The Dax remained just below its recent record high today before the US Federal Reserve’s interest rate decision. After its daily high of 16,836 points, the leading index ended trading at 16,766.05 points. That was 0.15 percent less than at the end of the previous day. As was the case throughout 2023, it did better than the MDax again on Wednesday. The index of medium-sized German stocks fell by 0.58 percent to 26,427.65 points. While the Dax is defending an annual increase of more than 20 percent, the MDax has only gained a good five percent in 2023 so far.

The Dax remained just below its recent record high today before the US Federal Reserve’s interest rate decision. After its daily high of 16,836 points, the leading index ended trading at 16,766.05 points. That was 0.15 percent less than at the end of the previous day. As was the case throughout 2023, it did better than the MDax again on Wednesday. The index of medium-sized German stocks fell by 0.58 percent to 26,427.65 points. While the Dax is defending an annual increase of more than 20 percent, the MDax has only gained a good five percent in 2023 so far.

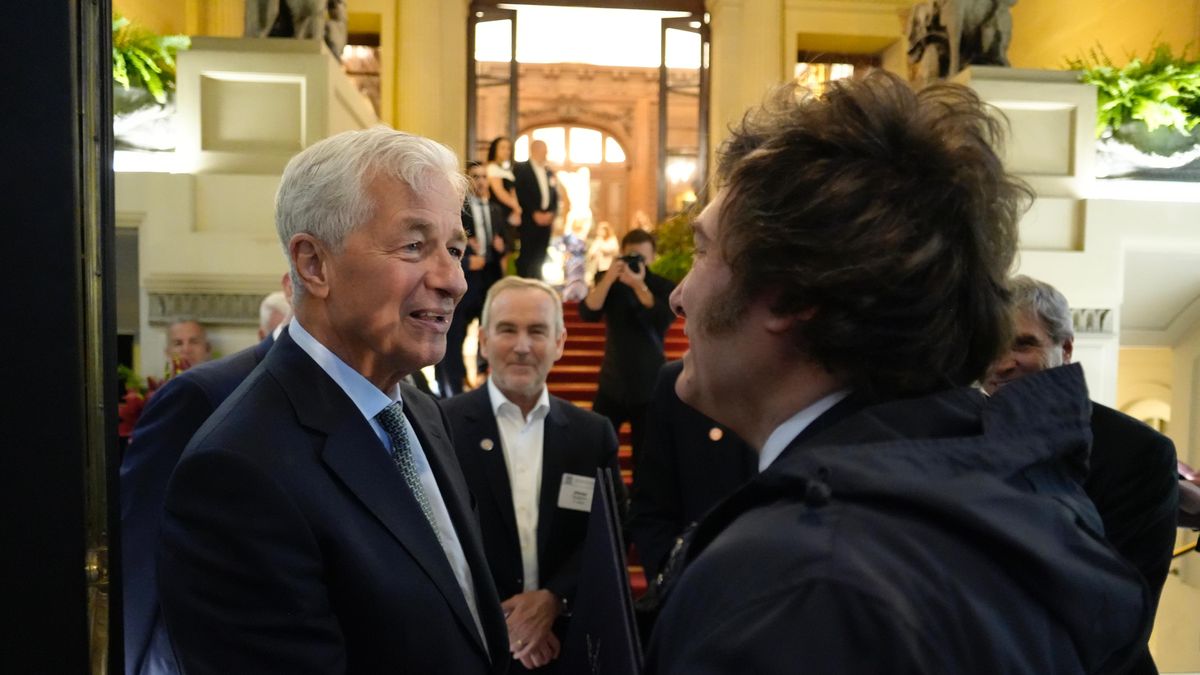

The increase in producer prices in the USA weakened somewhat more than expected in November, but this no longer provided any fresh impetus before the interest rate decision. The US Federal Reserve Bank is likely to keep monetary policy quiet again at its last interest rate meeting this year. Market observers are paying particular attention to what signals the monetary authorities around their boss Jerome Powell will send for the coming year.

The hope of interest rate cuts soon is currently the biggest driving force behind the current year-end rally, which has already brought the Dax an increase of almost 15 percent since its October low of 14,630 points. Market participants also expect interest rates to be cut by the European Central Bank (ECB) in the coming year. The ECB will make its next interest rate decision on Thursday alongside the Bank of England.

There were reclassifications by analysts among the individual stocks on the German market in the middle of the week. The recovery of BASF’s shares was given further impetus by the fact that the major Swiss bank UBS made a U-turn and turned a sell recommendation into a buy recommendation. The chemical company’s stocks rose by 4.4 percent at the top of the DAX.

Many investors did not like the agreement by the traffic light coalition on a federal budget for 2024. Because savings decisions are expected for financing. A kerosene tax is to be introduced on domestic flights within Germany. Given this prospect, Lufthansa shares lost 2.8 percent in value.

Vice Chancellor Robert Habeck also spoke of an early expiry of the funding for electric cars and cuts for the solar industry. In particular, the shares of the inverter manufacturer SMA Solar then slipped significantly by 9.6 percent.

The shares of the specialty chemicals group Merck KGaA, which also focuses on semiconductor solutions, and the solar supplier Wacker Chemie were also affected. Their securities fell by up to 1.6 percent. Titles from the energy technology specialist Siemens Energy came last in the Dax with a loss of 3.2 percent.

RTL Group shares were a big loser in the MDax with a loss of 3.3 percent. In a study, the US bank JPMorgan expressed the expectation of negative price drivers.

On the European stage, the EuroStoxx fell to a similar extent as the Dax. The same applied to the French leading index Cac 40, while London’s FTSE 100 closed just in the black. In the USA there were positive signs for the most important indices, but without much movement.

The euro last cost 1.0791 US dollars. The European Central Bank had meanwhile set the reference rate at 1.0787 (Tuesday: 1.0804) US dollars. The dollar therefore cost 0.9270 euros.

On the bond market, the current yield fell from 2.25 percent the day before to 2.24 percent. The Rex bond index, on the other hand, rose by 0.12 percent to 126.83 points and the Bund future rose by 0.41 percent to 135.66 points.

Source: Stern