The market price is so high that they would lose against a devaluation at this time. Today, quotes incorporate an exchange rate correction minus 70%.

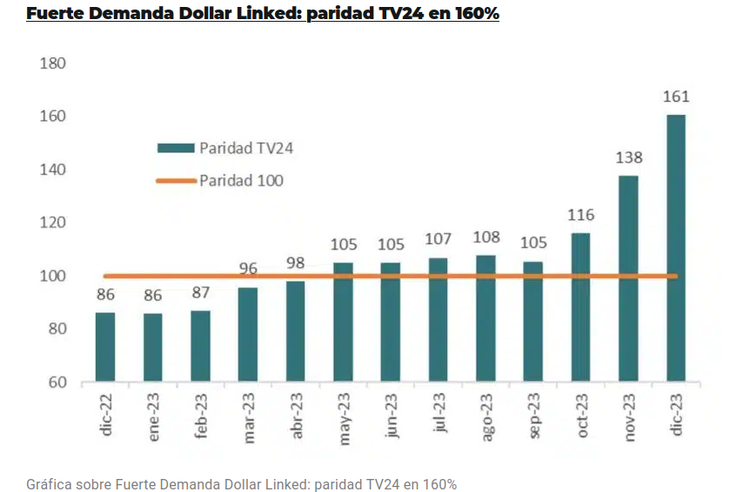

The markets are waiting of the first measures that could be announced in the coming hours (or days) the Minister of Economy, Luis Caputo. Although there have been many rumors about the nature of the future economic plan, what is repeated from the different versions is that a strong fiscal adjustment will be proposed at the beginning. In this framework, in the weeks prior to the inauguration, and in the face of rumors about a potential exchange rate jump, hedging instruments took their prices to the maximum. Among them, the bonuses linked dollar issued by the Treasury reached a record high of 160% above par, that is, values well above their nominal value.

The content you want to access is exclusive to subscribers.

“In recent days we have seen a very important flow that has been channeled towards Treasury securities in pesos with different adjustment clauses, generating a strong price rearrangementthe MegaQM brokerage company noted in its latest report.

The report indicates that “the parity of Linked Dollar instruments reached a record level, which had not occurred in previous cycles.” “In recent days, prior to the presidential inauguration, it has been operating in the range of 160% parity,” the report explains. This price level that can be accessed in secondary markets implies thatThe bond yields the expected devaluation minus 70%. By purchasing the bond well above its face value, the expected return is clearly lower than the devaluation that may exist. “From a hedging perspective, this implies that the first part of an eventual exchange rate jump is already built into the price. and would not impact the value of the asset if it occurred,” explains the study.

Screenshot_2023-12-10_17-59-46.png

The so-called TV24, which expires next April, was quoted below 100% between December 2022 and April 2023. Then, between May and September, it ranged between 105% and 108%. The takeoff of these titles occurred in October when, within the framework of the national elections, it turned out that the current president Javier Milei was in the second round against the former Minister of Economy Sergio Massa. In the month of the elections, TV24 went to 116%, in November it jumped to 138% and in the first week of December, with the imminent replacement, it exploded by 160%.

The great balance of dollar linked bond prices in recent days It implies that the instrument is so expensive that it would not cover the expected devaluation. The point for the market is to try to figure out how much the change in the exchange rate could be. Sources from the Central Bank, from the previous management of Miguel Pesce, indicated that This Monday the table will define whether it validates the last jump in the wholesale exchange rate on Thursday in the value of the quote “A” 3500 (something that did not happen during the last round), when some traders made trades above the end of $385. At the retailer it sold for $400.

Although operators consider that an equilibrium value it could be $650, which were mentioned by the Minister of the Interior, Guillermo Francos, the point is how you can get to it. The government could try to move towards that reference and then try to control the inflationary effects to avoid falling behind again.

It is not ruled out that it goes above that value and then seeks balance. At current prices, They point out that going to $850 is the equivalent of the exit exchange rate from the stocks in 2016.

As can be interpreted from Milei’s speech on the steps of Congress as soon as he took office, the new government is not willing to immediately release the dollar to avoid repeating experiences such as the so-called “Rodrigazo” of 1975 or the hyperinflation of 1989.

Source: Ambito