Complying with the Financial Administration Lawthis Friday The Government will send the 2024 Budget Bill to Parliament. The initiative will include a separate document to be analyzed by legislators, to which he agreed Ambitwhose objective is to propose “the review of a set of expenses and tax benefits that different companies and sectors have and that cause the State to lose almost 5 points of GDP”indicate in the Ministry of Economy.

Among the issues on which economic driving focuses are:

- The exemption from payment of income tax for judges, civil associations, foundations, mutual societies and cooperatives;

- The reduction of VAT on works of art;

- Social security contribution regimes;

- The exemption of liens on rural properties,

- The Economic Promotion Regime of Tierra del Fuego.

The primary fiscal deficit estimated in the draft budget for the Next year it is 0.9% of GDPbut “Congress is invited to make the effort to review this group of economic benefits to companies and sectors to achieve in 2024 that the year-end is with 1 point of GDP surplus.”

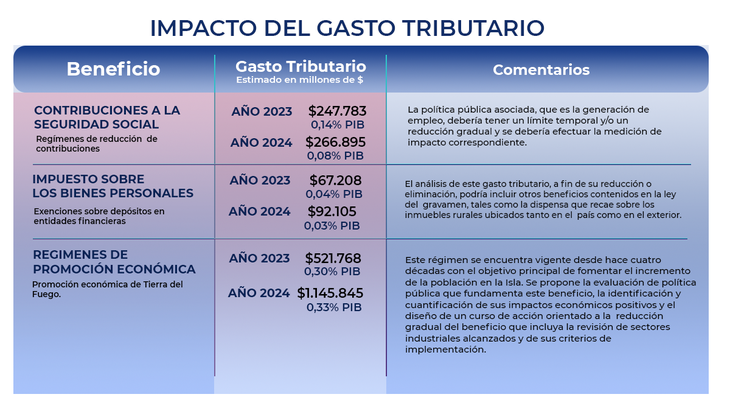

As he had already done in the project budget for 2023, now the Ministry of Economy once again raises the need for the analysis of “various tax benefits, differential treatments and budget subsidies that particularly favor large firms and corporations and that have a significant negative impact on the sustainability of public accounts by generating permanent reductions in revenue.”

BUDGET 2024 IMPACT_01.png

Tax expenses refer to the amount of income that the treasury fails to receive when granting tax treatment that deviates from that generally established in tax legislation, with the aim of benefiting or favoring the development of certain activities, areas, taxpayers or consumptions.

It implies, therefore, explains the official document, a transfer of public resources implemented through a reduction of tax obligations in relation to a reference tax, rather than a direct expense.

In this regard, he states that “The enactment of laws that reduce tax spending is a way that would strengthen the resources of the public sector, have greater financing for the development of priority public policies and consolidate a robust primary surplus result”.

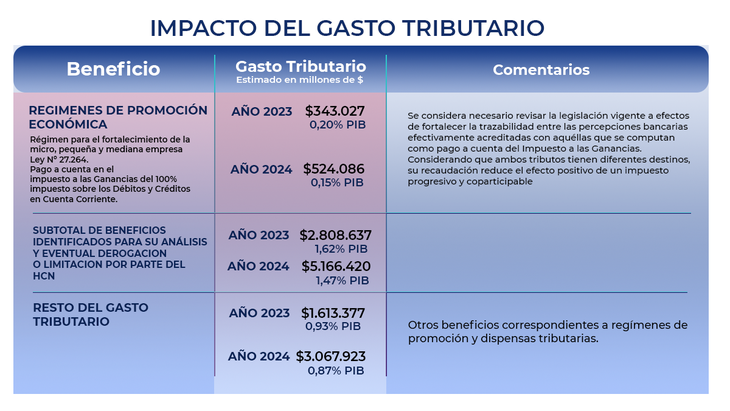

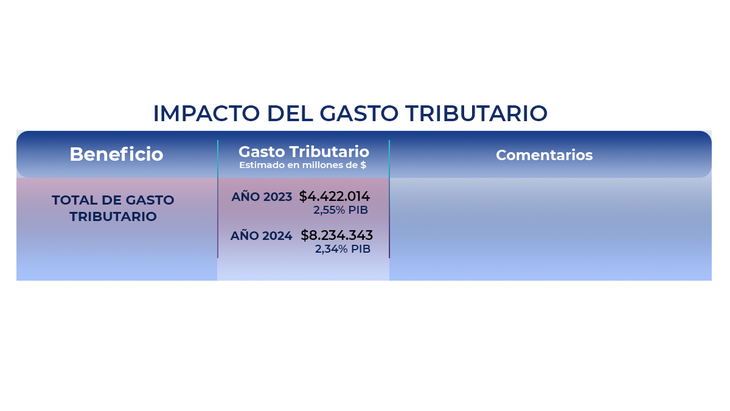

The estimate from the Treasury Palace shows that tax expenses and other tax benefits with budgetary impact implies permanent collection losses of approximately 4.72% of GDP in 2024.

BUDGET 2024 IMPACT_02.png

Budget: what is the spending plan?

The Ministry of Economy estimates that the total Tax expenditures for the year 2024 amount to 2.34% of GDPwhich is grouped into two main components: those derived from tax regulations (1.73% of GDP) and those derived from Economic Promotion Regimes (0.61% of GDP).

To facilitate the analysis of legislators, the offprint of the Ministry of Economy presents a selection of a set of tax expenditures, which account for 62.7% of the total (1.47% of GDP) on which it makes comments:

Rural goods

Among the topics to be considered, the document is the exemption of rural properties from the Personal Property Tax, which represents 0.48% of GDP.

In this sense, he proposes that “it would be necessary to subject legislative evaluation reasonableness to maintain the validity of this exemption in light of the contributory capacity, its profitability and access to other benefits in the form of subsidies, promotions, etc.” It specifies that the ownership of rural properties located abroad is concentrated in 450 people residing in the country.

Companies

It also proposes “focusing attention on the exemption from the Value Added Tax that falls on the fees of the directors of Companies that will represent, in 2024, 0.29% of the GDP.”

In this case, it indicates that a consideration similar to that formulated for the exemption of rural properties would apply in terms of evaluating “the possibility of its legislative repeal based on objective indicators regarding the benefit of this dispensation and the contributory capacity of its recipients.”

BUDGET 2024 IMPACT_03.png

The document also recalls that the ADR They pay 7% income tax instead of the general rate (35%) and? “In the case of Livestock, valuations at historical value are accepted; Alternatively, the alternative method of replacement value or market value could be evaluated.”

In conclusion, The reprint maintains that the loss of collection of 4.72% of GDP in 2024 derived from the expenditure and the set of tax exemptions and waivers “competes with the possibility of designing a medium-term fiscal path with sustainable primary surpluses” and consider that “could be analyzed and evaluated by the Honorable Congress of the Nation in order to, through legislative means, be reduced”.

In the same sense, he adds, other alternatives unrelated to tax spending could be evaluated, following the conclusions reached. Pillar II of the OECD Global Solution, which ensures that large companies are subject to a minimum tax rate of 15%.

BUDGET 2024 IMPACT_04.png

Source: Ambito