The Federal Public Revenue Administration (AFIP) ordered a payment on account of the Income Tax to the companies of the hydrocarbon sector for obtaining “extraordinary income” obtained by the development of their activity. This was made known through the General Resolution 5453/2023 published this Monday, December 4 in the Official Gazette, six days after the inauguration of Javier Milei.

In this framework, as detailed in the Resolution, the objective is to demand the adoption of tools that contribute to the “progressive distribution of income“for the sake of”reduce inequalities and protect people and groups that present greater conditions of vulnerability”.

“That, in this situation, in order to sustain the redistributive impulse of fiscal policy and in the face of the manifestation of high contributory capacity of certain economic sectors, reasons of tax administration and equity make it appropriate establish an extraordinary payment on account of income taxs that subjects belonging to said sectors must enter,” he explains.

Earnings: which sectors are included in the new payment

- Crude oil extraction (includes tar sands, oil shales, petroleum oils and oils from bituminous minerals, petroleum, etc.)

- Natural gas extraction (includes liquefied and gaseous natural gas)

- Manufacture of petroleum refining products

- Conventional thermal energy generation (includes the production of electrical energy using turbo-gas, turbo steam, combined cycle and turbo diesel machines)

It is for those who in the sworn statement corresponding to the fiscal period 2022 or 2023as appropriate – in accordance with article 3 -, would have reported a Tax result that is equal to or greater than $600,000,000.-), without applying the deduction of tax losses from previous years in accordance with the aforementioned tax law.

They remain excluded from payment on account established herein those subjects reached by the obligation established in the General Resolutions Nos. 5,391 or 5,424for the same fiscal period, or who had obtained a income tax exemption certificate -in force in the periods included in the first and second paragraphs of article 3-, in the terms of General Resolution No. 2,681, its amending and complementary ones.

Earnings: how payment will be considered

For the purposes of determining the payment on account provided for in article 1, the subjects reached must consider the sworn income tax return corresponding to the fiscal period 2022, in the case of legal entities whose closureand commercial exercise would have operated between the months of October and December 2022, both inclusive.

Taxpayers whose closings commercial exercise that had operated between the months of January and September 2023, both inclusive, must consider the income tax return corresponding to the 2023 fiscal period.

The payment on account will be computablee, in the terms of article 27 of Law No. 11,683, text ordered in 1998 and its modifications, in the fiscal period following the one taken as the calculation basis, according to the following detail:

a) With the closing of the fiscal year operated between the months of October and December 2022, both inclusive: fiscal period 2023.

b) With closing of the fiscal year operated between the months of January and September 2023, both inclusive: fiscal period 2024.

afip-gains.png

Earnings: How Payment Will Be Determined

According to the AFIP, the amount of the payment on account will be determined by applying the rate ofl FIFTEEN PERCENT (15%) on the Tax Result -without applying the deduction of tax losses from previous years in accordance with the tax law- of the fiscal period immediately preceding the one to which the payment on account will correspond.

In those cases where there isdeclared tax result for one or more activities promoted, the taxpayer may deduct from the amount of the payment on account, the amount corresponding to the relief for said activity. To do this, you must make a presentation through the Tax Code service called “Digital Presentations”, in the terms of General Resolution No. 5,126, until the day of expiration of the first installment provided for in article 6 hereof, indicating the amount by which the aforementioned payment on account must be reduced, for the purposes of its registration. in it Tax Account System.

Earnings: what dates should be taken into account to make the payment

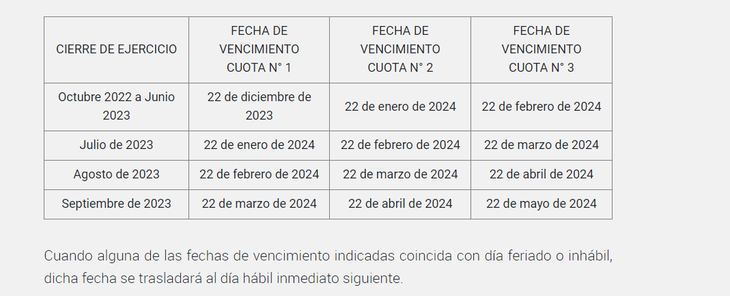

The payment on account determined in accordance with the procedure described, will be paid in THREE (3) equal and consecutive installmentson the dates indicated below:

Screenshot 2023-12-04 080133.png

Source: Ambito