After the devaluation of the peso, the Multilateral Real Exchange Rate had reached its highest level in the last two years. However, it is already 2.2% lower than last Friday in the run-up to the PASO.

Dollar: in less than 2 months the competitiveness of the exchange rate gained after the devaluation was lost

Depositphotos

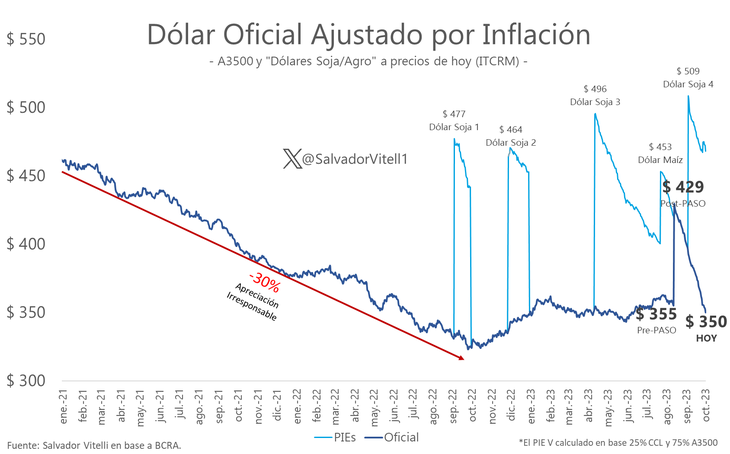

The multilateral real exchange rate (TCRM)an index that compares the Argentine peso with the currencies of the country’s main trading partners, had touched its best level in the last 2 years after the devaluation decided by the Central Bank after the PASO. However, The pass through was very fast and that competitiveness has already been lost. In fact, given the acceleration of inflation, we are at worse levels than before the Primaries.

The content you want to access is exclusive to subscribers.

The Economist, Nery Persichiniin dialogue with Ambit confirmed that the multilateral real exchange rate is already 2.2% lower than that in force on Friday, August 11 in the preview of the STEP. “The index, which is a proxy for the price competitiveness of the economy, fell 18.5% from the peak of Monday the 14th. That post-devaluation value would be equivalent to $429 today,” she explained.

As if that were not enough, he clarified, “the deterioration of the TCRM not only responded to the acceleration of Argentine inflation in a context of fixed exchange rate“, but rather that “the process is gaining speed because The currencies of emerging economies are depreciating in a very adverse international framework due to the rise in interest rates. This dynamic of risk-off doesn’t cooperate.”

Devaluation, fixed exchange rate and inflation

image.png

Also in conversation with this medium, the economist Salvador Vitelli agreed that the change in prices and consequently inflation have already canceled any effect of greater competitiveness that could have been achieved with the devaluation. “In real and exchange rate terms we are at even worse levels than in the previous PASO,” he confirmed and clarified. “In short, the devaluation lasted a month and a half.”

“The exchange rate delay will continue to exist because the Government’s intention is to maintain the exchange rate at these levels, precisely greater imbalances are going to accumulate under the carpet and this can mean that to the extent that they continue to maintain the exchange rate at these levels that let’s get to the general elections with a phenomenal delay“Vitelli added.

Thus, the economist expressed, Although in historical terms we have had greater exchange rate delay levels, the levels are high.

The market discounts a new devaluation

The futures market also marks strong highs for November and December. “They discount a jump in the exchange rate of more than 100%”Vitelli explained. “Precisely to return to competitive exchange rate levels, the devaluation will have to be increasingly greater and that will probably be difficult for it not to affect prices again,” he concluded.

If we take into account the future dollar contracts operated this day in MATBA-Rofex, the wholesale exchange rate for December is paid $705 with a daily increase of 2.5%, while by January 2024, it operates in the $823 with an advance of 3.4%. At the same time, The inflation projection of the consulting firm Econviews for December places it at 14.7%, while for January at 19.7%.

Source: Ambito