Econometrica released a graph that shows that there was a strong reduction in what is called the expanded monetary base (the monetary base plus Leliqs and repos) during January. After being replicated by the president Javier Milei A strong debate broke out on social networks between different economists. It is because of that Ambit He consulted several representatives of the City, whom he asked: Was there a contraction of the monetary base? Is it enough to lower inflation and stabilize the economy? How does it impact the price of the dollar?

The graph that generated the debate: what’s behind it

image.png

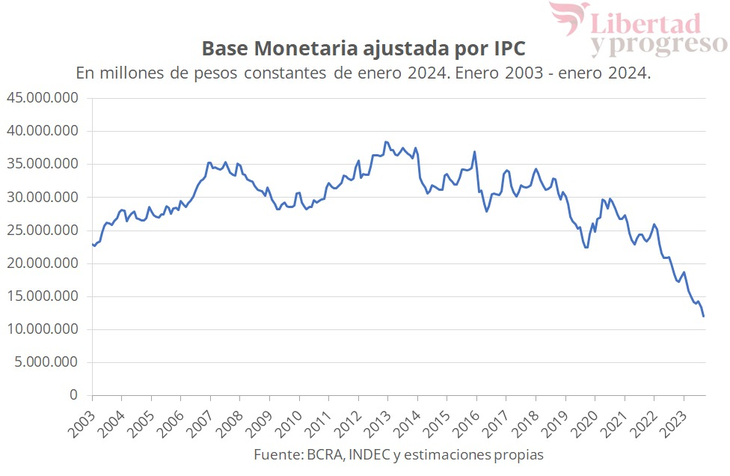

In dialogue with Ambit, Ramiro Castiñeiradirector of Econometricthe consulting firm that created the graph, explained: “The most relevant thing is that it is showing you how the money supply is falling sharplyat least that which depends on the Central Bank, that is, independently of credit.” It should be noted that this measurement shows the expanded monetary base.

For Castiñeira This analysis reveals a significant contraction of the peso money supply and, he added, that the sum of the two components in January amounts to $37.4 billion. He highlighted that, just a few months ago, It was $50.2 billion.. “That is to say, the contraction of the amount of pesos in the economy in real terms is greater than 25%”revealed.

“In order to unify the exchange rate and even to dollarize, you will need a smaller amount of pesos in the economy“said the analyst and remarked: “With an interest rate that is around 8% and inflation between 25% and 20%, A good part of the amount of pesos is being liquidated, as a result of inflationary acceleration“.

How the emission fell but not with the magnitude of inflation, the money supply is falling, added the expert. “The golden opportunity is going to be in May when the harvest is released, which grants a large amount of dollars and so? gives you a window as for unify the exchange market“, hill Castiñeira.

The demand for money falls: how is it interpreted?

Aldo Abramexecutive director of Freedom and Progress, In a conversation with this medium, he recalled how we got to the current situation: “It is true that when the Milei government began its mandate, there was a contraction of the monetary base because in the last part of the previous administration they dedicated themselves to broadcasting a lot. And when the current administration came in, there was a system by which they placed Treasury bonds and then with those bonds they canceled the Treasury debt that the Central Bank had, but later that contraction was reversed“.

image.png

For Abram, Today the level of the monetary base (in nominal terms) is the same at the end of the previous Government. “In this graph you can see a contraction because inflation is discounted”, he described. “But, base contraction there is no; What does exist is a drop in the demand for pesos. What happens is that the purchasing power of the currency goes down,” he explained.

“The bad thing about this is that before you only saw that the pesos lost purchasing power because a lot was issued, but Now, people stop suing them. This becomes a vicious circle because the more you lose purchasing power, the less people want the pesos,” Abram insisted.

“A possible contraction of the monetary base without recovering demand for the pesos could lead to a hyperinflationary process”warned the specialist.

The discussion focuses on the emission: gross or net?

For Leandro Ziccarellipodcast author IMF (Financial, Monetary and Irreverent), The discussion that arose on networks is “Byzantine”. “Those who denounce that there is a rampant issuance look at the gross issuance, that is, all the pesos that the Central Bank issues,” he said. He explained there are several reasons for issuing, such as to purchase of reserves, which he considered to be one of the “healthiest” emissions.

He then indicated that “In net terms, a large part of its pesos is later absorbed by the Treasury itself. The net effect between what the Central Bank issues and what the Treasury takes is negative, that is, “far from there being more pesos on the street, there are less.” “After There are other emission channels that the BCRA does not control, what are the Ledivs and the puts by the banks, that is basically a window where the entities can go to the Central to be paid in cash for the securities they have,” he highlighted.

“In net terms also The passes have managed to absorb a part of what was conquered from the Leliqs and the own interests that they are generating, with which very little of all those pesos has been left on the street,” he said and also agreed that There is a general rejection of weight by the public, which implies that There is no serious emission problem in net terms.

“Issuance has been very low in the month of December and at the rate that comes in January, taking into account the nominal value and seasonality, it is also limited. This is a point that many economists miss. That the monetary base grows in December is logical for seasonal reasons because people spend the same as in the summer. “If you have a monetary base that grows below inflation, it is not growing in real terms.”he opined.

Finally, the analyst highlighted that A problem would be if the issuance finances the fiscal deficit, but that is not happening.

Source: Ambito