Before the elections, amid concerns about a possible abrupt devaluation, fixed terms in pesos experienced an average decrease of 10%. But now, the expectation has changed.

After the fall of dollars financialbecomes a key strategy for investors which allows them to earn extra. In the last week, the industry noticed how savers redirected their funds towards Fixed deadlines in pesos after a period of dollarization prior to elections. This, added to the possibility of inflation reaching 10% in October, once again generated an incentive for the monthly interest rate to be close to 11%.

The content you want to access is exclusive to subscribers.

Before electionsamid concern about a possible abrupt devaluation, the Fixed deadlines in pesos they experienced an average decrease of 10%. However, The results of the general elections changed the market landscape and investor strategy.

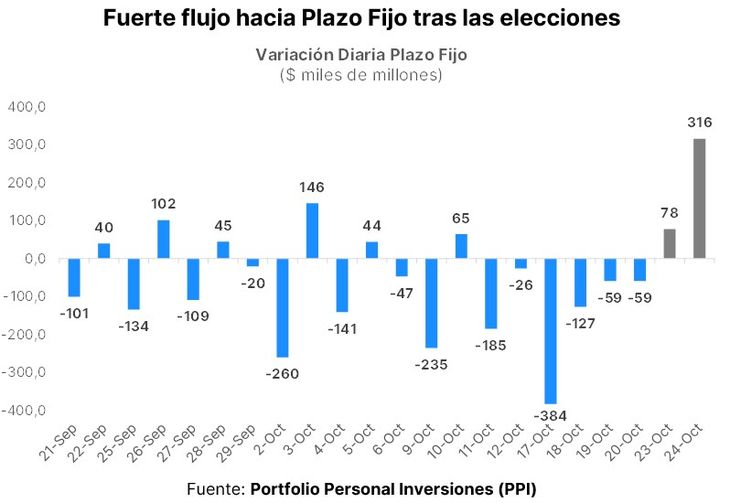

Prior to the elections, and amid fear of a sudden devaluation jump, fixed terms in pesos fell by an average of 10%. The results of the October 22 elections changed the market humor and at the same time they modified investors’ portfolios, explain financial analysts. After the elections Fixed deadlines rose by more than $400,000 million.

That level represents a third of the funds that had gone out since beginning of October, when the market was speculating on the possibility that Milei and his dollarization proposal would come out first in the elections.

Fixed deadlines increase after general elections

As reflected by the Personal Investment Portfolio (PPI) in a recent report, fixed-term deposits grew in the two days after the elections as the dollarization scenario was aborted.

The Fixed deadlines They regained momentum by expanding $78,214 million on Monday and $316,148 million ($394,362 million in total), cutting accumulated drainage of $1,269 billion since the beginning of October.

Going forward, PPI maintains that it hopes that the monthly rate of 10.9% “tempts savers” to renew the stock “or at least helps contain the recent disarmament.”

unnamed.jpg

Dollar: is the carry trade returning?

With the greatest incentive in the rate due to a moderate drop in inflation and the fall of financial markets, the market is already wondering if the “carry trade” returns, the strategy that consists of investing in instruments in pesos, while the dollars free are calm, and then move on to profits in hard currency and obtain an extra return.

The economic team has expectations that the dollar it stays stable or even decreased in the previous three weeks to the November 19 ballot. He central bank It projects that by that time, the banks will have recovered the fixed-term funds in pesos that had been withdrawn in search of the dollar. The 15% drop in the price of cash with settlement will convince savers to take advantage of the high rates in pesos. Now, the profile of investors and savers has mutated towards the high returns offered by fixed terms, which reach 133% annually.

Source: Ambito