The digital accounts are the payment method most chosen by Argentines to confront inflation, according to a survey carried out by the consulting firm Isonomía together with Payment Market called “Argentines and money.”

Investments that generate returns are the main factor why 27% of users opt for digital accounts as the best means of payment to face inflation, above cash (16%), the use of credit cards (11%), homebanking (9%), debit cards (7%), virtual currencies or crypto (6%), transfer (6%) and checks (physical or e-check), (2%).

Regarding the preferred method of savings, “unanimously, Argentines prefer to buy dollars, although in recent years, they have tried new alternatives,” the report highlights.

“Faced with the impossibility of saving in dollars due to lack of surplus, they look for new alternatives, and the ilow risk investments (FCI) through virtual wallets they position themselves as a key tool to confront inflation“said the report.

Digital wallets: the characteristics of users

In this sense, it specifies that the 73% of users -led by older adults over 50 years old- is banked (savings account and/or debit/credit card in a bank) and that 69% – mostly young people between 18 and 29 years old, followed by people between 30 and 49 years old – have a digital account in a virtual wallet.

Although half of Argentines use digital wallets dailyit’s special because It is safer than transiting with cashthe latter remains as ePreferred payment method (with loss of prominence), partly because people from low-income sectors are the ones who use it the most, having a greater participation in the informal economy.

Likewise, based on the current economic contextthe study indicates that “the vast majority of Argentines knows the payment methods offered in each of the businesses he frequents.

In this sense, 75% of Argentines take into account the payment methods offered by businesses or digital stores, while 60% stopped buying a product or service because they could only pay in cash.

Digital wallets: why users decide to use them

“Virtual wallet users prefer investments that generate daily returns“said Uriel Mendelberg, senior analyst of Isonomía’s Analytics & Research Management, during a meeting with the press in which he also participated. Agustín Onagoitysenior director of Mercado Pago for Argentina.

In this regard, they warned that for “security” reasons 64% of respondents choose to have money in a virtual wallet or digital account, while 24% prefer to travel with cash.”

However, despite preferring digital media, users are forced to use cash in certain situations, such as paying at a neighborhood kiosk (22%), paying for services (20%), paying for taxis and public transportation (both 10%). ).

Screenshot 2023-12-20 174653.png

Cash is the most used for people with fewer resources.

Collecting salaries by digital wallet: an opportunity?

He salary collection (11%) is another factor by which the user I would prefer to use digital mediaand about this the study specifies that “only one in 10 Argentines collects their income” through a digital wallet.

“Only one in 10 Argentines collects their income” through a digital wallet. Among the reasons for collecting income through a virtual wallet, respondents highlighted convenience and speed, security, and interest generation.

Among the reasons for collecting income through a virtual wallet, respondents highlighted the comfort and speedsecurity and the generation of interests

In any case, it is pointed out that “There are still barriers to accessing digital wallets,” with access to an Internet signal (24%) being “the main complaint.” They are followed by “Financial Education / Mistrust (14%), “Not all businesses have it (7%), “Delays in transfers” (3%), “Failures in apps” (6%).

However, one in four people would prefer to collect them through that means, the study states.

The connection of Argentines with money

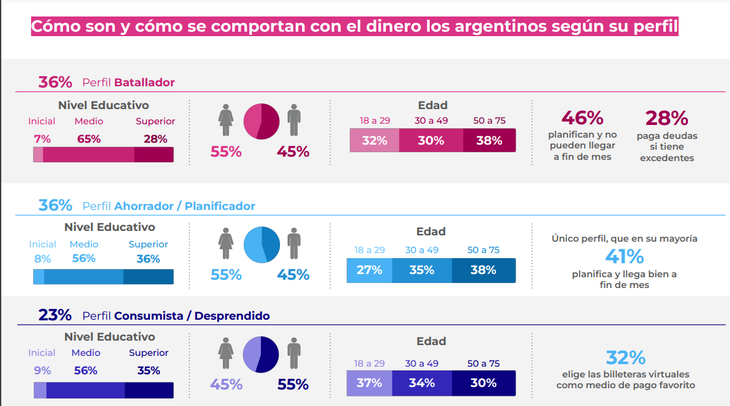

Finally, when analyzing the “link of the Argentine with money”, it was concluded that 36% are “battlers, who work hard to generate money”another 36% is “saver and planner, who have the habit of saving and do not waste money” and 23% are “consumeristic and detached, with a tendency to acquire, spend or consume goods without moderation or out of necessity.”

mercaopago.png

The higher the educational level, the greater the ability to plan expenses.

Source: Ambito