Despite the panic it generated in the markets the new variant of Covid-19, the main analyst of investment banking JP Morgan put cold cloths on the situation in front of worried investors.

“The South African cases are close to the pandemic average and the deaths from Covid-19 are close to the minimum, a quite favorable situation in relation to the last two years,” explained Arko Kolanovic, senior analyst at JPMorgan, in a document published last Wednesday. .

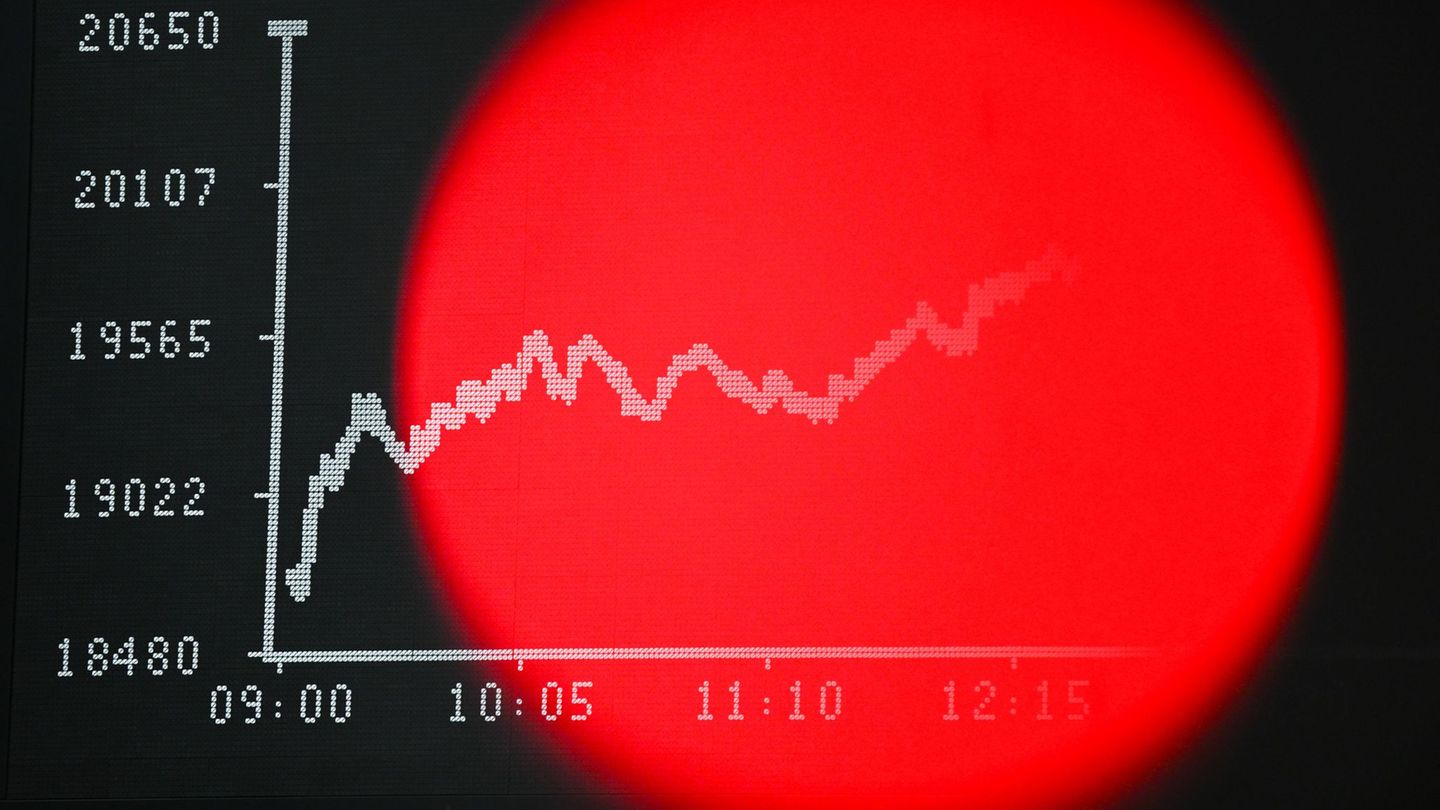

While, The financial company assures that the current epidemiological data should not worry, so it recommended investing in this moment of falling values of the shares. “We see the recent liquidation in these segments as an opportunity to buy shares in the face of the fall in prices of companies dependent on the economic cycle and reopening (airlines, steel companies and chemicals), and of raw materials,” he says.

According to the report, the Ómicron variant would be less severe than previous strains, which “would fit historical patterns for a less severe and more transmissible virus to rapidly displace the more severe variants,” which could turn Ómicron into a ” catalyst to transform a pandemic into something more like seasonal flu, “wrote the JP Morgan strategists.

In that sense, Kolanovic suggested the purchase of bonds to guarantee higher yields predicting the end of the coronavirus pandemic, especially “given the wide availability of vaccines and new therapies that are expected to work in all known variants.”

In this way, the advantage is to invest on the side of cyclical actions related to the reopening of the economy, instead of growth actions -as during the pandemic-. However, he stressed the lack of confidence around governments and the new restrictions around the contagiousness of the new variant.

For its part, this report adds to the JP Morgan forecast regarding the value of oil, whose prices will exceed 125 dollars per barrel in 2022 and 150 dollars in 2023, increases related to the productive capacity of the member countries of the Organization of Petroleum Exporting Countries (OPEC).

“We believe that OPEC will slow down the promised increases in early 2022, and we believe that the group is unlikely to increase supply unless oil prices are well supported,” said the US investment bank, which also estimates that the Global demand for crude oil reaches 99.8-101.5 million barrels per day in the next two years.

Source From: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.