The entries were made in 28 days against maturities of $1,575 billionwhich represented a firm reduction in business with the release of $1,549 billion.

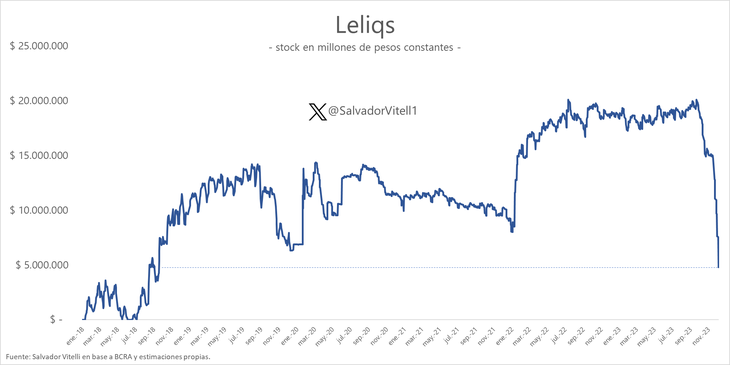

The Argentine central bank (BCRA) took $28,648 million pesos (about US$78.9 million) on Tuesday. in Liquidity Letters (Leliq) with an unchanged rate of 133% per year. With these values, they only renewed 1.5%. Leliqs’ new stock is $4.8 billion. This was the last tender of the Government of Alberto Fernández.

The content you want to access is exclusive to subscribers.

image.png

The entries were made in 28 days against maturities of $1,575 billionwhich represented a firm reduction in business with the release of $1,549 billion.

The elected Argentine president, Javier Milei, will take office on Sunday after a campaign with the promise of dollarizing the economy and eliminating the BCRA.with the immediate implementation of a “shock” plan and the liquidation of the “Leliq” because they were considered inflationary.

Source: Ambito