In its Monthly Retail Payments Report, the BCRA confirmed that 52.2% of payments were initiated with interoperable QRs, which represents more than 15.6 million, an increase of 219% year-on-year.

Payments with transfer through the interoperable QR reached 15.6 million operations.

Payments with transfer through the reading of QR codes with mobile phones, links and POS collection terminals They set a new record in September, and remain the most used digital payment method in Argentina.

The content you want to access is exclusive to subscribers.

For its part, Money transfers (immediate “push” transfers) registered a growth of 106.1% year-on-year. More than 300 million immediate transfers were exceeded for $10.6 trillion, which imply year-on-year increases of 106.1% and 35.6%, in quantities and amounts respectively.

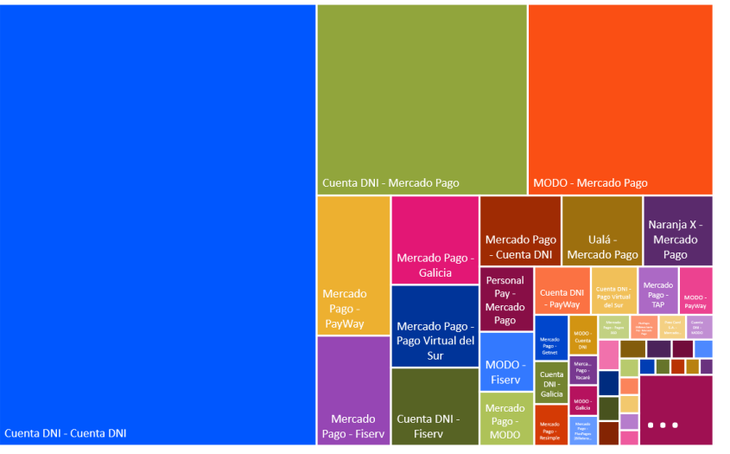

image.png

At the same time, Payments with transfer through the interoperable QR reached 15.6 million operations. Payments with this means reached 52.2%, representing more than 15.6 million payments, 219% year-on-year for $71.6 billion.

78.8% were made by clients who used their demand accounts and 21.2% their payment accounts. Likewise, 58.8% of businesses credited demand accounts and 41.2% credited payment accounts.

19.2% of payments, meanwhile, were made through reading the debit card credentials in a point of sale terminal, reaching 5.7 million operations, which implies a drop of 48.3% year-on-year and $95.6 billion, a decrease of 30.7% compared to 2022. At the same time, the use of debit cards remains higher than credit cards.

Source: Ambito