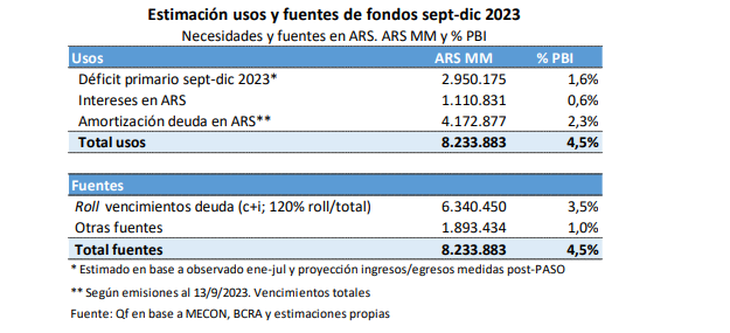

Between September and December it has to raise $8.2 billion to cover the gap in public accounts, pay interest and renew maturities. With a 120% roll over, it could get $6.3 billion.

The decision to raise the non-taxable limit of Income Tax for formal workers, refund of VAT on food to 9 million people and the additional assistance to retirees and other beneficiaries of social assistance, who join the rest of the the measures announced after the PASO on August 13, raise in themselves an increase in the needs of the public sector, and along with it, the problem of obtaining the necessary financing. According to a study by the consulting firm Quantum, of the economist Daniel Marx, the Government could obtain most of those funds in the last quarter.

The content you want to access is exclusive to subscribers.

Quantum points out that “If the application of the measures occurred fully and within the planned times, the primary deficit in 2023 would amount to 3.2% of GDP” compared to the 1.9% that had been agreed with the International Monetary Fund (IMF). Although there would be an improvement in income from withholdings as a result of the devaluation of August 14, the rest of the expenses that increase due to the announcements would leave an increase in the fiscal deficit of half a point above what was already coming out. of the program.

Since August, After reaching an agreement with the IMF, the Ministry of Economy began to increase net financing in the capital market. From an average roll over of 120% of the debt in pesos, this year it reached almost 150%. Between January and the first half of September she obtained financing for $3.9 billion. Part of that money, about $500,000 million, was used to return advances from the Central Bank. This month alone he has a net funding of 203%, obtaining $950,000 million.

Screenshot_2023-09-19_17-13-55.png

Quantum estimates that the primary deficit between September and December, with the measures announced after the PASO, is located at 1.6% of GDP (for a total of $2.95 trillion). Added to this are debt interest for 0.6% of GDP (another $1.1 trillion) and debt amortization for 2.3% of GDP (that is, $4.1 trillion).

In total, the Government in the last quarter needs to raise $8.2 billion or the equivalent of 4.5% of GDP. Where could the resources come from? Quantum maintains that, With a roll over level of the maturities remaining until the end of the year of 120%, it could obtain $6.3 trillion in the market (3.5% of GDP) and $1.8 trillion (1% of GDP) would remain to be sought from other sources. It is assumed that the latter would have to be advances from the Central Bank or transfers of profits. “In monetary terms, 1% of GDP would be equivalent to 29% of the current monetary base and 9% of the BCRA’s remunerated liabilities. This would add additional pressures to the delicate situation the economy is going through,” says Daniel Marx’s consultant.

What should be taken into account is that the estimate is made based on a level of debt renewal in pesos of 120%, which is what has been happening for most of the year. But in the last month and a half, the Government activated the placement of bills in pesos, taking advantage of the high demand that is registered in the markets for hedging instruments, both indexed by CER and by the official dollar. This has caused the level of coverage to rise a lot, with which It is not ruled out that the package could be financed with debt in pesos.

Source: Ambito