In that sense, the American economist highlighted that outside of GDP, “the Chinese economy appears to be faltering“and argued that official statistics say that China is experiencing a “Japanese-style deflation and high youth unemployment“.

Until now, This phenomenon does not imply a crisis in itselfbut Beijing’s economy is entering a stage of “stagnation”.

Why is China’s economy in trouble?

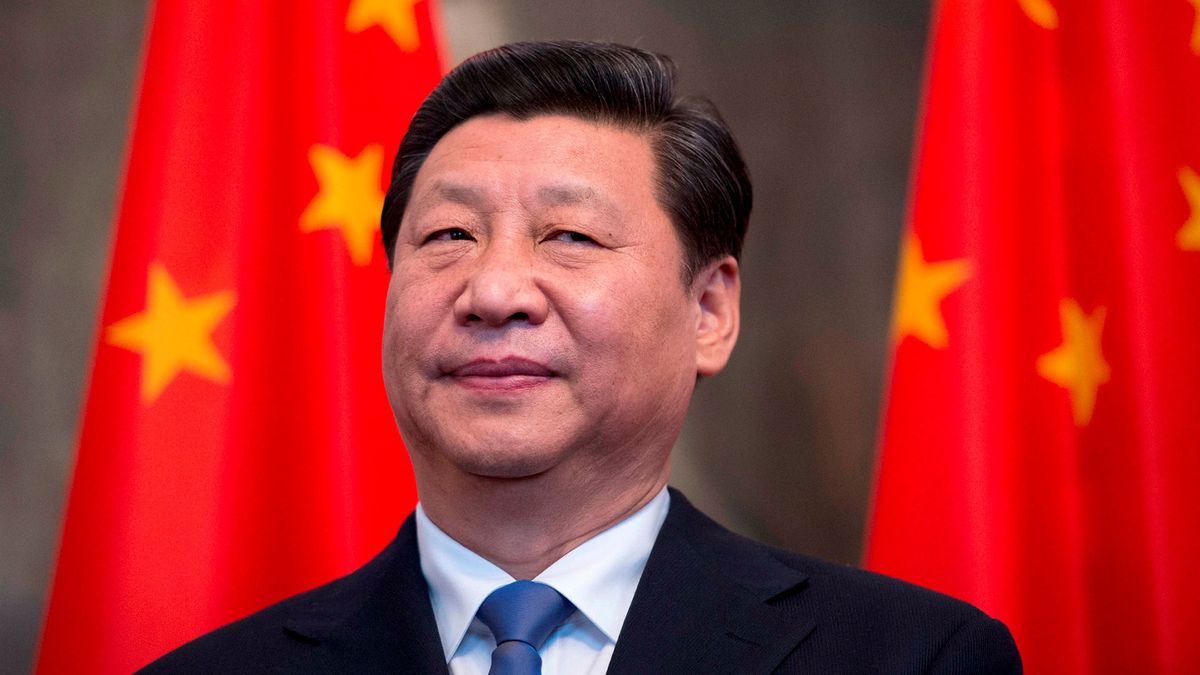

For Krugman, The answer could be found in the “bad leadership” of the president, Xi Jinping. “He is beginning to look like a bad economic manager, whose propensity for arbitrary interventions (something autocrats tend to do) has stifled private initiative,” the economist says.

Now, if Xi would be a better leader, Would China continue to have economic problems? The response of Krugman It is yes and it is specifically due to the fact that “China’s economic model was becoming unsustainable“.

As explained by the political expert journalist from The New York Times, Stewart Patersonhe Consumer spending is very low as a percentage of GDP.

It is due to multiple factors, among them the “financial repression“, which involves paying low interest on savings and granting cheap loans to favored debtors. As explained Krugmanwhat is done is to keep “household incomes low” and divert them towards investments controlled by the government, “a weak social safety net that causes families to accumulate savings to face possible emergencies“.

Furthermore, the drop in consumption makes it difficult to sustain productive capacity like China’s. Although, the Asian giant can maintain the usage capacity, according to the economist Michael Pettis thanks to the extremely high investment rates, more than 40% of GDP. And alert: “The problem is that it is difficult to invest that much money without encountering severely diminishing returns.“.

High investment rates can be sustainable if, like China in the early 2000s, you have a rapidly growing workforce and high productivity growth as you catch up with Western economies. However, China’s working-age population peaked around 2010 and was declining since then. And although the Asian giant demonstrated a impressive technological capacity In some areas, their overall productivity also appears to be stagnant.

“This is not a nation that can productively invest 40 percent of GDP. Something has to give,” Krugman summarized.

When did the problems start in China?

According to the balance of Krugman, flaws in the model have been evident for at least a decade. However, it was attempted “mask“the problem of inappropriate consumer spending promoting a gigantic real estate bubble. The market even observed incredible growth in accordance with international standards.

China: how to break the deadlock?

To move forward, according to external analysts, China must:

- Put an end to the financial repression;

- Allow a most of the economy’s income flows to households;

- Strengthen the social safety net so that consumers do not feel the need to hoard cash.

This way, could reduce your unsustainable investment spending. Although there are powerful actors, especially state-owned companies, that benefit from the financial repression. For this reason, it becomes more complex to unravel that network.

Should the world worry about China’s economy?

If you compare China’s current economic situation, it is similar to that of Japan after the bursting of its bubble in the 1980s. Although Krugman He highlighted that Japan managed its reduction well and avoided mass unemployment. “It never lost social and political cohesion, and real GDP per working-age adult actually increased by 50% over the next three decades, not far behind the growth of the United States,” she noted.

Now, the concern is that China does not respond in that way. ““Let’s not gloat over China’s economic setback, which can become everyone’s problem.”he concluded.

Source: Ambito