It applies to subjects with higher incomes (employee workers and retirees, among others) and comes into effect as of January 1, 2024. The non-taxable minimum is equivalent to 15 vital and mobile minimum wages.

The Federal Administration of Public Revenues (AFIP) detailed the criteria according to which Cedular Tax withholdings will be carried out as of January 1, 2024.

The content you want to access is exclusive to subscribers.

He non-taxable minimum of the aforementioned regime It is equivalent to 15 minimum vital and mobile salaries, Therefore, the tax applies to subjects with higher incomes: dependent workers and retirees, among others.

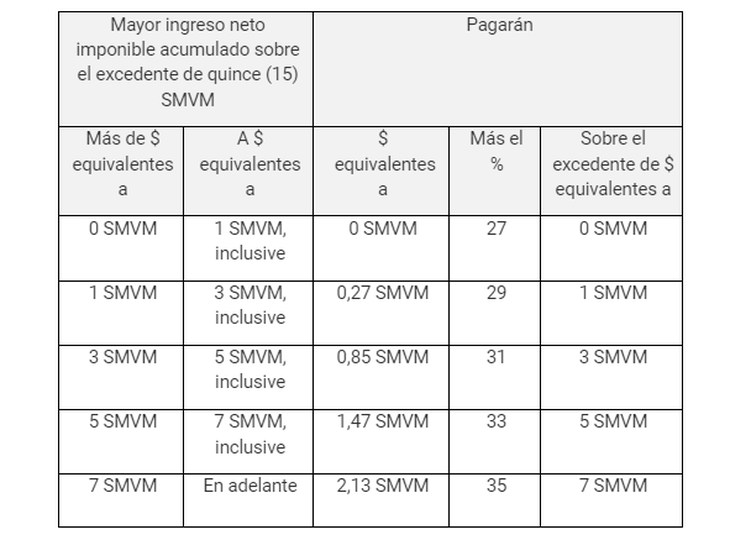

The procedure for practicing income withholding is the one that arises from RG 4003-E/2017 -specifically, in its Annex II. In this way, the withholdings to be applied on the income received during the month of january They will be determined considering the following scale:

Screenshot 2023-12-29 202504.png

It should be clarified that in subsequent months the amount to be withheld from the highest accumulated income in the month in which it is settled will be determined by applying the accumulated scale to the same month.

They must act as retention agents:

- a) Subjects who pay on their own account the income mentioned in the first article S/N following article 101 of the Income Tax Law, either directly or through third parties, and

- b) those who pay the aforementioned income on behalf of third parties, when the latter are human or legal persons domiciled or based abroad.

Source: Ambito