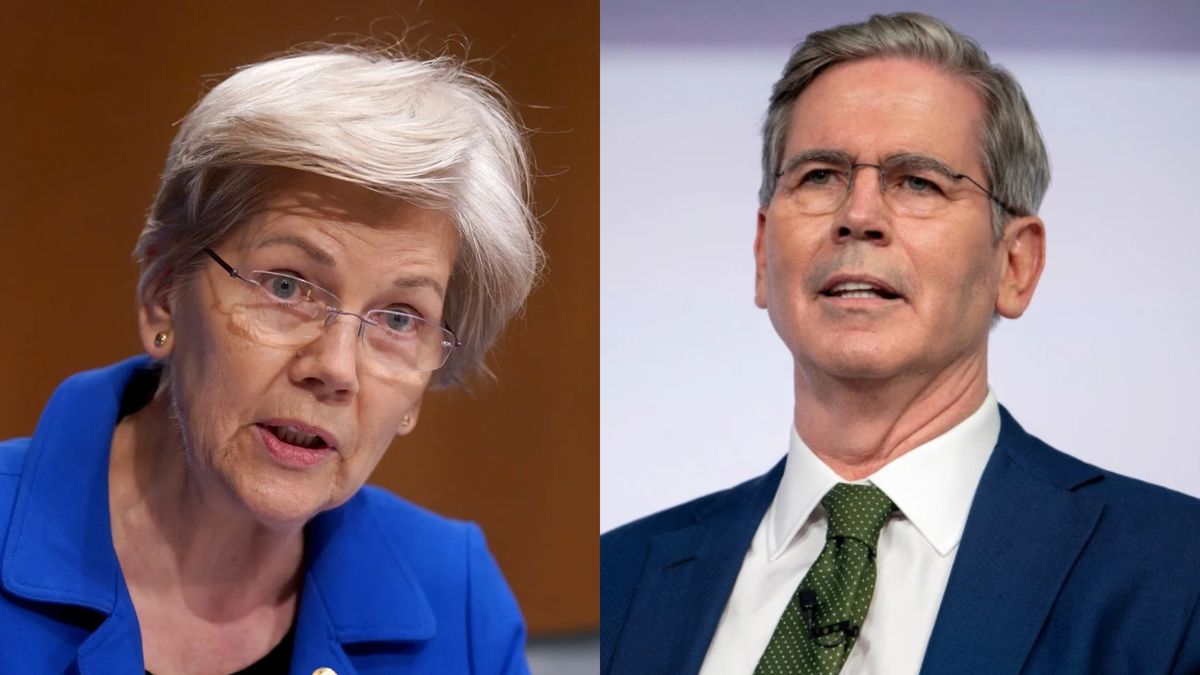

“We sent the Argentine government a guarantee proposal in yuan for Brazilian exports, for Brazilian exporters it is a good thing, it will be good news if Argentina accepts”Haddad said at a press conference in Johannesburg, where the Brics Summit (Brazil, Russia, India, China and South Africa) is taking place.

The Brazilian government maintained that the agreement in yuan of the Argentine and real reserves removes the possibility of non-compliance by Argentina.

According to the minister, the operation involves the direct conversion of the yuan into real by the state-owned Banco do Brasil in London, for a total of up to 140 million dollars.

“Brazilian exporters can have some flow of sales of their products with 100% guarantee. For Brazil, there is no problem, because the exchange rate will be made with the yuan for the real and this also assures the National Treasury that there is no risk of default. A guarantee that the Treasury considered adequate and that the Banco do Brasil accepted, as presented”, Haddad assured.

As a result of the drought suffered by Argentina and the consequent lack of foreign currency income from the sale of grains, the governments of Argentina and Brazil are negotiating a mechanism to facilitate payment to 200 Brazilian exporting companies that sell in Argentine territory without having to wait for the flow of reserves at the Central Bank.

Last May, President Alberto Fernández and his colleague Luiz Inácio Lula da Silva talked in Brasilia about the possibilities of financing Brazilian exports, but Brazil was looking for greater guarantees due to the lack of dollars from Argentina.

Lula unsuccessfully proposed that the New Development Bank, the bank of the Brics, be able to finance exports from Brazil to Argentina.

The idea that the National Bank for Economic and Social Development (BNDES) of Brazil, the largest development bank in the Americas, can finance exports with subsidized rates to Argentina.

The powerful Federation of Industries of the State of São Paulo had demanded that the government find mechanisms to avoid losing markets to China in Argentina due to the obstacles due to the lack of foreign currency for external sales to be compensated.

Through the swap agreement with China, Argentina managed to maintain the trade flow with the Asian country, something that Brazil was looking for, whose main industrial exports go to the Argentine market.

Argentina is Brazil’s third largest trading partner after China and the United States but unlike the first two, it is the main buyer of industrialized products.

Lula had said on Tuesday during the Conversando con el Presidente program that Haddad’s proposal to Argentina was “calm and pragmatic”, defending the de-dollarization of the world economy, the use of local currencies between commercial partners and the creation of a unit to replace the dollar in trade between the Brics countries.

Source: Ambito