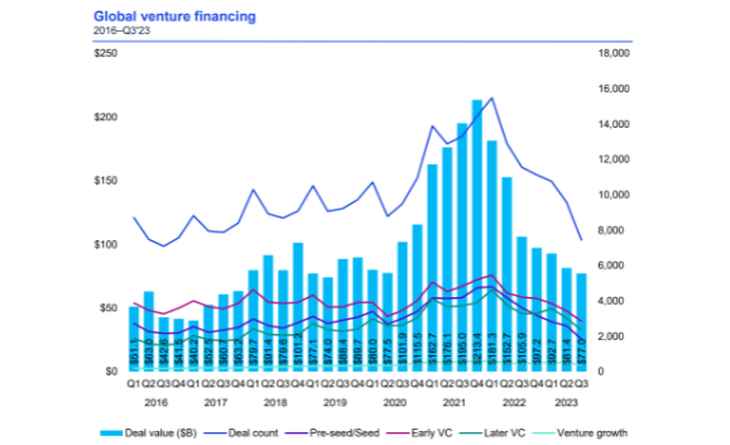

Global venture capital investment fell from $81.4 billion across 9,563 deals during the second quarter of 2023 to $77.05 billion.

Global transaction figures in Venture Capital continue to decline, as detailed in the latest edition of the KPMG study, which revealed sector data for the third quarter of 2023.

The content you want to access is exclusive to subscribers.

He transaction volume fell to a level not seen since the fourth quarter of 2018. Global investment in venture capital fell from 81.4 billion dollars in 9,563 agreements during the second quarter of 2023 to 77,050 million dollars in 7,434 agreements in the third quarter of this year, which represents a decrease of 5.35% in value and 23% in number of transactions.

Europe It is the continent that showed some reaction to the global decline, going from $16.4 billion in the second quarter to $17.3 billion in the third, but its transaction volume fell from 2,454 to 1,671. The Americas, for their part, showed a drop that reached 38.6 billion dollars, the lowest level since the fourth quarter of 2019.

Finally, the risk capital also showed a decline in the Asia-Pacific region, reaching $20.3 billion, the lowest level since the first quarter of 2017.

Investment in venture capital falls: what are the causes

Besides the global macroeconomic situation, The reason for this drop, already detailed in previous editions, is the greater investor caution when choosing your investments. “The startup selection processes and decision making have been more extensive, due to the greater selectivity with which investors operate, and deeper analyzes in search of profitability in business models,” says Rodrigo Guedes, leading partner of Equity Capital Markets Advisory at KPMG in Brazil.

investmentglobal.PNG

Corporate investment grew in 2023: the most favored sectors

However, in the midst of all this scenario, the KPMG report also showed some increases and positive aspects: Global investment in corporate venture capital grew slightly, from $39.1 billion in the second quarter of 2023 to $40.4 billion in the third quarter of 2023; while the exit value increased from $53.3 billion (in the second quarter of 2022) to $82.8 billion (in the third quarter of 2023). The clean technology sectors, artificial intelligence (AI) and the energy continue to attract investors. Cleantech companies accounted for more than half of the largest venture capital transactions in the third quarter of 2023.

Investments: what happened in Argentina

Global geopolitical and economic turmoil continues to impact venture capital in major regions of the world. “Although at the local level there has been an increase in the amount of Venture Capital investments during the last quarter, Argentina is experiencing a trend in line with the global market, in which values remain at significantly low levels. software and IT services industries, followed by Fintech, have been the most active business areas in the country”; points out Ramiro Isaac, Director of M&A & Debt Advisory at KPMG in Argentina.

Source: Ambito