The Government placed three bonds tied to inflation and raised almost $4 billion, facing maturities of about $3.3 billion.

Economy passed another market test: it placed almost $4 billion in bonds tied to the CER

Ignacio Petunchi

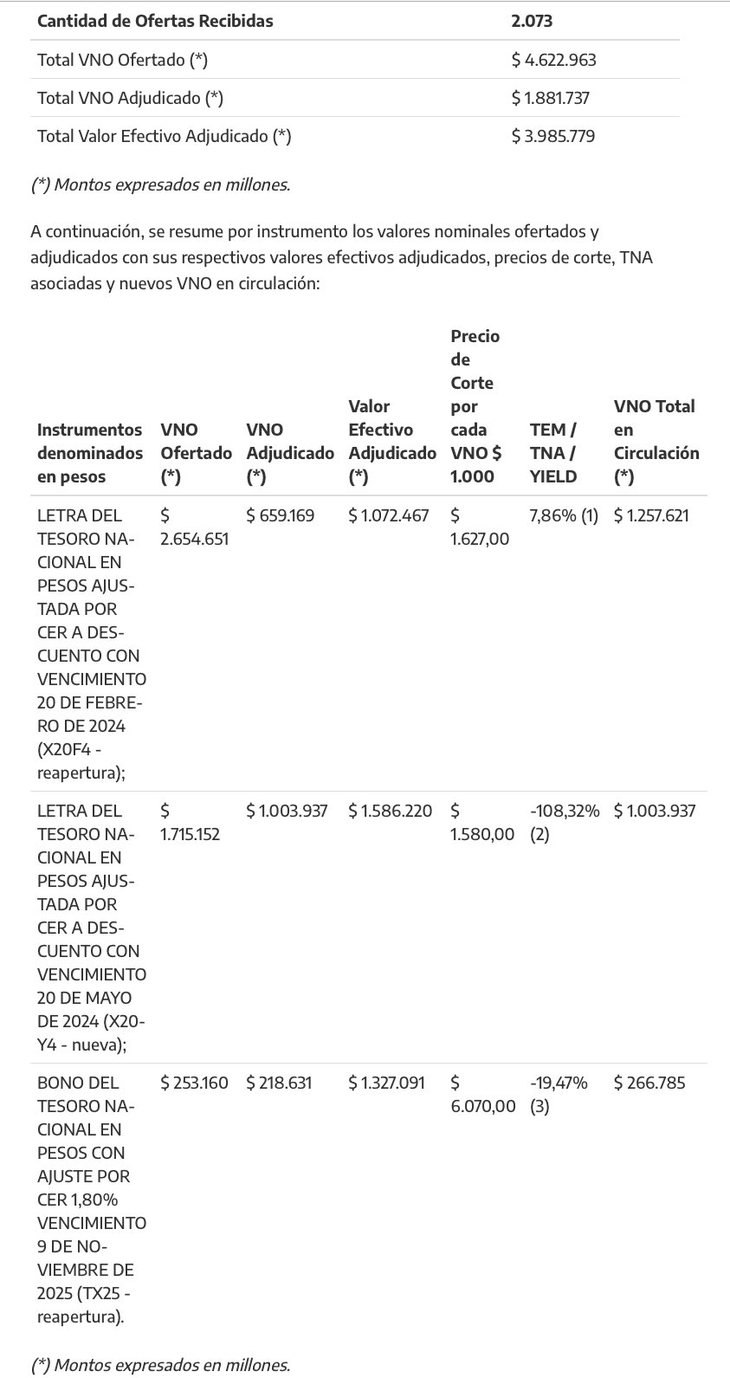

The Government passed the first debt tender in pesos of the year and offered this Tuesday to the market National Treasury bonds tied to inflationto face maturities during January for more than $3 billion. The total offered was $4.62 billion, through 2,073 offers. La Lecer as of February was located in the 7.86% monthly. Treasury also announced the repurchase of T5X4 for $875,000 million.

The content you want to access is exclusive to subscribers.

image.png

The interest in these titles was expressed in the 2,073 purchase orders received by a nominal value of $4.6 billion. Of that total, 1.8 billion were taken, which represented an effective value of $3.9 billion. Economy awarded little more than a trillion pesos, by the letter adjusted by CER (inflation) due February 20.

For the second, with similar characteristics, but to be paid in May of this year, 1.5 billion pesos were allocated. While, The third, a bond adjusted by CER plus a 1.8% surcharge, concentrated 1.3 trillion pesos.

In dialogue with Ambit, Santiago Lopez AlfaroPresident of Securities Patent He said: “It was a very good issue with a good rate and a net issue of 1 billion. The 7.85% monthly rate (Read to February) It is less than that of a fixed term and what short-term bonds discount, so for the Government it is cheap financing“.

Furthermore, this day it was announced that The Ministry of Economy will proceed to make a repurchase offer of the National Treasury debt in the portfolio of the Central Bank of the Argentine Republic, for an effective value of $875,000 million. The security to be repurchased, at today’s closing price, is NATIONAL TREASURY BOND IN PESOS ADJUSTED BY CER 4.25% expiration on December 13, 2024 (T5X4).

For his part, the analyst Leandro Ziccarelli explained how that net financing will be used: “If I’m not wrong, they almost didn’t take net financing today. They renewed the entire maturity and will use ARS 0.8b to redeem securities from the BCRA (those pesos disappear). This way, “The Treasury returns a good part of the pesos issued by the BCRA to buy reserves and while it changes BCRA liabilities for Treasury debt.”

Source: Ambito