The exchange rate gap averaged 20% throughout December, its lowest level since 2019. However, starting next month the situation may change due to seasonal factors, among others. Will the appetite for portfolio dollarization return?

Parallel dollars closed 2023 stable and with an exchange gap with the official dollar that averaged 20% throughout December, the lowest spread since 2019. The trend was driven by greater seasonal demand for pesos, the initial positive reaction of the market to the adjustment measures announced by Luis Caputo and a greater supply of foreign currency from exporters after the devaluation. However, In February, a seasonal reversal in the demand for money beginswith the largest month-on-month drop of the year historically, which could renew bullish pressures in financial quotes and the blue in the medium term.

The content you want to access is exclusive to subscribers.

After the runoff, financial dollars operated calmly due to different factors. On the one hand, the market expectations about the economic approach of the new administration, added to the promise of fiscal balance in 2024 and zero emissions to finance the deficit. Likewise, the Export Increase Program gave greater flow to the supply of the CCL dollar. On the other hand, much of the compression of the exchange gap was through the jump in the official dollar of 118%, which took it from $366 to $800.

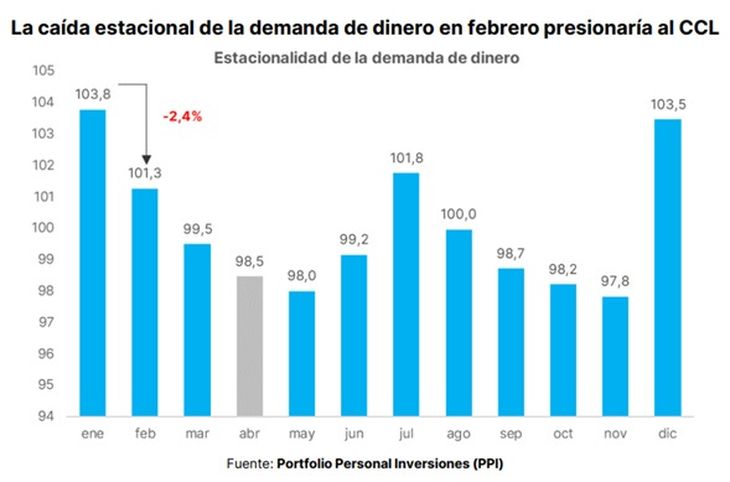

Another factor that allowed the relative calm in financial dollars was the strong demand for money that existed throughout December, which responds to seasonal factors and rises to maximums in the year at that time. However, a report from Portfolio Personal Inversiones points out that In February the drop in demand for pesos is the deepest in the year historically, which could have an upward impact on the prices of parallel dollars.

“After the seasonal peak in the demand for money in December and January (which plays in favor of a contained CCL, as we are witnessing), in February a reversal of that path begins, with the largest inter-monthly fall of the year, to make floor in May (which suggests a rise in the CCL). Consequently, starting in the second half of January the exchange gap would tend to widen both ‘below’ (crawling, traveling well below inflation) and ‘above’ (CCL rising).. This scenario would be risky for a BCRA that remains focused on ‘liquefying’, probably having to go into a hawkish mode. Beyond the particularity of February, We believe that the scenario is shaping up for a ‘last devaluation’ to get out of the exchange rate at some point in the first half of the year. (perhaps in April, in line with the arrival of the thick harvest)”, they highlight from PPI.

WhatsApp Image 2024-01-02 at 18.11.26.jpeg

Dollar and gap: what are the prospects?

In this line, the economist Gustavo Ber He pointed out that January could continue at even higher levels the demand for money, as usual it would begin to deteriorate towards February. “In view of this, I believe that keeping the crawling peg at 2% may only be a short-term strategy, but it will be risky as time passes as competitiveness deteriorates as a result of accelerated inflation. The limit of said strategy will also be given by the evolution of the ‘gap‘, since it would have repercussions on an enlargement, possibly towards 30% during January and up to 50% during February due to the fall in the demand for money, which is why starting in March the strategy of such a slow crawling peg could be reviewed given that the initial exchange cushion would have already deteriorated, and incentives must be generated for the liquidation of the harvest,” he considered. .

For his part, the economist Federico Glustein He highlighted: “As inflation in December and the first weeks of January is confirmed, the demand for parallels should grow due to protection and, therefore, also its price. However, instruments such as CER bonds and other papers reduce part of the scope of growth in foreign currency demand, added to the fact that the BCRA buys daily in the MULC and generates a virtuous circle where there is no added pressure to the parallel ones, so “The impact will be slight.”

Source: Ambito