as he was able to reconstruct AmbitCacciola becomes president of the entity, replacing Franco Mignacco (Exar mining, lithium), after a hard-fought search for unity, which left -as always happens- wounded along the way. The biggest shock was the departure of two of the largest operators in the country. In return, CAEM announced weeks ago that nine new partners including exploration, chemical manufacturing, logistics and consulting companiesamong other.

Against the clock, the complete list of positions of the Board of Directors is defined, which due to a recent reform of the statute now corresponds to companies and no longer to individuals. The payroll must include the Presidency, six vice-presidencies, executive secretary, deputy secretary, treasurer, pro-treasurer, 11 regular members, 5 substitute members and four members of the Audit Commission.

The state of mining today is challenging. Last year they were exported US$3.8 billion, the best result since 2012, and it has 28 months of uninterrupted employment growth. In terms of investment, as explained by the Secretary of Mining, Fernanda Ávila, accumulates US$17 billion in the last three years. “It is the sector that registered the highest level of attention from investors”said the official.

image.png

In addition to the copper projects under exploration (the Red Gold will have one of the main vice presidencies in charge), another of the jewels of the coming years will be lithium, White gold that comes shining Sources from the Ministry of Mining forecast that by the end of 2023 lithium production in Argentina will have increased by at least 50% in just one year, upon reaching 60,000 tons. In 2022 they were almost 38,000 tonsbetween what was produced in Sales de Jujuy and in the Fénix project of the Salar del Hombre Muerto, in Catamarca, of Livent.

In the first five months of 2023, lithium exports reached US$369 millionwhich meant a year-on-year growth of 84% year-on-year and represented 23% of total mining exports. A quarter of Argentine mining is moved by lithium, almost without counting the Exar project and another that is inaugurated before the end of the year. Ávila spoke publicly of reaching the 400,000 tons of equivalent lithium carbonate in the coming years and in CAEM agree.

But beyond the figures, the delay in the approval of SIRA and the Sirace, the lack of foreign currency to remit dividends, the million-dollar debts generated by intra-companies abroad for loans in dollars that do not go through the Central Bank and the possible accompanying Cacciola, CAEM’s new leadership will assume an unprecedented level of approval for mining in Argentina and some concernsas determined by the last report of polyarchy about the sector.

The survey revealed that the 56% of those surveyed expressed themselves in favor of the development of mining activity in Argentina.

In July 2017, 19% considered the development of mining in the provinces to be of little or no importance, with 3% undecided. In February those who opined against fell 11% and those who were undecided grew to 9%. The last measurement uncovered 14% reluctant and 16% hesitant.

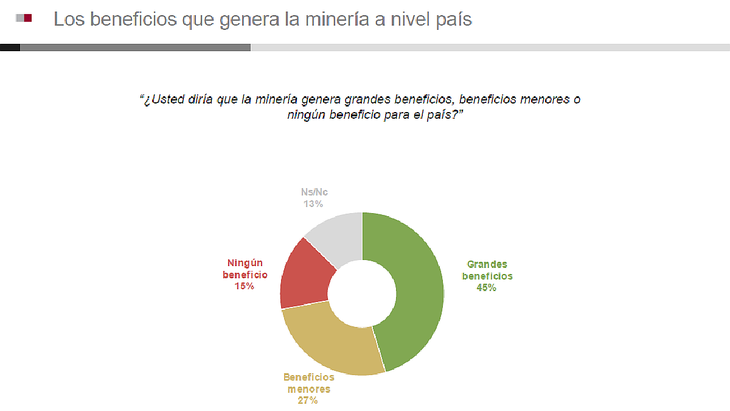

“Would you say that mining generates great benefits, minor benefits or no benefit for the country?”asked Polyarchy. 45% answered great, 27% minor and 15% no benefit. Historical.

Finally, the survey inquired into the economic income generated by mining for the national State. In November 2016, 44% considered them little or not at all important, while 46% said they were relevant. In the past year those numbers have changed: those who disbelieved in the possibility of generating national income fell to 24% and those who believe that it does contribute to state coffers reached 67%. doubly historic.

What changed in the perception of mining in Argentina?

It improved the view of mining in the mining provinces. “However, objections to environmental issues continue, particularly issues associated with water,” said the work to which this medium accessed.

The view of Argentines (public perception) on mining changed. Yes ok Throughout the country, information in general on mining is weaker and more diffuse, as is knowledge or interest in this sector. In the last two or three years, a process of monitoring public opinion began to be glimpsed. in favor of the sector.

image.png

Lithium and copper changed the outlook in favor of mining. Both have a lot to do with this change in perception and perhaps today we are facing one of the best moments for mining in terms of the positive view that the population offers about this industry throughout the country, Poliarquía pointed out, although it also He remarked that “expectations have a lot to do and perhaps less the real results.”

The position in favor of the development of the sector and on the benefits generated by mining improved. In particular, those that would correspond to the national State. According to the study, the latter is an issue that the provinces might want to review, although it is a very specific issue that is not yet on the radar of the general population.

image.png

The pending challenges of Argentine mining

Mistrust of control over companies continues. With different degrees or levels, this control exists, although the provincial governments are not very careful to expose it more clearly, something that also occurs in relation to the contributions of the activity.

A strong critical view of environmental issues persists. The focus in particular is on water and public control. Greater vigilance on caring for the environment continues to be demanded, but also on the promotion of more employment and supply activity to the sector.

Seek equitable treatment for foreign investors. As detected by Poliarquía, Chinese investments are a new protagonist that everyone is looking at more closely, although perhaps also with some misgivings. However, an important fact is that the general population seems to offer a window of opportunity by suggesting that Chinese investments deserve the same treatment as others from other countries.

MANAGEMENT COMMITTEE 2023-2025

- President: Santa Cruz Mining

- First Vice President: Exar

- Second Vice President: Depromin

- Third Vice President: Glencore

- Fourth Vice President: Minera Argenta (Pan American Silver)

- Fifth Vice President Argentina Fortescue SAU

- Sixth Vice President: Minera Del Altiplano

- Secretary: Patagonia Gold

- Deputy Secretary: Chamber of Stone of the Province of Buenos Aires

- Treasurer; Allkem

- Protreasurer: Camicruz

VOWELS:

- Member 1: Mansfield Mining

- Vocal 2: Albemarle

- Vocal 3: Argentine Current

- Member 4: Andes Mining Corporation (McEwen Copper)

- Vowel 5: MARY

- Vowel 6: Cephas

- Vocal 7: Mina Pirquitas

- Vocal 8: Rincon Mining

- Vocal 9: South American Eramine

- Vocal 10: Mining Chamber of San Juan

- Vocal 11: Austral Gold

SUBSTITUTE VOWELS:

- Substitute 1: Sun’s Edge Exploration

- Substitute 2: Cemincor

- Alternate 3: Lithium Americas Corp.

- Substitute 4: Piuquenes Mining Company

- Substitute 5: Mining Chamber of Salta

HEAD ACCOUNT AUDITOR

SUBSTITUTE AUDITOR

- Argentine Mines (Miners)

- opensilver

Source: Ambito