For JPMorganas the dollar maintains its strength at a global level and there is an increase in prices of certain essential productsthe deceleration of inflation in the region could be delayed.

In a report, the financial giant maintains that the political changes in Latin America They usually have an impact on the economies of the region. Likewise, sudden changes in the expected tax return have an impact quickly in the real exchange rate“a common characteristic in economies with low levels of savings and marginal productivityl.”

2018-07-05t142517z_832711069_rc1324d02aa0_rtrmadp_3_britain-eu-jpmorgan.jpg_423392900.jpg

The document indicates that the bank diverted its attention from the “high frequency business cycle data” to review the recent electoral processes taking place in the region, as well as those to come, starting with “countries that lack access to markets, such as Argentina,” which will define next November 19 the position of head of state in the second round. The report also analyzes the situation of Ecuador’s pro-business candidate, who defeated Correism in a tight second round, and the opposition in Venezuela, who selected a candidate apparently prevented by the ruling party.

Dollar and interest rates in Latin America

In an interview cited by the Bloomberg agency, JPMorgan’s chief economist for Latin America, Cassiana Fernandezsignatory of the document mentioned above, warns that the region’s central banks are moderating their rate relaxation cycles due to the deteriorating global economic outlook.

The Brazilian warns that the increase in US Treasury bond yields and signs of additional tightening of the Federal Reserve “weaken local currencies and increase inflationary pressure due to rising import prices”, something that undoubtedly complicates the Argentine situation even more. “This leads to a more cautious approach by central banks, keeping borrowing costs higher for an extended period”, he adds.

For Fernández, despite the early and aggressive reductions in interest rates in 2021 in the region, which was a pioneer in this matter, many Latin American central banks They now face obstacles, such as rising oil prices due to conflicts in the Middle East. For example, Chile, in particular, faces challenges with the depreciation of its currency.

Thus, for the American financial giant, The region faces a challenging global economic environmente, leading to greater caution from central banks. “Several countries have indicated the need to ensure that inflation is under control before moving forward with more flexible monetary policies,” warns Cassiana. This situation is especially relevant while “The dollar remains strong and commodity prices rise, which could delay the slowdown in regional inflation”.

Thus, regional currencies such as the Chilean peso (9%), the Mexican peso and the Peruvian sol (7%), as well as the Brazilian real (6%) lthey plan the losses of emerging markets in the last three months, according to data from the aforementioned agency, after strong advances at the beginning of 2023. For JPMorgan’s chief economist for Latin America, The moment that emerging markets are going through “is very complicated.”

Argentina and the second round: what JPMorgan said

In its regional report, the US bank assures that the fact that the main parties of the Together for Change coalition maintained a neutral stance “at least formally”, reduces the probability “of a disorderly transition.”

The bank analyzes that, Milei “moved towards the center, and chose to present himself as a change with respect to Kirchnerism, with the aim of attracting Patricia Bullrich’s voters.” With a Milei that “ssounded more moderate and without mentioning the word dollarization at all”.

“Despite political uncertainty, the likelihood of a disorderly transition has decreased.” However, he warns thatthe fiscal situation deteriorates furtherwith the appreciation of the real exchange rate, the escalation of underlying and repressed inflation, and net reserves in negative territory“which increases the magnitude of the adjustments necessary after the second round.”

In short, and waiting for the dust to settle, and for the second round polls, JPMorgan expects “a close second round”, but not a disorderly transition. However, yesI expect fiscal conditions to deteriorate further after November 19.

Screenshot 2023-11-01 at 10.27.04.png

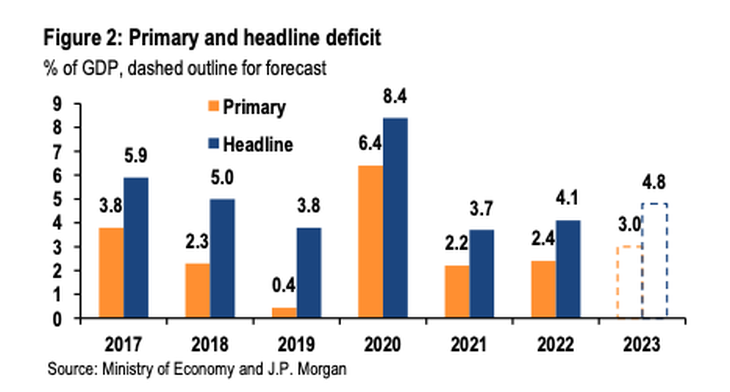

“The primary deficit of the Treasury (cash basis) registered 1.5% of the Gross Domestic Product (GDP) between January and September. The primary deficit increasedeven more so when compared to the deficit of 1.1% of GDP recorded in the same period of the previous year”, emphasizes the bank. For its part, the global deficit (including interest payments) “stood at 2.7% of GDP, compared to 2.1% in the same period of the previous year”.

“The budget deterioration so far this year is due to a drop in income of 1.2% of GDP, mainly due to the drought,” the document maintains. The drop in income has only been partially offset by “a reduction in primary expenses of 0.8%most of which (0.5%) is explained by the real decrease in pensions in a context of accelerating inflation,” he adds.

The report concludes with the projection that the Consolidated public sector deficit will continue to grow amid growing imbalances until reaching around 14% of GDP at the end of the year, above 11.1% of GDP during the year of the pandemic. “This coincides with our forecast of a further acceleration in inflation”, concludes JPMorgan.

Source: Ambito