The refund program requires some requirements when making purchases. Find out what they are and why you might not charge it.

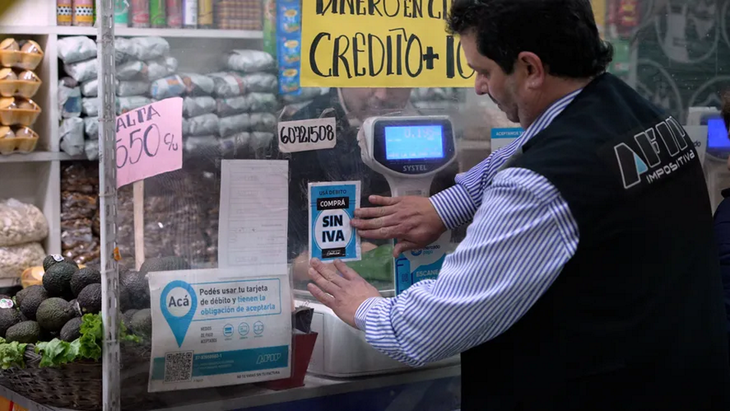

The program “Buy without VAT“reintegrates the 21% of purchases made in food and hygiene products basic basket that are carried out with Debit, ID account either BNA+ mode. He refund limit per month is $18,800and will be accredited automatically in the bank account where the person receives their income, allowance, pension or retirement. The return can take up to 48 hours after shopping.

The content you want to access is exclusive to subscribers.

The benefit applies to registered workers, retired and monotributistasbut it is important to take into account some keys why it could miss the return.

dni account.jpg

The Government reported that the program Buy without VAT will work until December 31.

Bank province

VAT refund: why didn’t I receive the refund?

There are some points for which the 21% refund could be lost, so users who wish to obtain it must avoid the following mistakes:

1) Use credit or prepaid cards

The 21% refund is applied as long as it is paid with the payment methods mentioned above: debit, DNI account either BNA+ Bank. Therefore, purchases made with credit cards or prepaid cards from virtual wallets will not have the benefit of VAT refund.

2) Not having declared the CBU before the AFIP

Beneficiaries of the VAT refund program must have the CBU declared before the AFIP to be able to receive the refund, otherwise they will not be able to obtain the refund. To register it, you must follow the following steps:

- Enter the AFIP website: https://www.afip.gob.ar/landing/default.asp with CUIT/CUIL and tax code.

- In the web search engine, enter: “CBU statement”.

- Go to the actions tab and check the option “Buy without VAT”.

image.png

More of 11,500,000 people they already received the refund of Value Added Tax (VAT).

3) Exceed the monthly refund limit of 21%

The 21% refund has a refund limit of $18,800 per month per person, not by family group. In the event that the refund amount is exceeded, you will lose the benefit during that month.

To know how much is the refund that correspondsthe calculation that must be done is the amount spent multiplied by 0.21.

Source: Ambito