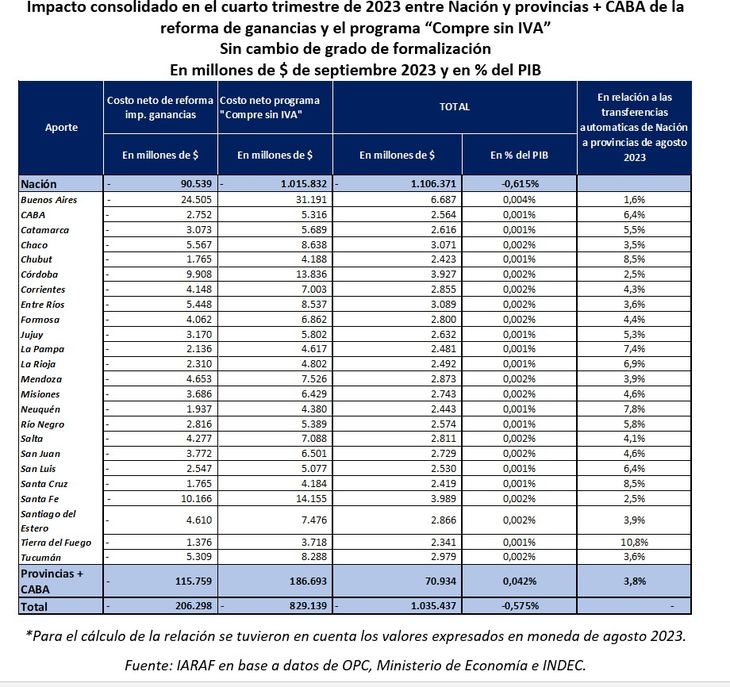

Given that due to the profit reform the provinces and CABA would lose 0.06% of GDP between now and the end of the year, if the “Buy without VAT” system were fully applied, they would gain 0.05% of GDP, given that for The reimbursement would charge an extra 0.11% of GDP due to greater collection, the IARAF projected.

Until the end of the year, The provinces would benefit from the Income Tax reform and the “Buy without VAT” program, according to an IARAF study estimated this Thursday.

The content you want to access is exclusive to subscribers.

Because the Nation entirely bears the fiscal cost of the tax refund program VAT -implies a maximum refund of $18,800 to approximately 20 million people-, the provinces and CABA would add resources with the implementation of both measureseven without considering an improvement in the formalization of sales necessary to obtain reimbursement, highlighted IARAF, led by economist Nadin Argañaraz.

Since for the earnings reform, the provinces and CABA would lose 0.06% of GDP between now and the end of the year, If the Buy without VAT system were fully applied, They would gain 0.05% of GDP, given that for the refund they would charge an extra 0.11% of GDP for greater collection, was projected.

It is important to clarify that up to this point it is assumed that Previous purchases to achieve reimbursement are made entirely formally, meaning that the system does not generate greater formalization, which is unlikely.

“If the formalization of consumption increased by 10%, the provinces would have a positive net effect of 0.08% of GDP. In the case without an increase in formalization, the increase in collection of the provinces and CABA is equivalent to 3.8% of “automatic shipments from the nation to the provinces for the month of August and in the case of a 10% increase in formalization it would be equivalent to 8.7%”said the report.

iaraf.jfif

The income tax reform according to the Congressional Budget Office (CPO) would have an annual fiscal cost of 0.63% of GDP. If this is accrued it gives 0.16% quarterly. With this type of renovation there is a direct cost and a possible final cost. This is because the greater disposable income that the measure generates can be used for consumption and generate greater national, provincial and municipal taxation.

The work considered a 22% joint collection of VAT and Profits, 5% of provincial gross income and 3% of municipal gross income. All these percentages are effective on the global amount of the increased disposable income (they are aliquots inside, as appropriate).

Source: Ambito