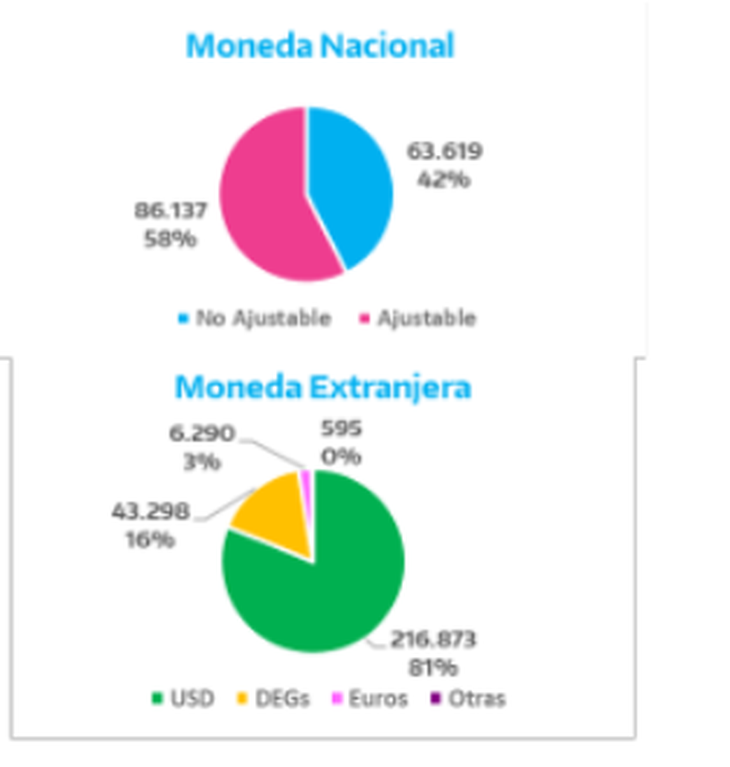

As clarified, 36% of the debt in a normal payment situation is payable in local currency while the remaining 64% is payable in foreign currency.

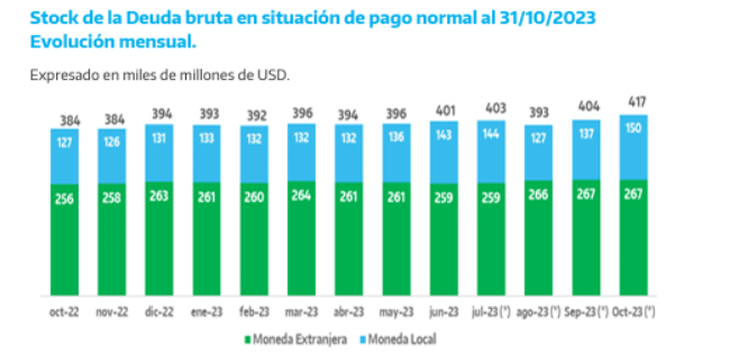

The public debt rose to US$419,291 million during October (up 3.4%), according to the Finance Secretary. Compared to the previous month, the debt in a normal payment situation increased by the equivalent of US$12,680 million, representing a monthly increase of 3.14%. The variation is explained by the growth of debt in foreign currency by US$123 million and the increase in debt in local currency for an equivalent amount in dollars of US$12,557 million.

The content you want to access is exclusive to subscribers.

According to the report, 36% of the debt in a normal payment situation is payable in local currency while the remaining 64% is payable in foreign currency.

The new data comes from the statistical update which the Government published today in a report detailing that the increase is produced by “a growth of US$123 million in debt in foreign currency” and another equivalent to ““US$12,557 million in debt in local currency.”

At the same time, it is explained that 77% of the gross debt in a normal payment situation corresponds to Titles and Bills of the National Treasury, 19% to obligations with Official External Creditors3% corresponds to Transitory Advances 2 and the remaining 1% to other instruments.

Casssptura.PNG

The main cause of the increase in record debt primary of US$419,291 million in October, was the persistence for the third consecutive month of a regime of fixed official exchange rate at $350 per dollar in the wholesale channel, despite the fact that inflation remained at a higher rate than in the case of CER adjustable bonuses took the effect of the acceleration in September to more than 12%; and to a lesser extent due to the growing financing needs of the National Treasury, given that while the maturities of the month were for US$5,437 million, the placement operations of new sovereign securities amounted to the equivalent of US$8,208 million.

From there arose a genuine net increase of US$2,771 millionwhich added to the effect of exchange differences, and adjustment by CER without mitigating variation in the exchange rate, added another US$9,917 million, a proportion greater than 3 to 1 of operational debt of the Central Administration.

And if you add the debt assumed by the central bank With the issuance of monetary regulation instruments, such as Leliq and Pases, which amounted to the equivalent of US$60,168 million, at the official exchange rate taken by the Ministry of Finance for the rest of the obligations, the central public sector debt rose to US$479,459 million.

debtp.PNG

Source: Ambito