After a strong decline, the CER segment rose 2.6% on average while the dollar linked maintained the upward trend and rose 0.8%. However, the maturity profile for 2024 is highly demanding and the market will wait attentively for the conditions of the possible exchange.

After strong volatility in recent days, bonds in pesos rebounded after the news that the Government would announce on the day an understanding with the IMF. With this news, they managed to close the day positively. In the last rounds, the CER segment showed strong falls due to the rearrangement of market expectations on inflation, after knowing the data from the City of Buenos Aires was lower than expected, in addition to the increase in the gap and a possible exchange that would lead to carried out by the Government to clear the maturities this year. In this framework, analysts consulted by Ámbito highlight that The market will remain attentive to the conditions of the exchange being negotiated, although they do not rule out a further fall in parities.

The content you want to access is exclusive to subscribers.

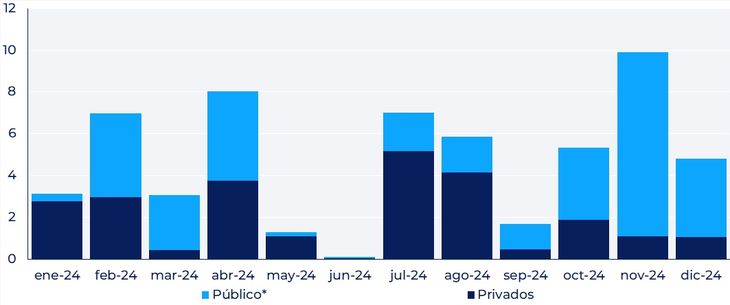

In recent years, the debt in pesos grew greatly due to the use of the local market as a source of financing the fiscal deficit. In this way, the maturity profile is demanding. In 2024according to information from Adrian Yarde Buller, chief economist at Facimex Valores, $57 billion matures, of which 43.5% is held by private investors. The most challenging months in terms of private maturities are July for $5.2 billion, August $4.2 billion and April $3.7 billion. Likewise, there are high commitments in January of $2.8 billion and February of $3 billion.

In this framework, as Ámbito announced, the Minister of Economy, Luis Caputo, received representatives of the banks days ago to analyze a possible exchange of Treasury debt and considerably reduce maturities this year. So, In recent days, the CER segment went through negative days, with falls of up to 9% in securities maturing in 2025 and 2026. In this Wednesday’s session, the CER segment rebounded, led by the TX28 (8.5%), the TX26 (8.1%) and the PARP (6%). However, PR13, PAP0 and CUAP continued to fall 5.6%, 1.4% and 1.3% respectively.

Lucas Decoudfixed income analyst at Grupo IEB, said: “The fall in recent days can be attributed to three factors. The CABA inflation data published this week surprised downwards, showing a variation in December prices of 21.1%, which allows us to be optimistic about the national CPI data that will be known this Thursday. Secondly, the reports that the economic authorities would be meeting with the different market institutions to plan a voluntary debt exchange that would cover all the maturities of 2024 for which CER bonds with maturities would be offered may have had some impact. to 2025, 2026 and 2027. Finally, the advance of the CCL during the last week and the first round of this week ate up all the profits in dollars that had been accumulating being positioned in instruments in pesos, which could have motivated the disarmament of some positions.”

Facimex Valores SA

Source: Facimex Valores SA

From Personal Portfolio Investments They highlighted: “It is expected that the expectation of swapping 2024 debt for instruments that mature in 2025, 2026 and 2027 will hit the long section of the curve, just as we think and as it happened. Thus, the shortest CER bonds advanced notably between 5.6% and 7%, while securities with longer maturities reflected a more timid performance. For its part, the strong demand extended to dollar-linked bonds, which added between 1.8% and 2.7% to their price. Finally, the Duales were mixed. Along these lines, the Duals maturing in February (TDF24) and August (TDA24) ended up offered sliding 0.1% and 0.7% respectively, while the rest of the curve grew between 0.1% and 8.9 %”.

Regarding the possible impact of the exchange, Decoud considered that “the greatest impact could be observed in the longer instruments with duration similar to the bonds that would be offered in the exchange that would have maturities between 2025 and 2027, which would generate an additional supply for current bonds, which would put downward pressure on parities.”

Source: Ambito