The bill sent by the national government this afternoon to the National Congress the new ““Special regime for income tax on personal property” “REIBP” for all fiscal periods until December 31, 2027.

The option to join the REIBP will be, according to the text, individual and voluntary, and will be open until March 31, 2024.

Taxpayers who choose to join the REIBP will pay the Personal Property Tax corresponding to the fiscal periods 2023, 2024, 2025, 2026 and 2027 in a unified manner.

“For the purposes of determining the tax base of the Personal Property Tax for the fiscal periods 2023 to 2027, the following conditions must be met:

- The assets existing in the taxpayer’s assets as of December 31, 2023, inclusive, will be taken into account.

- All assets of the estate existing as of December 31, 2023 will be valued using the valuation rules provided for in Law No. 23,966 on the Tax on Personal Assets, text ordered in 1997 and its modifications. In the case of the assets referred to in paragraph g) of article 22 of the aforementioned legal norm, the total value of the assets taxed in the country will include those that can be withdrawn in accordance with point 3.

- From the resulting amount, the value of the exempt assets indicated in article 21 of Title VI of Law No. 23,966 on the Personal Property Tax, text ordered in 1997 and its modifications, will be subtracted.

The assets included in sections g), i), j) and k) of article 21 of Law No. 23,966 on the Tax on Personal Property, text ordered in 1997 and its modifications, They will only be subtracted from the taxed assets if they were in the taxpayer’s assets before December 10, 2023, inclusive.

From the resulting amount, the non-taxable minimum provided for in article 24 of Law No. 23,966 on Personal Property Tax will be deducted., text ordered in 1997 and its modifications. If the taxpayer’s home exists among the assets, the value of said property will also be subtracted up to the limit provided for in the second paragraph of article 24 of Law No. 23,966 on the Tax on Personal Property, text ordered in 1997 and its modifications. . In both cases, the amount in force for the 2023 fiscal period will be taken. The final resulting amount will be multiplied by five (5).

Aliquots

Taxpayers who are human persons and undivided estates that areand join the REIBP will apply the rate of 0.75% on the tax base determined according to the rules of article 171.1.

The substitute managers referred to in articles 171.2 and 171.3 who adhere to the REIBP The 0.5% rate will be applied to the tax base determined according to the rules of article 171.

Taxpayers covered by the rules of article 171.4. that adhere to the REIBP will apply the rate of 0.75% on the tax base determined according to the rules of said article 171.4.

Way to pay

Tax credits. For the payment of the respective tax under the REIBP, the tax credits, advances and payments on account of the Personal Property Tax corresponding to the 2023 fiscal period.

Payment amount

To determine the payment to be made under the REIBP, to the amount resulting from applying the rate provided for in article 175 on the tax base determined under the rules of article 172, A compensatory interest equivalent to 125% of the interest rate applied by the Banco de la Nación Argentina for fixed terms of 30 days must be added for the period between January 1, 2024 and the day prior to the effective payment of the indicated amounts. in articles 176 and 177.

The total cancellation of the tax payable under the REIBP must be made until May 31, 2024, inclusive.

Taxpayers must make an initial payment of the REIBP of no less than 75% of the total tax to be determined under the rules of this regime. This initial payment must be made until March 31, 2024, inclusive. The national Executive Branch may modify this last date, but never beyond April 30, 2024.

Exclusion of Personal Property Tax for the fiscal periods 2023 to 2027.

Taxpayers who choose to join the REIBP will be excluded from all obligations under the Personal Property Tax rules for the pending tax periods until the expiration of the regime (that is, from 2023 to 2027, both inclusive). This exclusion covers all aspects of the Personal Property Tax, including the obligation to submit sworn declarations, calculate the tax base, determine the tax, pay the tax or its advances or payments on account and any other obligation related to the Personal Property Tax.

Modifications to the Personal Property Tax

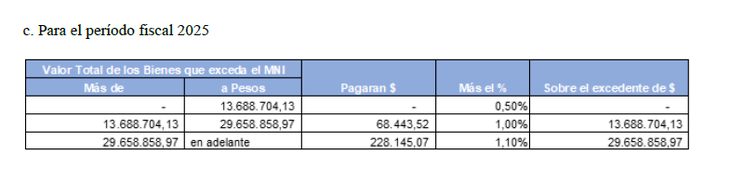

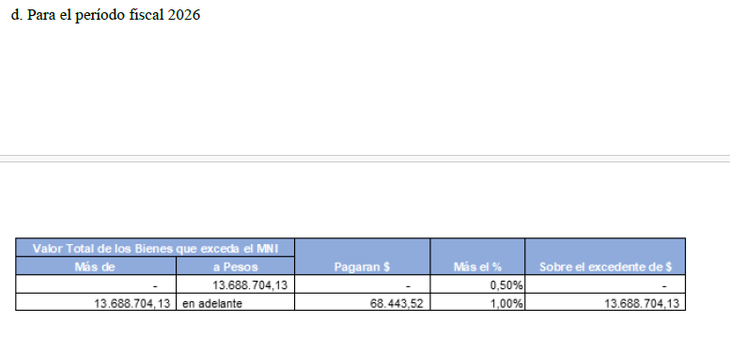

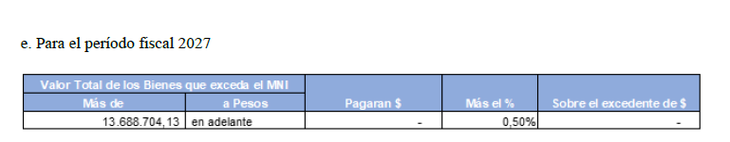

The tax to be paid by the taxpayers indicated in section a) of article 17, will be the one that results from applying, on the total value of the assets located in the country and abroad subject to the tax – except those included in the article without number incorporated after article 25 of this law – that exceeds that established in article 24, the following scale:

BBPP1.PNG

bbpp2.PNG

bbpp3.PNG

bbpp4.PNG

Source: Ambito