This benefit occurs in the midst of the package of measures announced by Sergio Massa that establishes the extension of the payment of personnel contributions and VAT in the months of September, October, November and December.

The Government made official the extension of expiration of the payment obligations corresponding to self-employed. She confirmed it through Official bulletin. This benefit occurs in the middle of the package of measures announced by Sergio Massa that establishes the extension of the payment of staff contribution and VAT in the months of September, October, November and December.

The content you want to access is exclusive to subscribers.

Likewise, the General Resolution 5422/2023 determines “the need to make systemic adjustments that allow collection through direct debit to a bank account or automatic debit to a credit card, leading to establishing a special expiration date for the payment of the personal contribution of self-employed workers corresponding to the month of September 2023, with respect to the subjects excepted from the benefit”.

With this advertisement, they benefit 701 thousand professionals and small self-employed merchants (337 thousand professionals and provision of services; and 364 thousand merchants, according to the Ministry of Economy.

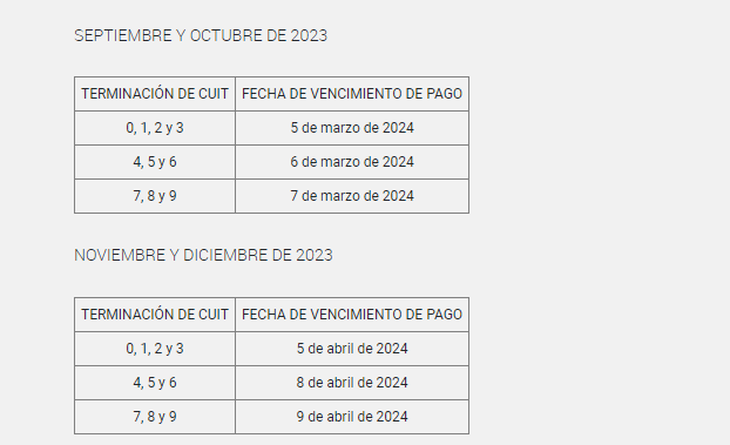

Self-employed: how is the payment schedule for staff contributions?

autonomos1.PNG

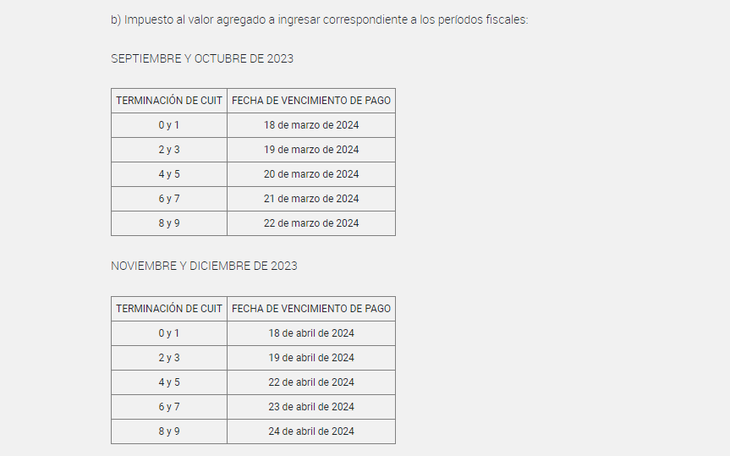

Self-employed: Value Added Tax (VAT) payment schedule

autonomos2.PNG

Source: Ambito