The Government confirmed benefits for monotributistas, which include suspension until the end of the year the cancellations of the monotax due to non-payment and the ex officio exclusions that are made in the simplified regime when the taxpayer exceeds any of the parameters provided for in the regulations and has to become a registered responsible party.

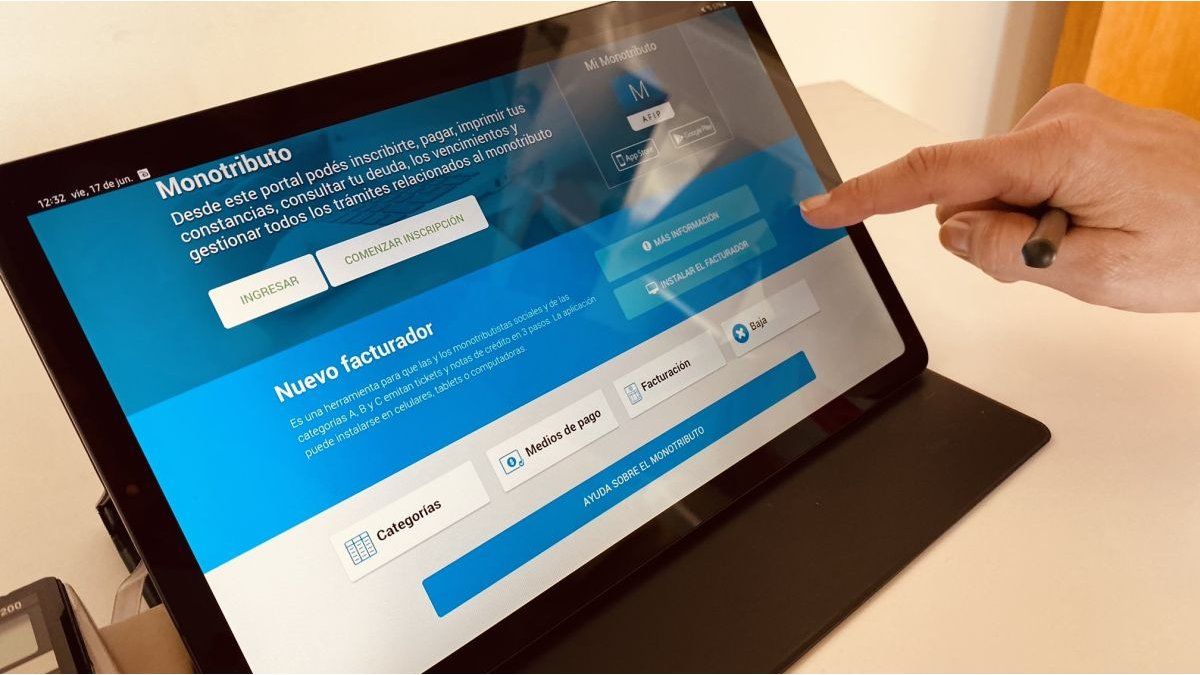

It is a General Resolution of the Federal Administration of Public Revenues (AFIP) which is published in the Official bulletin.

In relation to the casualties, The AFIP can remove taxpayers from the regime who do not pay their contributions within a period of 10 months.

The published measure excludes the months of September, October, November and December from that calculation.

Sebastián Domínguez, partner of SDC Asesores Tributarios, pointed out that “if a monotributista has not paid his contributions since December 2022, by not paying in September 2023 he could be automatically deregistered by the AFIP.”

“Given this suspension, even if you do not pay September, October, November and December, you will not be discharged until December 31, 2023. On the other hand, in January 2024 the AFIP could automatically discharge you for having fulfilled the condition,” he said.

In relation to ex officio exclusions, these occur when the taxpayer exceeds any of the parameters determined by the law to be a monotributist, which include, in addition to the annual billing, the price per unit (for those who sell furniture) and rental cost.

The AFIP was only recently authorized by the Executive Branch to modify the billing parameters, but not the other indicators, so in an inflationary context these continued to increase, giving reasons for the AFIP to act ex officio to send the taxpayer to the general regime. .

Domínguez explained in this regard that the causes of exclusion are:

- The sum of the gross income obtained from the activities included in this regime, in the last 12 months immediately preceding the obtaining of each new gross income – including the latter – exceeds the maximum limit established for category H ($7,996,484, 12) or for category K ($11,379,612.01), depending on whether it provides locations and services or sells movable things.

- The physical parameters or the amount of rent accrued exceed the maximums established for category H, currently $920,713.84 annually.

- The maximum unit sales price, in the case of taxpayers who sell personal property, exceeds the sum of $85,627.66.

- Acquire goods or make expenses, of a personal nature, for a value incompatible with the declared income and as long as they are not duly justified by the taxpayer.

- Bank deposits, duly purified, are incompatible with the income declared for the purposes of categorization. For example, the purification of deposits involves discounting duly documented loans, inheritances and donations received, among other operations.

- They have lost their status as monotributistas or have imported movable things for subsequent marketing and/or services for identical purposes.

- They carry out more than 3 simultaneous activities or have more than 3 operating units.

- Carrying out locations, providing services and/or carrying out works, they would have been categorized as if they sold movable things.

- Their operations are not supported by the respective invoices or equivalent documents corresponding to the purchases, leases or services applied to the activity, or to their sales, leases, provision of services and/or execution of works.

- The amount of the purchases plus the expenses inherent to the development of the activity in question, made during the last 12 months, total a sum equal to or greater than 80% in the case of sale of goods or 40% in the case of locations, provision of services and/or execution of works, of the maximum gross income established in article 8 for Category H or, where applicable, in category K, today $7,996,484.12 and $11,379,612.01 , respectively.

- Be included in the Public Registry of Employers with Labor Sanctions (REPSAL) as soon as the sanction applied as a repeat offender becomes final.

Source: Ambito