In General Resolution 5423/2023, it requested to modify the table called “Aliquots and amounts not subject to withholding.”

The Federal Public Revenue Administration (AFIP) determined what retention will be like for independent workers. He did it, a week after the modification of the tax so that from October it would be paid by people with salaries greater than $1.7 million.

The content you want to access is exclusive to subscribers.

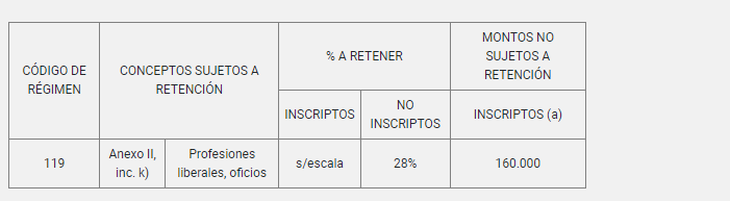

Through the Official bulletin, In General Resolution 5423/2023, it requested to modify the table called “Aliquots and amounts not subject to withholding”, the expression contained in the fifteenth line “Liberal professions, trades, executor, agent, business manager” by the expression “Executor, agent, business manager”.

“He Ministry of Economyamong other measures and tools aimed at granting benefits to workers self-employed and other subjects, entrusted this Federal Administration the adequacy of the withholding regime established by the general resolution cited in the previous paragraph, in order to update the amounts of the scale and/or rates applicable to the retention calculation when it comes to payments for the exercise of liberal professions or trades,” the resolution stated.

At the same time, it is incorporated into the table called “ALIQUOTAS AND AMOUNTS NOT SUBJECT TO WITHHOLDING” the following regime:

profits1.PNG

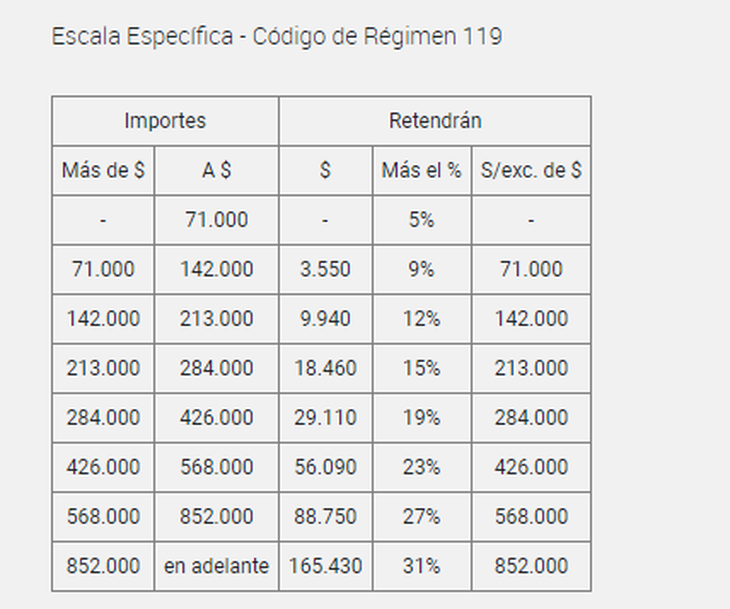

On the other hand, it incorporates the Specific Scale – Regime Code 119:

profits2.PNG

Lastly, the provisions of this general resolution will come into force on the day of its publication in the Official Gazette and will be applicable for payments made from the October 1, 2023, inclusive.

Source: Ambito