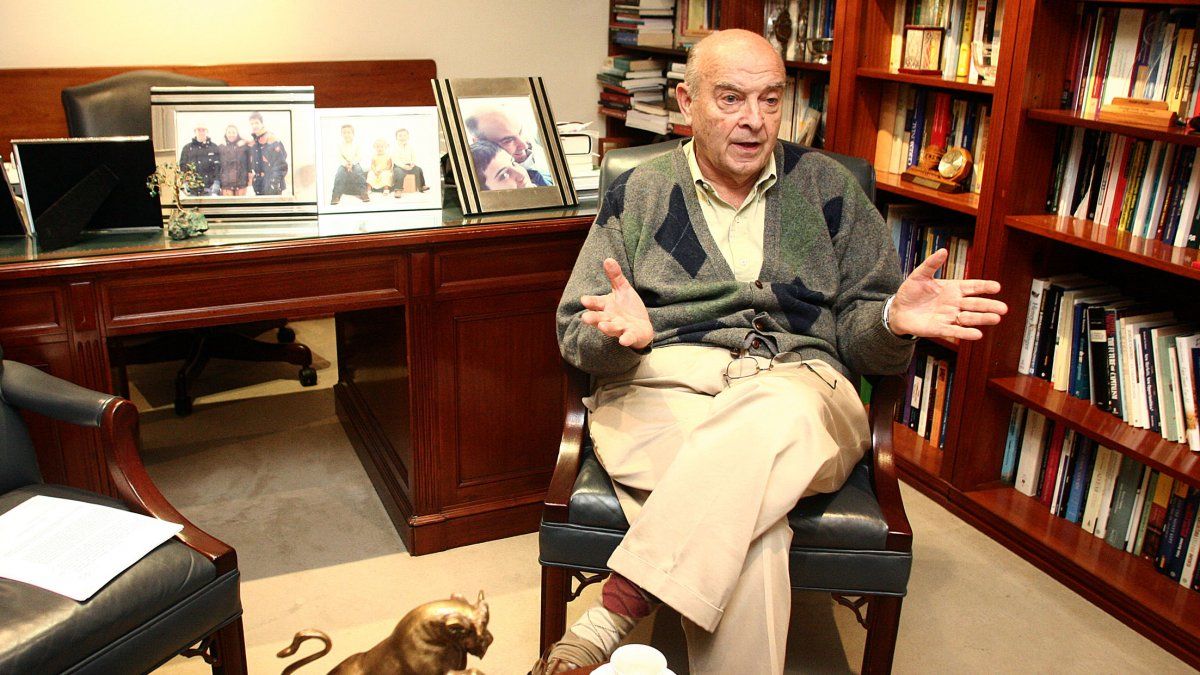

Former Minister Cavallo in his blog analyzed the economic plan carried out by Luis Caputo. In this regard, he pointed out that inflation could decrease starting in April, that the exchange rate would tend to appreciate and that only in 2025 would the conditions be in place to launch a stability plan – dollarization, convertibility or inflation targeting.

Sunday Cavallo is admired by Javier Milei. In early October, the president said he was “the best economist in history.” In addition to publicly giving his support to Milei, the former minister of Carlos Menem and Eduardo de la Rúa collaborated with the current administration by helping to complete the list of officials of the Ministry of Economy, with key figures such as Joaquín Cottani, current Secretary of Economic Programming. Hence his opinion on economic policy is important. In this sense, on his blog he published an analysis in which he states that “the government will be able to launch a stability plan when it has managed to eliminate all vestiges of exchange stocks”.

The content you want to access is exclusive to subscribers.

In essence, it states that, If certain assumptions are met – among them not issuing to finance the Treasury and accumulating USD 30,000 in reserves -, 2024 will be a transition year, in which relative prices will be rearranged, the exchange rate will appreciate, the interest will be negative and inflation will begin to decline starting in April at rates of 7 to 8% monthly. And glimpse that At the beginning of 2025 the conditions will be in place to launch a stabilization plan.

Below is a summary:

- In an economy with a high degree of de facto dollarization, A stabilization plan can only be implemented when all vestiges of restrictions on the movement of capital have been eliminated and the exchange market functions as a truly single and free market.

- The measures announced so far aim to facilitate the realignment of relative prices and the elimination of the fiscal deficitbut all restrictions on the movement of capital remain.

- During this period it is possible that the monthly inflation rate will be reduced from the high levels it will reach in December -around 25%-. But this will occur only if the gap between the free exchange rate and the commercial exchange rate is closed.

Conditions

To simulate the possible course of the inflation rate throughout 2024, Cavallo formulates different assumptions:

- Calculates that the equilibrium level of the real exchange rate – once the exchange market is unified and liberalized and foreign trade functions normally, without withholdings or country taxes – will be 1. an index number that calculates by comparing a basket of similar goods in Argentina and the United States.

- In the transition towards balance, the government will adjust the official exchange rate below inflation in such a way that at the end of the transition period it accumulates a fall in the real exchange rate from 1.60 to 1.

- Throughout the transition period, the Central Bank will issue the money necessary to buy reserves for 30 billion dollars and to pay the interest on the repos, but will not issue to finance any fiscal deficit.

- The treasury will provide the funds necessary to finance between half and two-thirds of the reserve accumulation.

- He transition period will last one year.

Inflation

- The simulation exercise consistent with these assumptions allows us to estimate that the monthly inflation rate goes from 25% (in December) to 26% in January, 21% in February and 19% in Marchdespite the fact that the monetary base remains constant at 9 billion pesos and the monetary liabilities of the Central Bank grow only 6% monthly due to the payment of interest on repos.

- During those months, the inflation rate is not explained only by monetary expansion but, fundamentally, by the realignment of relative prices that motivated the economic measures of December 12 and that can be measured through the reduction of the real exchange rate of 1.60 to 1.

- A reasonable assumption is that in December 2023 there will already be a realignment of relative prices by 16%, in January by 20%, in February by 15% for sell out in March with a remainder of 9%.

- The inflation rate results from the sum of the realignment of relative prices plus the expansion of the Central Bank’s liabilities. From April onwards, the inflation rate is entirely explained by the expansion of the Central Bank’s liabilities. It is estimated at 8% monthly during the months of April to June and 7% monthly from July to December.

monetary expansion

- The expansion rates of the monetary base and the liabilities of the Central Bank are not zero because in the case of the monetary base, although it does not increase due to financing from the Treasury, it does increase due to the purchase of reserves that are not financed. by the Treasury and, in the case of the liabilities of the Central Bank, by the additional effect of the payment of interest for the repos originated in the monetary sterilization operations of the past.

- Except in the months in which the realignment of relative prices occurs, the monetary policy rate is 1% monthly below the inflation rate. In the first three months this rate remains at 8% monthly, that is, strongly negative in real terms, facilitating the liquefaction of the stock of repos, with the consequent benefit in terms of reducing the cost of the Central Bank’s remunerated liabilities.

Tax reduction

- Faced with the slow pace of devaluation in January and February, inflation in those months brings the real export exchange rate to 1 and in Februaryso, starting that same month, So that this real exchange rate does not fall below 1, the 15% tax on exports must begin to be reduced at a rate of 7% in February and 8% in March..

- Starting in April, the export exchange rate will remain at 1 to the extent that the devaluation rate accompanies the inflation rate. This is the assumption used in this simulation.

- In the case of the import exchange rate, which at the time of beginning to equalize the rate of devaluation with that of inflation would stagnate at 1.21, it will have to be adjusted gradually until reaching the value 1 in December 2024. through the reduction of the country tax at a rate of 3% during the months of April to June and 2% monthly from July to December.

- The persistence at 7% monthly (inflation) is due to the need to maintain a pace of adjustment of the exchange rate equal to the growth rate of the Central Bank’s liabilities and the inflation rate. This typical phenomenon of inertial inflation, which can be perpetuated over time, even if the fiscal deficit has been eliminated, can only be broken with a well-designed stabilization plan.

- The possibility of launching a similar stabilization plan (dollarization, convertibility or “inflation targeting” like Peru) will occur at the beginning of 2025. If by then it will also have been possible to unify and liberalize the exchange market and the Central Bank has a stock of reserves of 30 billion dollars. Of course, if these two conditions were achieved sooner, the launch of the stabilization plan could be anticipated. But I do not dare to affirm that this is highly probable.

- Once the stabilization plan is launched, the monthly inflation rate can immediately drop to 20% annually to end at the end of the next 24 months at 5% annually. The commitment made by President Milei during his electoral campaign would be fully fulfilled.

Source: Ambito