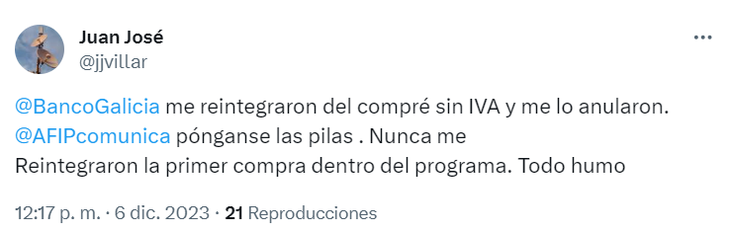

Program beneficiaries Buy without VATpromoted by the Minister of Economy and former presidential candidate Sergio Massathey complained on social networks because suffered cancellations of refunds taxwhich is done through a bank debit.

The initiative sought to alleviate the impact of the inflation on workers who were not benefited by the profit reduction and was pending until December 31. Although the idea that the measure was lifted began to fly over.

claim.PNG

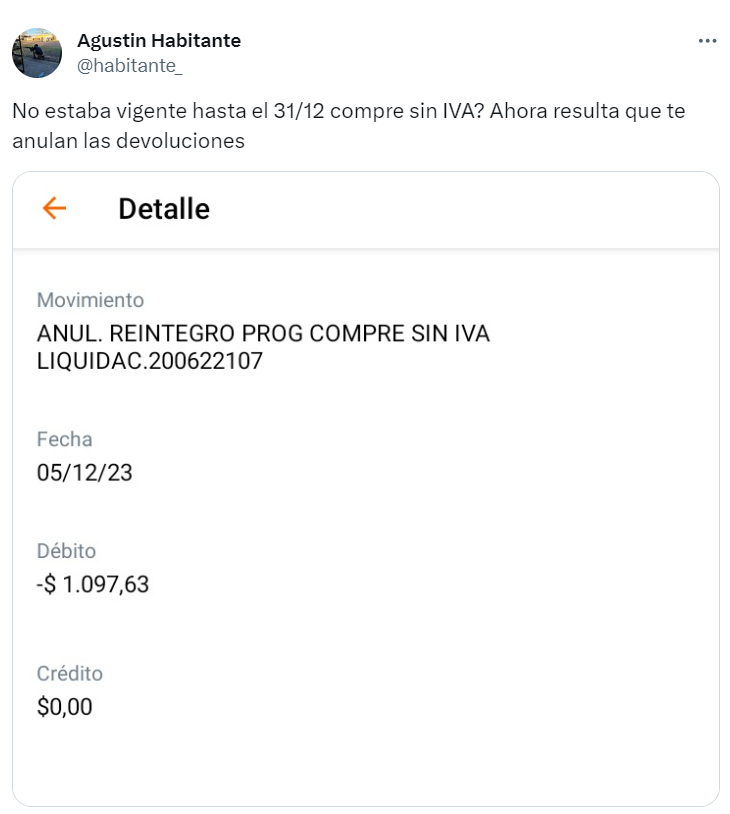

Hundreds of bank users observed that cancellations of debits that corresponded to the 21% tax of the products of the basic basket: “Annul. VAT collection, “Cancel, Refund Prog Buy without VAT” and similar legends can be seen next to the movements that subtracted money.

Like the cancellations were carried out without prior communications or AFIP nor of the Bank entitiesusers began to get restless.

However, leading banking entities clarified to Ámbito that “The cancellations correspond to returns that were duplicated due to a system error that has already been resolved“.

claim 3.PNG

Likewise, from one of the main banking entities they assured that “there was a system problem with the processors” and explained that “A deviation was detected in the “Buy without VAT” process in which credit adjustments were duplicated during November 15 and 16“.

“The duplication of credits affected the calculation and monthly limit of adjustments per client during the subsequent days until 11/27, so a reprocessing had to be carried out to debit the erroneous credits and carry out the accreditations correctly,” they expanded in dialogue. with this diary.

claim 2.PNG

VAT refund: until when is it valid?

The program “Buy without VAT“is an economic measure through which the twenty-one% of the value in purchases of essential products when using debit cards. It came into effect from September 18 until December 31, 2023according to the Ministry of Economy.

With this program you reimburse 21% of expenses in common consumer goods made by debit cards in establishments retailers either wholesalers within 48 hours of purchase and has a maximum limit of $18,800 per month.

VAT refund: who can access it

In addition to the informal workers who received the Reinforcement or IFE from Anses, these groups also access the VAT refund:

- Retirees, pensioners or holders of Non-Contributory Pensions (PNC) that do not exceed 6 minimum assets.

- Universal child allowance holders (AUH)up to 6 minimum assets.

- Universal pregnancy allowance holders (AUE).

- Workers in dependency relationship, with a monthly income of up to 6 Minimum Vital and Mobile Wages (SMVM). In the case of multiple employment, the sum of the gross remuneration will be considered.

- Workers in private homes.

- Monotributistas.

VAT refund: what products are covered?

The Basic Food Basket of the National Institute of Statistics and Censuses (INDEC) for an adult includes:

- Bread.

- Water biscuits.

- Sweet cookies.

- Rice.

- Wheat flour.

- Other flours (corn).

- Noodles.

- Dad.

- Sweet potato.

- Sugar.

- Sweets: includes sweet potato, jam, dulce de leche.

- Dried legumes: lentils and peas.

- Vegetables: chard, onion, lettuce, plum tomato, carrot, pumpkin, canned tomato.

- Fruits: apple, tangerine, orange, banana and pear.

- Meats: roast, common meat, backbone, shoulder, minced meat, buttock, chicken, fish meat.

- Cold cuts.

- Eggs.

- Milk.

- Cheese: cream cheese, cuartirolo cheese, grating cheese.

- Yoghurt.

- Butter.

- Oil.

- Non-alcoholic beverages.

- Alcoholic beverages.

- Fine salt.

- Condiments.

- Vinegar.

- Coffee.

- Herb.

Source: Ambito