The retail sales of small and medium-sized companies (SMEs) fell 5.1% annually in September and accumulate a decrease of 2.6% in the first nine months of the year, compared to the same period in 2022, according to the Argentine Confederation of Medium Enterprises (CAME). It is the ninth consecutive month in which consumption declines in the annual comparison. Meanwhile, in the month-on-month comparison, sales decreased 1.1% compared to August.

To date, September was the worst performing month of the year. He consumption accused the loss of family purchasing power derived from the strong price increases. While the income policies launched by the Government were not able to contain the fall in demand. There were fewer installment financing options and that reversed purchase decisions, especially for higher value goods. Some businesses noticed higher card payment declines than usual.

came.png

Two of the most affected sectors in the month were Food and drinks, with a contraction of 8.1% annually and Pharmacies (-12.3%). The decline of these basic items confirms the difficult situation that commercial activity is going through.

This emerges from the SME Retail Sales Index of the Argentine Confederation of Medium Enterprises (CAME), prepared based on a monthly survey among 1,241 retail businesses in the country, carried out from October 2 to 6.

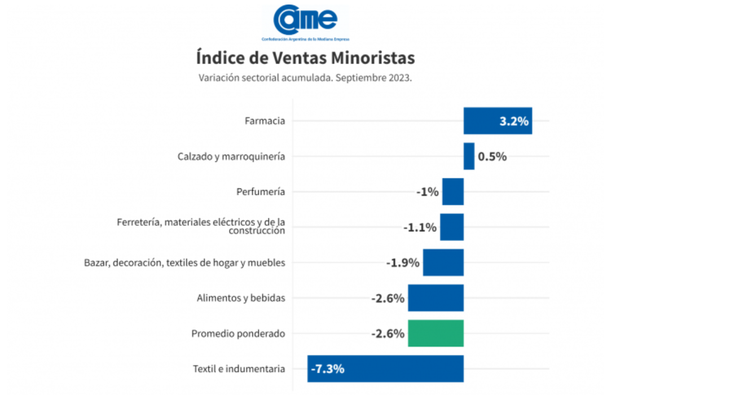

In September, six of the seven items recorded year-on-year drops in sales. The largest decline occurred in Pharmacy (-12.3%) and the only item on the rise was Footwear and Leather Goods (+4.3%). In the accumulated of the year, Pharmacies (+3.2%) and Footwear and leather goods (+0.5%) are the only ones that experience growth.

came2.png

SME retail sales: how each sector fared

Food and drinks

Sales fell by 8.1% annually in September, prices constant and accumulate a decrease of 2.6% in the first nine months of the year compared to the same period in 2022. In the month-on-month comparison they decreased 1.6%. “There is no money on the street,” was the most repeated phrase among the businessmen consulted. There were also complaints about delays in deliveries from suppliers and shortages of flour, sugar, grass, coffee, among other products.

Bazaar, decoration, home textiles and furniture

The decline was 1.2% annually in September and adds a decline of 1.9% in the first nine months of 2023, compared to the same period last year. In the month-on-month comparison, they rose 2.4%. The sector has had low sales levels for many months, being managed mainly with national products, and economical. The month’s price increase alienated the public, and the businesses consulted said that at times they were left without merchandise because suppliers “speculate and do not deliver.”

Footwear and leather goods

Sales rose 4.3% annually in September, always at constant prices, and registered an increase of 0.5% in the first nine months, compared to the same period in 2022. In the month-on-month comparison they rose 3.5% . The sector started its high season, and this year with anticipation due to the pleasant temperatures that have been dragging on since August, which hastened sales of spring footwear In some stores they indicated that it is possible that they have anticipated Mother’s Day purchases, to cover themselves for future increases.

Pharmacy

Sales plummeted 12.3% annually in September, however, they still accumulate growth of 3.2% in the first nine months of the year, always compared to the same period in 2022. Compared to last month, they fell 9. 9%. It was a very bad month for the sector, not only because of low sales levels but also because of the drop in profit margins. You can’t get drugs, medicines are missing, There are purchases that customers must order and pick up up to five days later.

Perfumery

An annual decline of 1% was recorded, and they also accumulated a fall of 1% in the first nine months of the year compared to the same period in 2022. In the comparison with August they rose 1.1%. Few and low-value products were sold. In the stores they stated that they cannot find dermatological creams, and that the high rates charged by cards for installment financing slow down sales. Furthermore, with the latest increases in the dollar, imported products became very expensive and had no outlet. In any case, businessmen are optimistic about picking up sales in October, due to Mother’s Day.

Hardware, electrical materials and construction materials

Sales fell 3% annually in September, at constant prices and are thus down 1.1% in the first nine months of the season, compared to the same period in 2022. On the other hand, against August they rose 2.1%. 1%. It didn’t help low availability of credit in the cards, where many clients found their limits saturated, nor the exchange uncertainty, since it is a branch very sensitive to these two variables. The proximity of the end of the year in a market that is not reactivated is generating uncertainty in the businesses of the sector, which are being very cautious when estimating the stock for the coming months.

Source: Ambito