According to the 2024 Budget, only the City of Buenos Aires and four other provinces will have a surplus.

The reduction of shared resources for the modifications in the Income Tax and the VAT would affect the nation and the provinces. According to a report from the Argentine Institute of Fiscal Analysis (IARAF), according to the 2024 Budget, only the City of Buenos Aires and four other provinces will have a surplus. On the other hand, 19 would remain in fiscal deficit.

The content you want to access is exclusive to subscribers.

Income tax: the impact on the nation and provinces

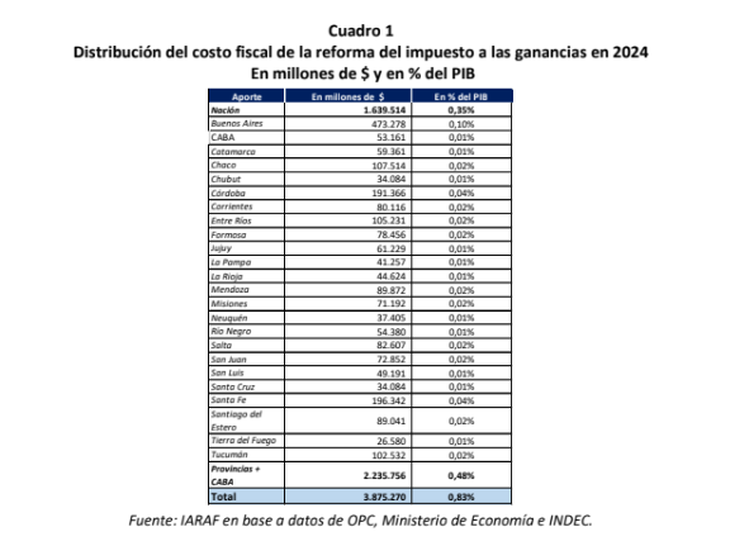

According to the OPC (Congressional Budget Office), this tax modification would imply a loss in revenue equivalent to 0.83% of GDP, which expressed in current currency would imply $3,875,000 million. Being a co-participating tax, this loss of Income falls to the Nation and provinces plus CABA.

iaraf1.PNG

The five provinces with further reduction in income They would be Tierra del Fuego ($137,000 per inhabitant), Catamarca ($136,000 per inhabitant), Formosa ($127,000 per inhabitant), La Rioja ($114,000 per inhabitant) and La Pampa ($111,000 per inhabitant). While the jurisdictions with the lowest loss per inhabitant would be CABA ($18,000 per inhabitant), Buenos Aires ($26,000 per inhabitant), Mendoza ($44,000 per inhabitant), Córdoba ($47,000 per inhabitant) and Neuquén ($50,000 per inhabitant).

VAT: the impact on the nation and provinces

In 2024, according to the 2024 Budget presented in September of this year, VAT collection would suffer a decrease of 1.15 percentage points of GDP. This drop in collection It is associated with tax administration measures carried out in 2023 with the objective of compensating for the loss of revenue due to the drought. This would happen as a result of the tax credits generated by the higher customs payments collected in 2023.

That is, they were carried out collection advances due to higher customs receipts in 2023, which will be compensated in 2024. However, IARAF estimates this loss in revenue at 0.87 pp of GDP.

In this case Nation would lose revenue in 2024 by 0.41% of GDP, which is equivalent to $1,894,000 million. On the other hand, the 23 provinces plus CABA would lose income of 0.45% of GDP, equivalent to $2,108,000 million.

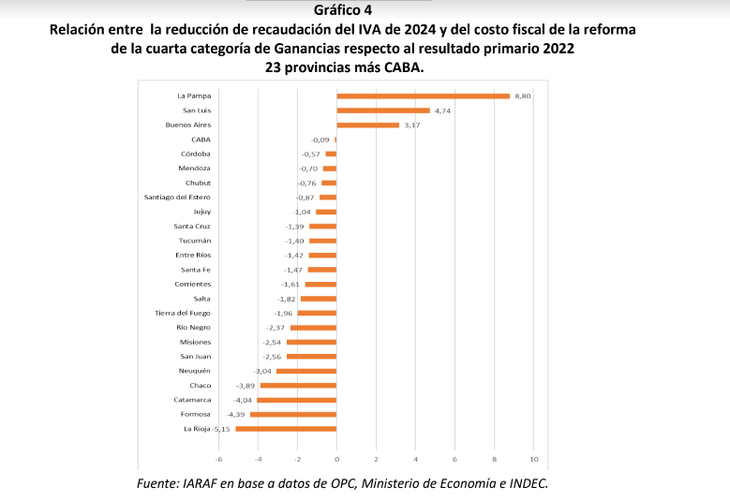

VAT and Profits: what is the joint impact for the provinces

Now, it remains to evaluate the joint impact of these two elements on the income of the Nation and provinces plus CABA. Nation would see its income from these reduced two taxes in 2024 compared to 2023 by 0.76% of GDP, which is equivalent to $3,533,000 million. The provinces would lose 0.93% of GDP income, which translates into $4,334,000 million and a 55% share of the total reduction.

The 5 most affected jurisdictions They would be Tierra del Fuego ($265,000 per inhabitant), Catamarca ($262,000 per inhabitant), Formosa ($247,000 per inhabitant), La Rioja ($220,000 per inhabitant) and La Pampa ($215,000 per inhabitant). The 5 least affected jurisdictions would be CABA ($32,000 per inhabitant), Buenos Aires ($52,000 per inhabitant), Mendoza ($85,000 per inhabitant), Córdoba ($92,000 per inhabitant) and Neuquén ($98,000 per inhabitant).

iaraf2.PNG

Source: Ambito