“Simple Quota” will be the new program that replaces “Now 12” valid until January 31. The plan will be launched in the next few hours, as confirmed by Ámbito. As this medium anticipated, The Government held meetings with financial entities to advance a new consumer financing program after the request of the business chambers.

From February 1, Argentines will have “Cuota Simple”, a program to buy in 3 and 6 fixed installments, in 34 items and with the lowest market rate of around 85%, below the Central Bank’s fixed-term rate (110% TNA). On Thursday, the central bank will finish confirming the rate at its usual Board meeting. Currently, the TNA of the Now 12 program is 82.5%. Another of the particularities is that the program It will be renewed quarterly.

The program will have national reach and will be available in both physical and virtual stores. According to official sources, the three and six fixed installments are the most chosen by consumers who choose Ahora 12, totaling 80% of the transactions. For this reason, the Ministry of Commerce and the Central Bank (BCRA) in a meeting with the Argentine Confederation of Medium Enterprises (CAME) opted for these deadlines.

Considering the background of the previous program, Now 12, The items with the greatest participation are clothing, small appliances and tourism. According to the consultant Ecolatina, purchases with installment plans Now 12 tend to explain between the 20% and 25% of consumption with credit cardswhich reflects its relevance for consumers.

NOW 12.jpeg

Purchases with Now 12 installment plans tend to explain between 20% and 25% of credit card consumption.

Commerce secretary

Both the Argentine Chamber of Commerce (CAC) and the Argentine Confederation of Medium Enterprises (CAME) expressed their support for the program and defined it as “very relevant to promote consumption, national production and employment” and a “key instrument with quotas at a preferential rate.”

In dialogue with Ámbito, Ricardo Diab, general secretary of CAME, expressed: “Now 12 for us was a driver of consumption. Logically at that time it was of no interest and then it was modified. Today this tool emerges that is not ideal for us but is important, with a rate of 85% which is much less than any personal loan and other type of financing.

At the same time, he added: “It is a possibility to stretch the money in our pockets. For us it was also important to know if we could add some products, such as construction but This time it’s not possible.”

Simple fee: one by one the items that will be contemplated

- Glasses and contact lenses

- Dress

- Educational services

- Illumination artifacts

- Musical instruments

- Personal care services

- Bookstore items Toys and board games

- Funeral services

- Spas

- Kit for home connection to public water and sewer services

- Alarm installation services

- bikes

- White line

- Event and trade exhibition organization services

- Footwear and leather goods

- Books

- Educational services

- Mattresses

- Machinery and Tools

- Technical Services for Electronics and Home Appliances

- Computers, Notebooks and Tablets

- Motorcycles

- Vehicle Repair Services

- Automotive and Motorcycles

- Durable kitchen items

- Furniture Cell Phones

- Medical equipment

- Tires, accessories, CNG gas vehicle conversion kit and spare parts for automobiles and motorcycles

- Televisions and monitors

- Shows and cultural events

- Small Appliances

- Tourism

- Gyms

- Perfumery

Concern about consumption

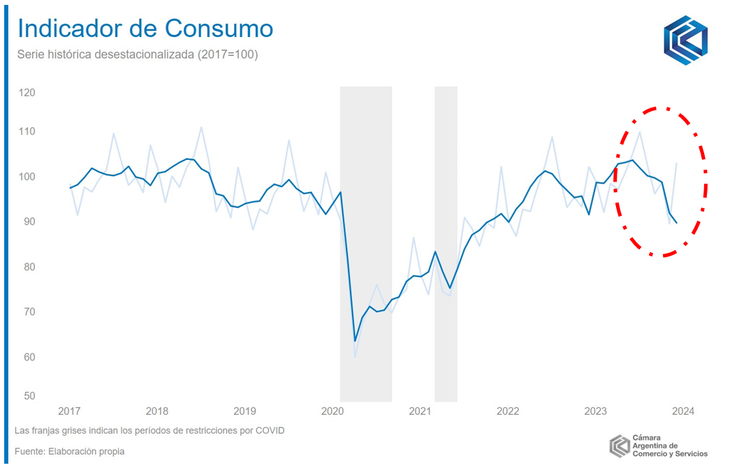

The need to maintain this plan is due above all to the strong contraction in consumption that it seeks to cushion. In December, andl Consumption Indicator (IC) of the Argentine Chamber of Commerce and Services (CAC) showed a contraction of 2.4% compared to November (discounting the usual seasonal effects of consumption throughout the year).

In this way, the downward trend in consumption is ratified given that December was the sixth month with negative monthly variation. Despite this, the IC varied 0.7% compared to December 2022 and accumulated growth of 3.3% yoy in 2023, although, in absolute terms, the loss of dynamism seen in recent months It continued to deepen.

image (1).png

This occurs in an economic scenario where the inflation again suffered a marked acceleration and registered a double-digit monthly variation. In December, the monthly variation was 25.5%, with an interannual and/or accumulated annual variation of 211.4%, as explained by the CAC. In January, a retraction to the same levels heterogeneously according to each category.

Source: Ambito