The AFIP made official the payment on account of the Income Tax for companies that will help finance the “new IFE”. According to data released by the collecting agency, it is expected to impact big firms from the financial sector, such as banks and insurance companies. That is, the cut will be made by economic activity and will only affect 96 companiescould know Ambit.

In this way, AFIP through the General Resolution 5424 published in the Official Gazette, are included those who:

- As of September 27, register as your main activity any of those detailed in the item “Financial intermediation and insurance services”Classifier of Economic Activities (CLAE) or are registered as Payment Service Providers (PSP) before the Central Bank of the Argentine Republic.

- In the sworn declaration for the 2022 or 2023 fiscal period, they have reported a Tax Result that is equal to or greater than $600,000,000, without applying the deduction of tax losses from previous years.

Profits: who is excluded

They remain excluded of the payment on account the subjects reached by the obligation established in the General Resolution 5391 and those legal entities that have a certificate of exemption from the income tax.

For the purposes of the payment determination on account provided for in article 1, the subjects reached must consider the sworn declaration of the income tax corresponding to the fiscal period 2022, in the event that the year-end had operated between the months of August and December 2022, both inclusive.

Earnings: how the payment will be made and what should be taken into account

For the purposes of the payment determination on account provided for in article 1, the subjects reached must consider the sworn declaration of the income tax corresponding to the fiscal period 2022in the event that the year-end had operated between the months of August and December 2022, both inclusive.

Taxpayers whose year-ends would have operated between the months of January and July 2023, both inclusive, must consider the income tax return corresponding to the fiscal period 2023.

He payment on account will be computable, under the terms of article 27 of Law No. 11,683, text ordered in 1998 and its modifications, in the fiscal period following the one taken as the calculation basis, according to the following detail:

a) With closing of the fiscal year operated between the months of August and December 2022both inclusive: fiscal period 2023.

b) With closing of the fiscal year operated between the months of January and July 2023both inclusive: fiscal period 2024.

afip-portadaza-taxes.png

Earnings: how the amount will be determined

He payment amount The account will be determined by applying the rate of the FIFTEEN PERCENT (15%) about him Tax Result -without applying the deduction of tax losses from previous years in accordance with the tax law- of the fiscal period immediately preceding the one to which the payment on account will correspond.

In those cases in which tax results have been declared for one or more activities promoted, the taxpayer may deduct from the amount of the payment on account the amount corresponding to the relief for said activity.

To do this, you must make a presentation through the service with Tax Code called “Digital Presentations”, in the terms of General Resolution No. 5,126, until the day of expiration of the first installment provided for in article 6 hereof, indicating the amount by which the aforementioned payment on account must be reduced, for the purposes of its registration. in the Tax Account System.

– The entry of the payment on account and, where applicable, of the compensatory interest and other accessories, will be carried out in accordance with the provisions of General Resolution No. 1,778, its amendments and its complements, using the Tax-Concept-Subconcept code: 10-184-184, and the corresponding number must be entered as a fee as stated. provided for in article 6 hereof.

For the payment of interest and other accessories, the relevant subconcept codes must be selected when generating the Electronic Payment Flyer (VEP).

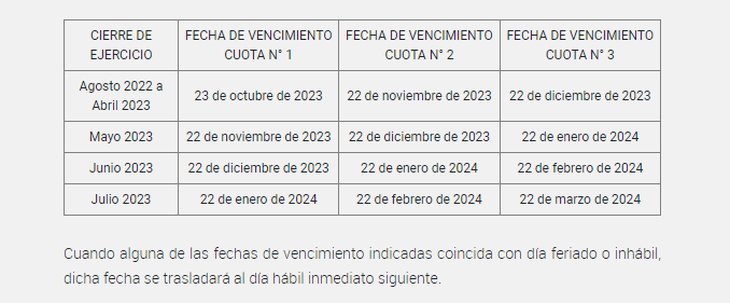

Earnings: what are the expiration dates

The payment on account determined in accordance with the procedure described, will be paid in THREE (3) equal and consecutive installmentson the dates indicated below:

profitsafip.PNG

Source: Ambito