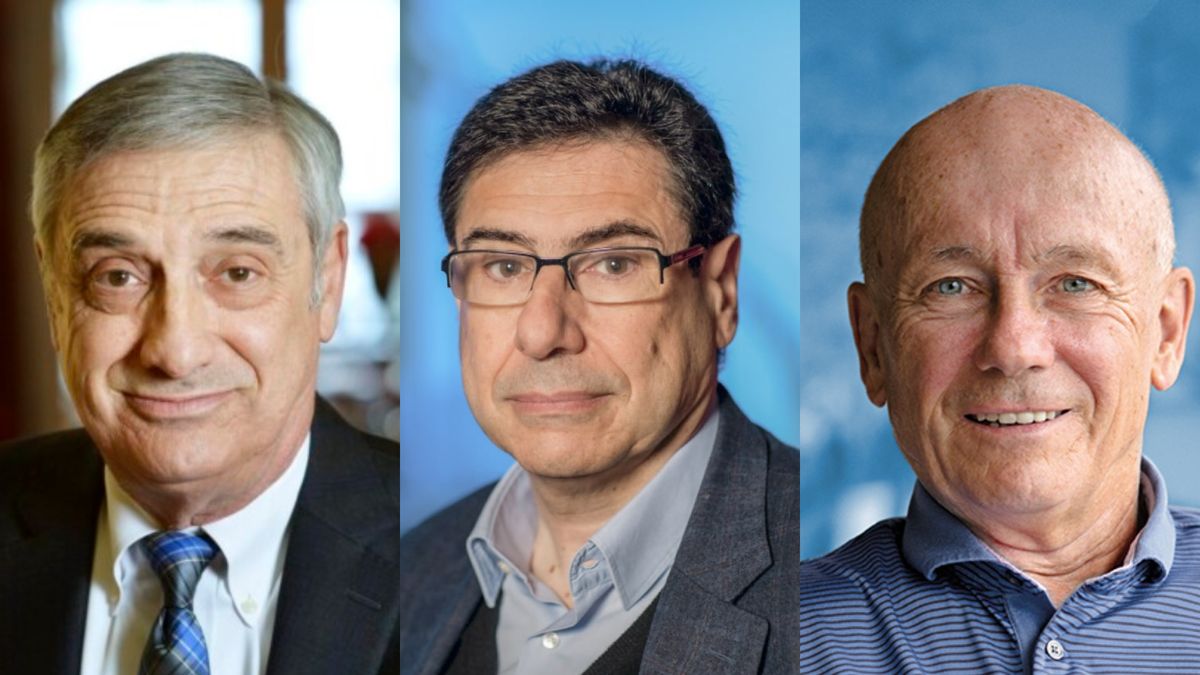

In an auditorium before more than 300 finance executives, the Economist Enrique Szewachright hand of Carlos Melconian In putting together the economic plan for Together for Change, he was very critical of dollarization, because he stated that “Argentina’s most serious problem is not the currency, but rather it is fiscal.” In that sense, he anticipated that the priority of the Mediterranean Foundation will be to achieve zero fiscal deficit.

“The first months, the whirligig will say ‘everyone puts in,’” he told the executives during the annual convention of the Institute of Finance Executives (IAEF) that was held in Puerto Madryn, where he participated Ambit. In dialogue with this newspaper, he explained that, as the main objective will be to balance public accounts to lower inflation, he ruled out an initial reduction in taxes, anticipated that there will be an improvement in collection and rejected a pension reform, despite stating that pensions They are the main expense of the State.

Enrique Szewach: Each one asks for their own thing… The first months the whirligig will say, everyone says, except for those who pay the inflation tax who are the poorest and could not survive, there is going to be a process so that this is not bloody. We all want to lower taxes. But the most important tax to lower today is inflation. If you do not have the fiscal deficit at zero, any tax reduction is temporary. Macri started with zero withholdings and ended up raising them. First you have to have an orderly State that does not go into more debt, and then you will be able to reorder everything. There are other things that will go down first, such as country risk. And there will also be reductions in the labor tax for SMEs. And we are going to reorganize the AFIP, so that it stops hunting in the zoo.

Q.: In the “everyone contributes”, how will they avoid being conditioned by the Red Circle, given that the Mediterranean Foundation is financed by the main companies in the country?

IS: We have no conditions. As Melconian says, our program is for 46 million people, we want to restore a general balance. The Mediterranean partners financed a program and a team, but they did not get involved in the program, we worked with total independence. We don’t want a position. We all have a reputation. If someone had told us, you have to do this, we wouldn’t have taken the task.

Q.: So the withholdings are taken out on day one as they say in the campaign?

IS: We will try to get them out as soon as possible. But again, the first tax that must be lowered is inflation. In addition, we are going to eliminate the exchange gap and the restrictions on imports for agriculture, so they will be better off. Because the problem that the countryside has, in addition to the withholding, is that the imported inputs go to the dollar above the official one with the Country tax, and the exports go below the official one with the withholdings.

Q.: I said in the IAEF auditorium that public spending is 20 points of GDP, of which almost half are retirements. Is there going to be a pension reform?

IS: Today, pensions are at rock bottom and we cannot bear to see them continue to liquefy. There will be a pension reform, but it is moving forward. Because, even if you do it now, it does not affect the current deficit

Q: Are you going to change the indexation formula, because if inflation goes down, spending increases, because it is indexed to what happened in the past?

IS: That is an issue that we are trying to see how to do. But today the priority is for retirements to stop falling.

Q: In what period will they reach zero deficit?

IS: We want to go as fast as possible. We calculate that after we fix the relative prices, after the first months we will be able to clearly announce a horizon of one year to be in zero deficit.

Q: How will they do it?

IS: You don’t have a single thing that you can touch and that’s it, it’s over. It will be a cocktail shaker of micro measures, between increased income and cutting expenses. On the expenditure side, almost 1 point will be with lower energy subsidies. A part remains to maintain the social rate. Another will be the reduction in the deficit of public companies. Some will close, others will be restructured, others will have to have a surplus. Politics will define it. Another point will be administrative reform, which could be 0.3% of GDP. But the first year gives you very little, you can’t take people out from one day to the next. We are also going to look at trust funds and discretionary transfers to the provinces, such as retirement funds. On the income side, collection will improve, because the withholdings remain, and the harvest will improve. The fuel tax must also be updated. Likewise, we know that we also lose the Country tax on the purchase of the official dollar.

Q: Aren’t there more measures related to improving income than to cutting expenses?

IS: Well, there is a mix. Because trimming is a process. We have the entire problem of State reform line by line, but it takes time. The most serious thing is not the fantasy of dollarization, but of the chainsaw plan.

Q.: There are consulting firms that estimate that the total fiscal deficit could close 2023 at 3.5% of GDP. Do you agree?

IS: He must be there, but we don’t know. Because Massa is increasing spending with these latest measures, and is also anticipating the collection of taxes, such as company profits.

Q.: What do you think of the elimination of fourth category Earnings that Massa wants to do?

IS: We have a personal income tax project, because salary is not profit. But it is part of a broader reform, along with simplification, monotax and taxes on work. There is a whole tax rethinking, but I don’t think it can be lowered in the first year.

Q.: According to an OPC report, two thirds of the State’s expenses are rigid; to lower them, laws need to be modified. Is there a strategy to achieve these consensuses?

IS: Politics should be in charge there. We made a control board that has a table per topic, and there it says whether a law, a decree, or a resolution is required. Whatever a law requires, we will go to Congress to fight it. We will go to explain, and we also have the leadership of the President, Patricia Bullrich. Also, Carlos Melconian has contact with governors, politicians, and the Supreme Court. There is an advantage and that is that two thirds of the electorate want change. The seasonal climate helps. The problem is that if you ask everyone what change means, you will have 10 million definitions and that is a problem.

Q.: The business community agrees with these ideas, but there are doubts about internal cohesion and governability. During the Macri Government, rates increased and radicalism complained. Now that the Mediterranean Foundation program was chosen over the ones that the JxC economists had been carrying out, what guarantees that it will not happen again?

IS: Today, when you look at the documents of the foundations, it does not have many differences with our program. There may be some nuances, but there is no one saying that rates should not be raised.

Source: Ambito