Thus, China’s economic slowdown It is a phenomenon influenced by cyclical and structural factors and not only does it have implications for the country itself, but it can also have a significant impact on the global economy due to the key role that that nation plays on the international stage.

WhatsApp Image 2023-10-09 at 10.17.10.jpeg

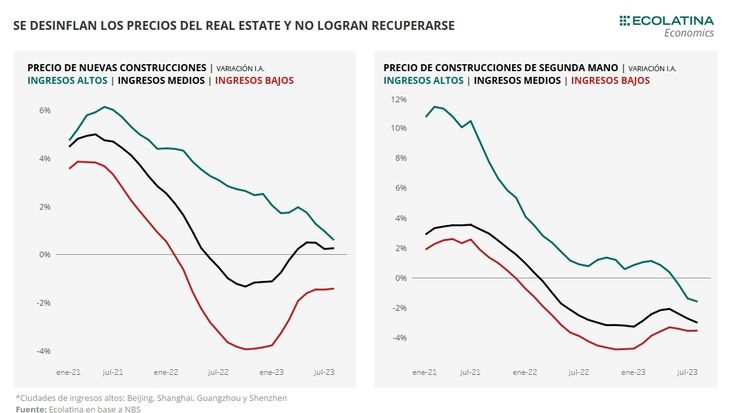

According to the document prepared by Ecolatina, “a bubble which, with the slowdown in economic growth, faces a fall in “Home sales that in 2022 alone contracted by 28% annually”. To make matters worse, according to projections from the International Monetary Fund (IMF), “the recovery would begin just after 2024 and only for public developers.”

Under these conditions, large real estate operators, such as the well-known Evergrande, face serious financial problems, “with delays in debt payments, especially those contracted abroad, and delivery of unfulfilled homes.” Consequently, the report warns that the interannual evolution of the Prices of new constructions have been falling for more than a year, as well as existing buildings.

Chinese slowdown: how it impacts Argentina

“China’s economic slowdown raises concerns for Argentina on multiple fronts“, says Ecolatina. Directly, according to the report, in a lower demand for power which can put pressure on commodity priceswhich are vital for the Argentine economy.

Even without a crisis, the IMF already projects a slowdown in Chinese growth, resulting in an annual decline of 4% in the period 2023-28. This, in turn, would lead to falls of 2.8% this year and 1% in 2024 for the price of non-energy commodities..

Indirectly, this situation would have an impact on key trading partners for Argentina, such as Brazil. Brazilian exports China are more linked to sectors such as mining, especially iron and copper, in contrast to Argentinawhich mainly exports food.

For metallic commodities, a drop of 2.6% year-on-year is already expected in 2024 (although they would have growth of 3.5% in 2023), which could deeply affect Brazil and, by extension, Argentina.

In this context, the foreign trade expert, Marcelo Elizondoexplains to Ambit that the Argentine economy is at a crossroads due to the complex trade relationship with China, which has several levels of impact. Firstly, that country represents the second largest market for Argentine exports, with a historical average of between US$8 billion and US$9 billion in prosperous years.

“However, For 2023, it anticipates a decrease in exports due to a smaller harvest,” he points out.

WhatsApp Image 2023-10-09 at 10.17.21.jpeg

“This reduction in exports has a double effect,” says Elizondo. And he explains that, on the one handthere is no perceived decrease in Chinese demand in terms of quantity, but it does affect the international prices of certain Argentine productssuch as fruits and meats, which are not considered essential.

On the other hand, “this economic slowdown in China has repercussions globally, triggering a decline in international trade growth around the world, estimated at approximately 1.7% this year.”

For Elizondo, China, as global economic engine, faces systemic challengesas it is overloaded with investment and faces debt problems in several economic sectors, raising uncertainties about its future as a driver of global growth.

The expert agrees with Ecolatina that, given this panorama, Argentina must diversify its markets beyond China. The country has seen considerable growth in other Asian markets, such as India and Vietnam, and opportunities exist in others such as Malaysia and Indonesia.

“Despite China’s promises of investment in Argentina through the new Silk Road, “many of these promises have not yet come to fruition, requiring constant monitoring to ensure their fulfillment,” he adds.

Finally, within the framework of geopolitical considerations, it is crucial to take into account that China is focusing its efforts on regional issues and strengthening its relations with Russia and Iran. This could delay the execution of investments in other markets, including Argentina. Additionally, a change in the Argentine government could influence relations with China and investment decisions.

Argentina: diversify, a possible solution

In summary, the situation in China has multiple levels of impact on Argentina, from exports to investments and geopolitical considerations. To mitigate them, it is vital that Argentina diversify its markets and closely follow investment promises.while being attentive to changes in global geopolitical dynamics.

In this context, the diversification of export destinations becomes crucial for Argentina. Strategically, strengthen ties with emerging Asian markets such as India, Vietnam and Thailand, which have a considerable population, it is vital. In addition, Ecolatina suggests that seeking greater penetration into the European Union, taking advantage of Vaca Muerta’s resources, represents an important opportunity.

“Any economic slowdown in China, which translates into lower demand for our products, especially commodities, would be detrimental to Argentina,” he warns. Salvador Vitellihead of research at Romano Group, in dialogue with this medium.

Vitelli states that it is necessary to remember the recent commodity boom starting in 2021, “driven mainly by Chinese demand” generated a favorable trade balance in the first years of Alberto Fernández’s administration, “since A large part of our exports was supported by this demand from China“Therefore, any economic slowdown, hint of recession or setback in China”It affects us directly, since they tend to reduce external demand, including that of Argentine products.“.

In summary, the Argentine economy is intrinsically linked to the economic situation of China, both as a key customer and as an essential supplier. An economic slowdown in China, which affects the demand for our products and reduces our exports, due to what happens in the Asian giant, we must follow it very closely, especially taking into account a possible change of government starting December 10.

Source: Ambito