The yield to maturity of CER (inflation-tied) bonds is trading at negative rates amid expectations of high inflation rates: what does it mean?

Why CER bonds are trading with negative yields: time to buy or sell?

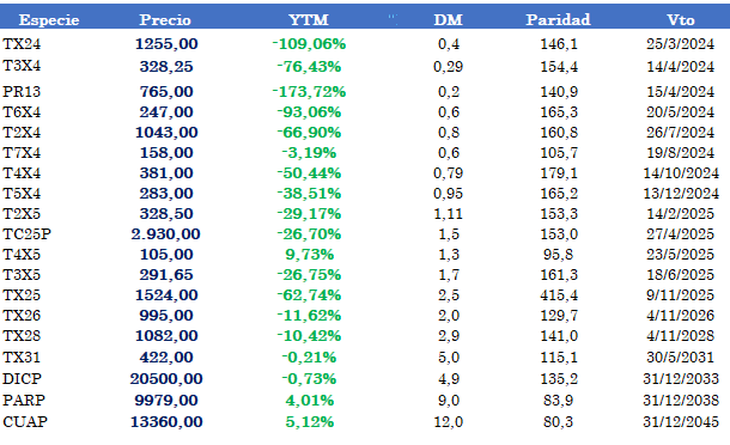

Courtesy DMB

Right now the yield to maturity of CER (inflation-tied) bonds is trading at negative ratesin some cases that exceed 100%, given this Ambit set out to explain why this phenomenon happened, what it means for the holders of these papers, and whether, even with this scenario, it is advisable to enter or not.

The content you want to access is exclusive to subscribers.

image.png

Consulted by this means, Leonardo Svirskyexplained that it is because “as we all know, there are months of high inflation coming, so Since all bonds mature in 2024, investors are paying too muchbecause expectations are very high and they anticipate waiting for the indices.”

“Bonds have been rising for a few weeks now and In some cases, such a rise even seems exaggerated.. Although these days there was some profit taking, the reality is that there is a lot of liquidity in the market,” the financial analyst added.

When demand for a bond increases, its price tends to rise. When the price of a bond rises, its yield to maturity (IRR) tends to fall. This is because the yield to maturity is calculated relative to the current price of the bond.

Also in conversation with this medium, Juan Pedro MazzaFixed Income Strategist at Cohencontributed that “investors demand coverage against inflation and they raise the parities of the CER bonds. As the parities are higher, the returns they offer are worse.” Therefore, What happens is that the bonds operate above par, which is why the rates remain negative.

It should be noted that “par” is the nominal value of a security and “parity” is the relationship between the market price and the technical value. When the market price is greater than the technical value, the security is said to be “above par.”; If it is lower, “below par”, and if both values are equal, it is said to be “at par”.

CER debt: time to enter or exit?

Walter MoralesPresident and Strategist of Wise Capitalassured: “The CER debt is trading at super negative rates, but this is partly due to the expectation that inflation will remain high until March inclusive.. To lower it, it is not only necessary to end the liquefaction of pesos, but also to allow imported products to enter with a reduced tax burden.”

In this regard, he opined that T2X5 and TX26 bonds are the most arbitragednext to TX31 although this one has little volume. “Today it is the investment chosen by investors, but You must prepare to unwind positions in the event that inflation is somewhat lower than projected., because there would be strong profit taking. If it doesn’t happen, it’s the investment to have.”

Source: Ambito