So far in 2023, the commercial debt that had been incurred and accumulated by imports was between 700 and 1,400 million dollars per month.

The commercial debt of the State with importers reached its historical maximum and continues to evolve. This was revealed by central bank through the latest report of Monetary politics (IPoM), which revealed that the debt with importers of goods in September was located at US$43,000 million.

The content you want to access is exclusive to subscribers.

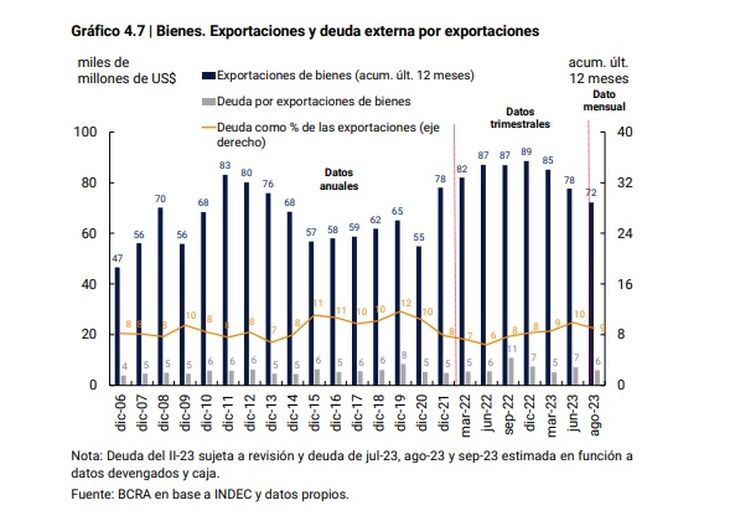

“It is estimated that the debt for imports of goods would have registered an increase of about US$11.8 billion in the first 9 months of the year. Thus, the relationship between external debt and the level of imports rose 13.7 pp, reaching 51.8%”, states the official document.

So far in 2023, the commercial debt that had been incurred and accumulated by imports was between 700 and 1,400 million dollars per month until the end of July. The first semester average was lower At 1.1 billion dollars, it represented approximately 17% of total imports. But after the first six months of the year it jumped.

Debt: what’s to come

The amount owed means another commitment for the next government. According to the document, the debt last June was US$37,000 million, so it would have grown by US$6,000 million during the quarter.

BCRA.jpg

This debt creates a strong repressed demand for dollars and It is particularly worrying if we take into account the red that reserves from the organization led by Miguel Ángel Pesce reach. that, according to the consultant 1816the negative stock of reserves is around US$6.1 billion. A number close to that calculated by the consulting firm Labor Capital & Growth (LCG), which places them at US$6,300 as of October 9.

Thus, for analysts, commercial debt It is the largest in historysince it used to be normally at US$20,000so being at US$43,000 million, the number became double. Likewise, they maintain the debt is at historical highs both in absolute and relative terms.

The truth is that it will be another source of pressure on the exchange market for the next government, since this is a repressed demand for foreign currency.

Source: Ambito