The Ministry of Finance will have to get at least $600,000 million from the market, which is the first part of what it needs in October.

The Ministry of Economy will go out this Thursday to look for the first part of the funding it needs in October, in a context highly convulsed by the development of the presidential elections and the negative signals that occurred in the last week, which fueled a run against assets in pesos.

The content you want to access is exclusive to subscribers.

In the first call, key because it is Before the first round of elections takes place, the Secretary of Finance, Eduardo Setti, will have to get at least $600,000 million from the market, and also, net funds to cover part of the expenses that Minister Sergio Massa’s announcements of measures are demanding.

It’s not the best weather. Last week, market operators were very nervous watching the “peso curve” collapse. at levels similar to those during the final stretch of Martín Guzmán’s administration in front of the Treasury Palace. Operators exited peso assets and switched to dollar options or positioned themselves in immediate liquidity pools.

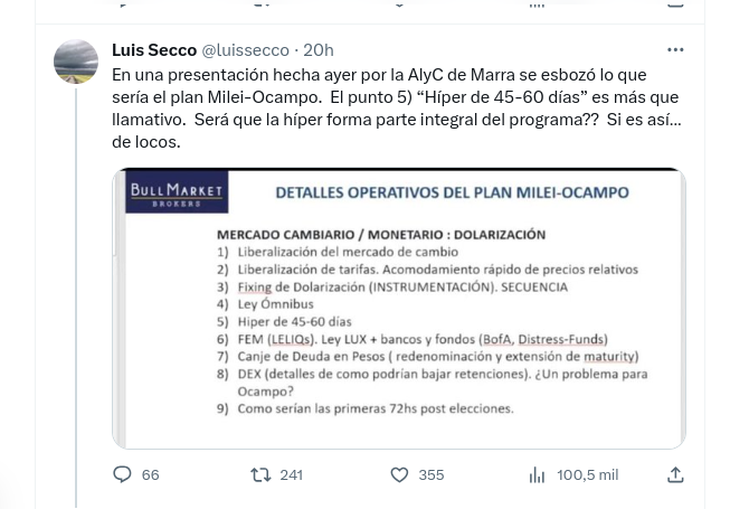

There is a feeling of insecurity, perhaps, enhanced by the idea that Libertad Avanza seeks to promote hyperinflation to facilitate an eventual dollarization program.. Javier Milei’s statements last week that it would be easier to adopt the US currency in the event of a price explosion caused concern. But this is also supported by information that circulated on social networks in which it was pointed out that in In a talk with investors, the Bull Market stock company, which belongs to the family of the aspiring head of Government of the City of Buenos Aires Ramiro Marra, distributed the points of an alleged Milei economic plan that contemplates a “hyperinflation of 45 to 60 days”. In the talk it is pointed out that whatever the result of the first round, whether Milei or Patricia Bullrich are profiled, the “transition is going to be wild” and that the month chosen for this will be November.

Screenshot_2023-10-08_07-33-44.png

Bull Market analysts consider that prices will be released after the second round, when the next government is already defined. Despite this, between Thursday and Friday it seemed that the market returned to normal. There was a recovery in the price of Argentine assets in pesos that brought greater peace of mind to operators who now await the new call from the Ministry of Finance.

It should be noted that at the end of last month, the government carried out an exchange of intra-state debt that allowed it to reconfigure maturities for 2026 of some $616,000 million that were going to expire until the end of the year. With this, Setti managed to further prepare the scenario for the remainder of the current government period. It is estimated that there were some $2.4 trillion left in maturities that are purely private and focus more on FCI that, due to the profile of its investors, look for short-term assets in pesos. One point to keep in mind is that FCIs that invest in fixed income assets are enduring bailouts while money markets grow.

Source: Ambito