Analysts are beginning to provide their first recommendations when thinking about their electoral portfolios. At Ámbito we collected some suggestions.

He market will arrive at runoff with a change in strategy when putting together the investment portfolio. Although it was expected a Javier Milei and a Sergio Massa In the final contest, the unexpected thing was that Massa was in first place and by a difference of more than 5 points compared to his opponent. In this framework, analysts begin to provide their first recommendations when thinking about their portfolios electoral. In Ambit We picked up some suggestions.

The content you want to access is exclusive to subscribers.

Juan Pedro MazzaFixed Income Strategist Cohen Financial Allies He commented in a recent publication that this electoral panorama that was raised in Argentina clears up the uncertainty towards 2024 that was reflected in the stabilization of financial dollars and dollar futures.

“With a strengthened ruling party, we anticipate a much more orderly transition. The risks of extreme events are attenuated: Milei has lost inertia and needs to moderate to win the elections. It is unlikely that it will again incentivize agents to get rid of their assets in pesos with the objective of reducing the demand for the Argentine currency,” he expressed in the article.

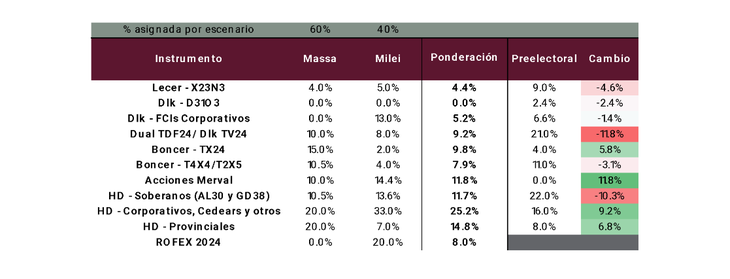

In this sense, Cohen adjusted the recommended portfolio for the different scenarios, depending on who wins in November. The report suggests:

Investments: what to invest in if you think Sergio Massa will win

- 20% in provincial bonds in dollars (preference for guaranteed bonds such as those of Chubut, Tierra del Fuego and Neuquén or of provinces with healthy fiscal accounts, such as Santa Fe, Mendoza or Córdoba)

- 20% in corporate bonds in dollars, Cedear and other hard dollar instruments

- 15% in adjustable bonus for CER TX24

- 10.5% in sovereigns hard dollar (AL30 and GD38)

- 10.5% on CER T4X4 and T2X5 adjustable bonuses

- 10% between TDF24 dual bonus and linked TV24 dollar

- 10% in Merval shares

- 4% in Adjustable Letter by CER X23N3

Investments: what to invest in if you think Javier Milei will win

- 33% among corporates hard dollarCedear and others

- 20% in Rofex futures to 2024

- 14.4% in Merval shares

- 13.6% in hard dollar sovereign bonds (AL30 and GD30)

- 13% corporate linked dollar mutual funds

- 8% between the dual TDF24 and the dollar linked TV24

- 7% in provincial hard dollar bonds (the credits of Córdoba to 2025 (CO21), of Chubut to 2030 guaranteed by royalties (PUL26) and of Mendoza to 2029 (PMM29).

- 5% in adjustable letter by CER X23N3

- 4% in adjustable bonuses for CER T4X4 and T2X5

- 2% in bonuses adjustable by CER TX24

This last portfolio exceeds 100% since it includes a 20% on Rofex future dollar contractswhich do not require an initial outlay.

cohen4.png

Inversions in actions

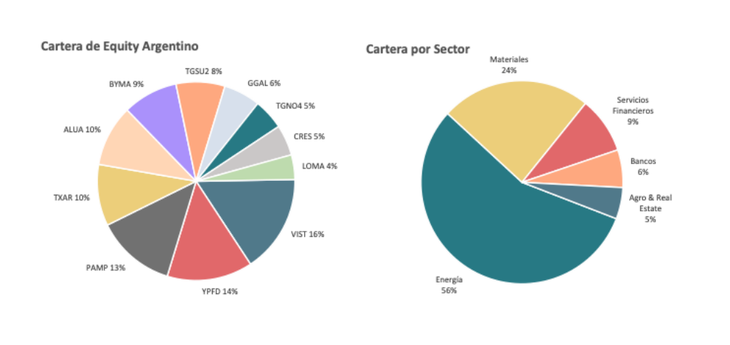

Besides, IEB Group published his portfolio Actions suggested in the post-election week and affirms that despite the sell-off that Argentine stocks suffered, the Argentine equity portfolio continues to show good performance in annual terms.

“In this context, we continue to prefer to overweight the Oil & Gas sector (VIST, YPF, PAMP, TGS, TGN) and Agro & Real Estate (CRES), which present genuine growth drivers in the face of a macro normalization for subsequent years. For their part, we also find companies that have little or no restriction on prices so that they can carry out a good pass-through of inflation/devaluation to prices (TXAR, ALUA, LOMA). Also, we continue to like BYMA, given that it is a good vehicle to mitigate the impact of inflation and/or devaluation due to its defensive component,” they expressed from IEB.

investments.png

Source: Ambito