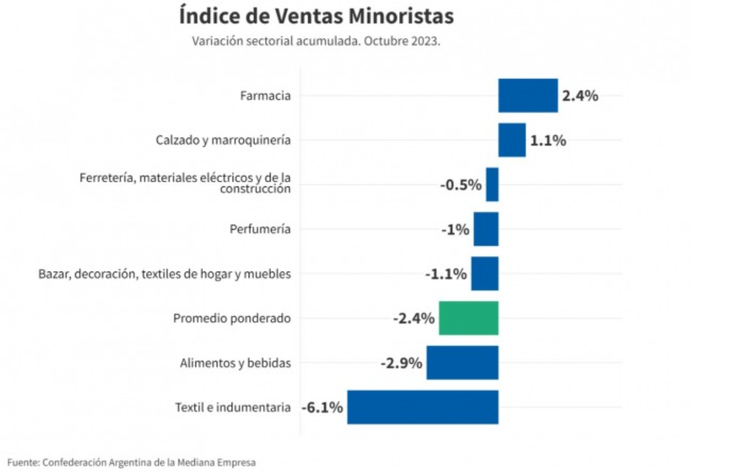

Regarding the month of September, the SME sales They increased by 4.7%, while compared to October of last year they fell by 0.7%, when measured at constant prices. In the first ten months of the year the retail commerce accumulates a decrease of 2.4% year-on-year. In turn, sales had a boost the week before the elections, when many people made early consumption decisions to avoid possible price increases.

In the analysis of the seven sectors evaluated, three of them closed the month with decreases compared to the same period of the previous year, while the remaining four registered increases in their performance. This diversity of results reflects the variability of the economic situation in different areas.

retailsales.png

This is how it arises from SME Retail Sales Index of the Argentine Confederation of Medium Enterprises (CAME)prepared based on a monthly survey among 1,315 retail stores in the country, carried out from November 1 to 3.

In October, three of the seven items recorded year-on-year declines in sales and four had increases. The greatest annual contraction occurred in Food and Beverages (-8%) and the greatest increase could be seen in Footwear and Leather Goods (6.6%).

Retail sales: sector-by-sector analysis

Sales fell 8% annually in October, at constant prices, and accumulated a drop of 2.9% in the first ten months of the year compared to the same period in 2022. In the month-on-month comparison they remained unchanged. Consumers adopted a more cautious purchasing strategy, purchasing only essentials, comparing prices and fragmenting their purchases.

- Bazaar, decoration, home textiles and furniture

Sales rose 6.4% annually in October, at constant prices, and accumulated a drop of 1.1% in the first ten months of the year compared to the same period in 2022. In turn, in the month-on-month comparison they rose 7.7% %. There was an uptick in demand, especially in the week before Mother’s Day. However, the problem of supplier speculation continues to be a challenge for the sector, generating uncertainty and volatility in product prices.

Sales rose 6.6% annually in October, at constant prices, and accumulate an increase of 1.1% in the first ten months of the year compared to the same period in 2022. In the month-on-month comparison they also had an increase of 2.2%. %. The sector has been selling well, although the comparison is made against a bad year such as 2022. Even so, Mother’s Day pulled this sector, also helped by promotions launched by businesses. The star product was sports shoes. Given the good result, some businesses suspect a certain advance of year-end purchases to escape future increases.

Contrary to the rest, sales fell 5.4% annually in October, at constant prices, although they still accumulate a growth of 2.4% in the first ten months of the year compared to the same period in 2022. In the month-on-month comparison they rose 7 .8%. The lack of products was the main problem in this area. There were shortages of drugs, delays in deliveries, cuts in imported items and it was added, especially this month, that there were products that were left without prices and therefore pharmacies chose not to sell until the replacement cost is clarified.

retailsales2.png

Sales fell 1% annually in October, at constant prices, and also accumulate a fall of 1% in the first ten months of the year compared to the same period in 2022. In the month-on-month comparison they remained unchanged. In the businesses consulted, they indicated that Mother’s Day was what saved the month, because, except for that date, very little was sold. Demand was concentrated in economical products of national origin, since imported ones were not available or their prices were very expensive. Businesses made alternative, lower-value brands available to their customers, and that helped contain sales for the month.

- Hardware, electrical materials and construction materials

Sales rose 5.2% annually in October, at constant prices, and accumulated a drop of 0.5% in the first ten months of the year compared to the same period in 2022. In the month-on-month comparison they rose 8.5%. Despite the supply challenges, businesses found themselves with a sufficient stock level because they accumulated inventories anticipating the uncertainty before the elections, similar to what happened in August. Credit card sales experienced a notable increase driven by promotions offered by businesses in search of liquidity. The inventory accumulation strategy and the use of cards helped maintain activity in the retail sector.

Sales rose 4.1% annually in October, at constant prices, and accumulated a drop of 6.1% in the first ten months of the year compared to the same period in 2022. In the month-on-month comparison they rose 6.1%. It must be taken into account in this comparison that sales in October of last year had experienced a notable decrease (-19.2%). Mother’s Day was one of the main drivers of sales, along with attractive offers that consumers took advantage of despite the constant escalation of prices in the market. The focus on promotions and special events has been essential to maintaining business activity.

Source: Ambito